Title: 🌾 WHEAT CFD: The "Money Looting" Thief Plan (Bullish Breakout Setup) ⚡🤑

Executive Thief Summary 🦹

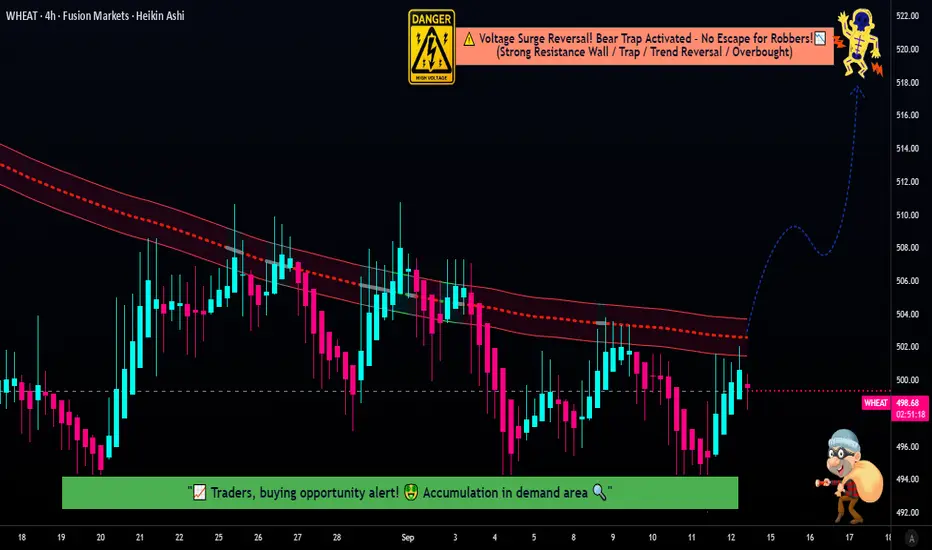

Ladies & Gentleman, Thief OG's! 👋 Ready to execute a precision heist on the Wheat markets? This plan uses a layered entry strategy (a.k.a. The Thief Strategy) to loot some profits from a potential bullish breakout. We're stacking limit orders like cash stacks and making a clean escape before resistance shows up. Alarm bells are ringing! 🔔

📈 The Technical Thief Plan (Swing/Day Trade)

Asset: WHEAT (Wheat CFD)

WHEAT (Wheat CFD)

Bias: Bullish ⬆️

Trigger: A breakout and close above 504 on the LSMA Moving Average.

🎯 Entry Strategy (The "Thief" Layering Method):

Step 1: SET AN ALARM at 504 to notify you the moment the breakout happens!

Step 2: Upon confirmation of the breakout, deploy multiple BUY LIMIT orders on any pullback at the following layers:

Layer 1: @ 502

Layer 2: @ 500

Layer 3: @ 498

Layer 4: @ 496

Pro Thief Tip: You can add or adjust these layers based on your capital and risk appetite. The goal is to get a better average entry price.

⛔ Stop Loss (Escape Route):

A collective Stop Loss can be placed at 493, ideally after the breakout and a pullback into your layers occurs.

⚠️ Disclaimer: Dear Thief OG's, I am not a financial advisor. You MUST adjust your SL based on your own strategy and risk tolerance. Protect your capital!

✅ Take Profit (The Getaway Car):

Our primary target to escape with the stolen money is at 520, a strong resistance zone where overbought conditions and traps may lurk.

⚠️ Disclaimer: This is MY plan. You are the master thief of your own trade. Take profits based on your own analysis and risk management. Run when you've got the bag! 💰

🔍 Why This Plan? The Fundamental Intel

This isn't just a technical play; the macro backdrop provides a compelling narrative for a potential move north.

🌍 Fundamental & Macro Score: 5.5/10 (Stable but Vulnerable)

Supply/Demand (6/10): Production is steady (EU & Russia with big crops), but record utilization and booming feed demand in Brazil/EU are supportive. US exports are forecast at a multi-year high.

Macro Factors (5/10): Black Sea geopolitical tensions add a risk premium. Strong global trade offsets ample stocks. Inflation and potential Fed cuts support commodities, though China's import cuts are a headwind.

😊📊 Trader Sentiment Outlook (Mixed but Leaning Cautious)

Retail: 38% Bullish 🟢 | 62% Bearish 🔴 (Cautious due to recent dips)

Institutional: 45% Bullish 🟢 | 55% Bearish 🔴 (Slightly more optimistic on export recovery)

The crowd is cautious, which can often be a contrarian signal for opportunities.

⚖️😨 Fear & Greed Gauge: Neutral (45/100)

Balanced between fear of abundant production and greed from tightening global stocks. Weather concerns in Europe/US and strong Asian demand are key drivers. No extreme emotions mean room for a sentiment shift.

🚀 Overall Market Outlook: Mild Bull (Long) 🟢

Expect gradual upside in H2 2025 from declining global stocks and solid demand. The trigger for a rally could be disappointing Russian yields or an acceleration in exports. Avoid shorts below $500 support.

👀 Related Pairs/Assets to Watch

CORN (Corn CFD)

CORN (Corn CFD)

SOYBEAN (Soybean CFD)

SOYBEAN (Soybean CFD)

FX:

USDRUB (US Dollar/Russian Ruble - for Black Sea export risk)

USDRUB (US Dollar/Russian Ruble - for Black Sea export risk)

DXY (US Dollar Index)

DXY (US Dollar Index)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Wheat #Trading #Commodities #CFD #TradingStrategy #Breakout #Bullish #SwingTrading #DayTrading #TechnicalAnalysis #FundamentalAnalysis #TradingViewIdea #Investing #SupplyDemand

Executive Thief Summary 🦹

Ladies & Gentleman, Thief OG's! 👋 Ready to execute a precision heist on the Wheat markets? This plan uses a layered entry strategy (a.k.a. The Thief Strategy) to loot some profits from a potential bullish breakout. We're stacking limit orders like cash stacks and making a clean escape before resistance shows up. Alarm bells are ringing! 🔔

📈 The Technical Thief Plan (Swing/Day Trade)

Asset:

Bias: Bullish ⬆️

Trigger: A breakout and close above 504 on the LSMA Moving Average.

🎯 Entry Strategy (The "Thief" Layering Method):

Step 1: SET AN ALARM at 504 to notify you the moment the breakout happens!

Step 2: Upon confirmation of the breakout, deploy multiple BUY LIMIT orders on any pullback at the following layers:

Layer 1: @ 502

Layer 2: @ 500

Layer 3: @ 498

Layer 4: @ 496

Pro Thief Tip: You can add or adjust these layers based on your capital and risk appetite. The goal is to get a better average entry price.

⛔ Stop Loss (Escape Route):

A collective Stop Loss can be placed at 493, ideally after the breakout and a pullback into your layers occurs.

⚠️ Disclaimer: Dear Thief OG's, I am not a financial advisor. You MUST adjust your SL based on your own strategy and risk tolerance. Protect your capital!

✅ Take Profit (The Getaway Car):

Our primary target to escape with the stolen money is at 520, a strong resistance zone where overbought conditions and traps may lurk.

⚠️ Disclaimer: This is MY plan. You are the master thief of your own trade. Take profits based on your own analysis and risk management. Run when you've got the bag! 💰

🔍 Why This Plan? The Fundamental Intel

This isn't just a technical play; the macro backdrop provides a compelling narrative for a potential move north.

🌍 Fundamental & Macro Score: 5.5/10 (Stable but Vulnerable)

Supply/Demand (6/10): Production is steady (EU & Russia with big crops), but record utilization and booming feed demand in Brazil/EU are supportive. US exports are forecast at a multi-year high.

Macro Factors (5/10): Black Sea geopolitical tensions add a risk premium. Strong global trade offsets ample stocks. Inflation and potential Fed cuts support commodities, though China's import cuts are a headwind.

😊📊 Trader Sentiment Outlook (Mixed but Leaning Cautious)

Retail: 38% Bullish 🟢 | 62% Bearish 🔴 (Cautious due to recent dips)

Institutional: 45% Bullish 🟢 | 55% Bearish 🔴 (Slightly more optimistic on export recovery)

The crowd is cautious, which can often be a contrarian signal for opportunities.

⚖️😨 Fear & Greed Gauge: Neutral (45/100)

Balanced between fear of abundant production and greed from tightening global stocks. Weather concerns in Europe/US and strong Asian demand are key drivers. No extreme emotions mean room for a sentiment shift.

🚀 Overall Market Outlook: Mild Bull (Long) 🟢

Expect gradual upside in H2 2025 from declining global stocks and solid demand. The trigger for a rally could be disappointing Russian yields or an acceleration in exports. Avoid shorts below $500 support.

👀 Related Pairs/Assets to Watch

FX:

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Wheat #Trading #Commodities #CFD #TradingStrategy #Breakout #Bullish #SwingTrading #DayTrading #TechnicalAnalysis #FundamentalAnalysis #TradingViewIdea #Investing #SupplyDemand

Order storniert

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.