LiamTrading – GOLD: The upward structure continues, target 4090 is approaching

Hello everyone,

Gold and US stocks are setting new records, but don't forget — strong sell-offs often occur when everyone believes prices can only go up.

Currently, gold maintains a sustainable upward structure, with each subsequent low higher than the previous one, confirming a clear trend on the H1–H4 frames.

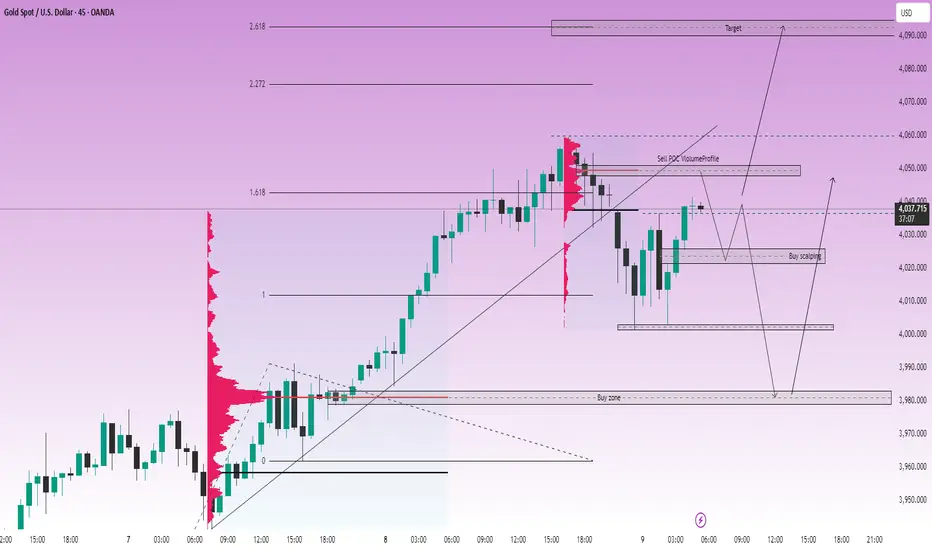

📊 Technical Analysis (Chart 45m – XAUUSD)

The price structure remains clearly Higher High – Higher Low, indicating that buyers still control the market.

Key liquidity zones are around:

🔹 4050–4060 (resistance – POC Volume Profile)

🔹 4020–4025 (temporary support zone – confluence Fibo 0.618)

🔹 3980 (technical bottom, strong previous liquidity zone)

The upward target according to Fibonacci Extension is currently in the 4090 zone, corresponding to the 2.618 extension level — likely to become a major profit-taking area for buyers.

🎯 Today's Trading Scenario

Short-term Sell (based on resistance reaction):

📍 4048–4050

🛑 SL: 4055

🎯 TP: 4030 – 4018 – 4005 – 3980

Buy scalping:

📍 4022–4024

🛑 SL: 4017

🎯 TP: 4030 – 4045 – 4060 – 4080

Buy swing (trend-following):

📍 3980–3982

🛑 SL: 3975

🎯 TP: 3995 – 4010 – 4025 – 4040 – 4060

🧭 Fundamental & Market Sentiment

According to the FOMC minutes from 16–17/9, most Fed officials believe that continuing to cut interest rates this year is appropriate.

This is the first time since 2020 that the Fed has officially reduced the interest rate by 0.25%, bringing the range down to 4.75% – 5.00%.

→ Cheap money + safe haven sentiment continues to be the main driver pushing gold higher.

However, with both gold and stocks reaching peaks, the risk of technical correction may occur when prices hit major liquidity zones.

📌 Conclusion

Gold is still in a stable upward trend, with a short-term target towards 4090 USD/oz.

However, watch for liquidity zones around 4050–4060 and 4000–4025 to optimize entry points, avoiding FOMO when prices are already high.

👉 I will continue to update details each trading session.

Follow me to not miss the earliest gold scenarios!

Hello everyone,

Gold and US stocks are setting new records, but don't forget — strong sell-offs often occur when everyone believes prices can only go up.

Currently, gold maintains a sustainable upward structure, with each subsequent low higher than the previous one, confirming a clear trend on the H1–H4 frames.

📊 Technical Analysis (Chart 45m – XAUUSD)

The price structure remains clearly Higher High – Higher Low, indicating that buyers still control the market.

Key liquidity zones are around:

🔹 4050–4060 (resistance – POC Volume Profile)

🔹 4020–4025 (temporary support zone – confluence Fibo 0.618)

🔹 3980 (technical bottom, strong previous liquidity zone)

The upward target according to Fibonacci Extension is currently in the 4090 zone, corresponding to the 2.618 extension level — likely to become a major profit-taking area for buyers.

🎯 Today's Trading Scenario

Short-term Sell (based on resistance reaction):

📍 4048–4050

🛑 SL: 4055

🎯 TP: 4030 – 4018 – 4005 – 3980

Buy scalping:

📍 4022–4024

🛑 SL: 4017

🎯 TP: 4030 – 4045 – 4060 – 4080

Buy swing (trend-following):

📍 3980–3982

🛑 SL: 3975

🎯 TP: 3995 – 4010 – 4025 – 4040 – 4060

🧭 Fundamental & Market Sentiment

According to the FOMC minutes from 16–17/9, most Fed officials believe that continuing to cut interest rates this year is appropriate.

This is the first time since 2020 that the Fed has officially reduced the interest rate by 0.25%, bringing the range down to 4.75% – 5.00%.

→ Cheap money + safe haven sentiment continues to be the main driver pushing gold higher.

However, with both gold and stocks reaching peaks, the risk of technical correction may occur when prices hit major liquidity zones.

📌 Conclusion

Gold is still in a stable upward trend, with a short-term target towards 4090 USD/oz.

However, watch for liquidity zones around 4050–4060 and 4000–4025 to optimize entry points, avoiding FOMO when prices are already high.

👉 I will continue to update details each trading session.

Follow me to not miss the earliest gold scenarios!

🔥10–15 daily XAUUSD & Forex signals

📈86% win rate per session

⏱️Real-time alerts with solid technical analysis

💡Consistency comes from the right trading plan

👉 Join my group for full signals & insights in real time t.me/+mQohGVIsAythYTk1

📈86% win rate per session

⏱️Real-time alerts with solid technical analysis

💡Consistency comes from the right trading plan

👉 Join my group for full signals & insights in real time t.me/+mQohGVIsAythYTk1

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

🔥10–15 daily XAUUSD & Forex signals

📈86% win rate per session

⏱️Real-time alerts with solid technical analysis

💡Consistency comes from the right trading plan

👉 Join my group for full signals & insights in real time t.me/+mQohGVIsAythYTk1

📈86% win rate per session

⏱️Real-time alerts with solid technical analysis

💡Consistency comes from the right trading plan

👉 Join my group for full signals & insights in real time t.me/+mQohGVIsAythYTk1

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.