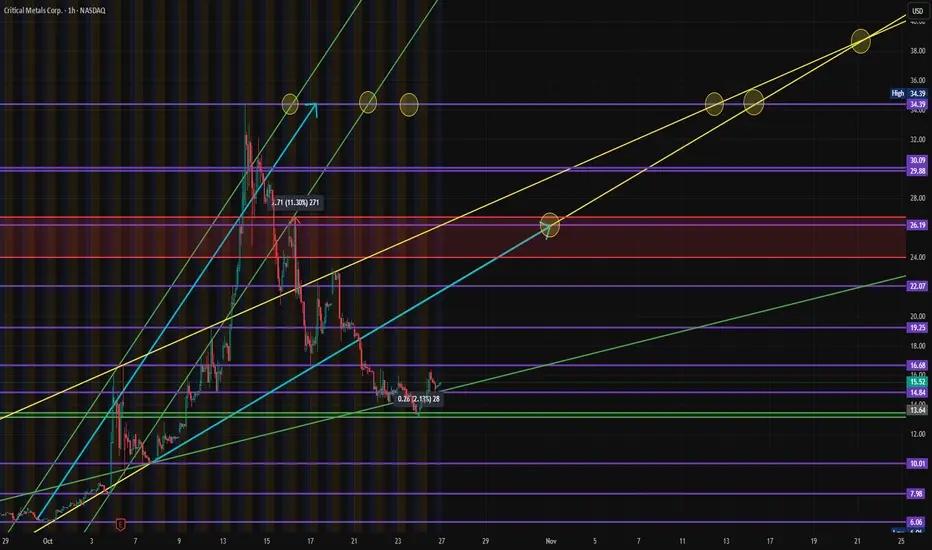

After cooling off from that massive run, price action has now begun compressing between $13.64 and $16.08, with early signs of base-building before another potential leg up.

🧩 Technical Outlook

Strong rally → deep correction → accumulation structure forming.

Support Levels: $13.64 (core zone), $10.01 (strong confluence), and $7.98 (long-term floor).

Resistance Zones: $19.25 → $22.07 → $26.19.

Channel projection shows potential for re-test of $26.19 by November if current momentum continues.

Higher timeframe targets extend to $30.09 and $34.39 in Q1 2026 if the bullish structure holds.

The setup favors accumulation entries below $16.08, with a short-term target to retest $22.07 and potentially $26.19 once momentum returns.

📰 Recent News & Fundamentals

Critical Metals shares have been volatile following major financing announcements:

📉 Announced offering of 18.03 million shares triggered a short-term selloff.

💰 Confirmed $50 million PIPE financing, strengthening capital for expansion.

🌍 Broader rare-earth momentum continues as China tightens export restrictions and JPMorgan initiates new investments into critical mineral supply chains.

Despite the correction, the sector tailwinds remain strong — and

📊 Sentiment Snapshot (from Schwab QORE Analytics)

Rating: F (Strongly Underperform) – percentile rank 100

26-week price change: +834%

Beta: 1.14

Sector: Materials / Diversified Metals & Mining

High volatility + weak sentiment ratings often precede large technical reversals — a setup that speculative traders should be watching closely.

💡 My Plan

I’m watching for clean accumulation below $16.08 for a potential re-entry swing trade.

Stop: under $13.50

Targets: $22.07 → $26.19 (swing)

Longer-term projections: $30 → $34 if the bullish trend resumes into 2026.

Trade geschlossen: Stop wurde erreicht

Stay tuned and subscribe to know more as we do!

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.