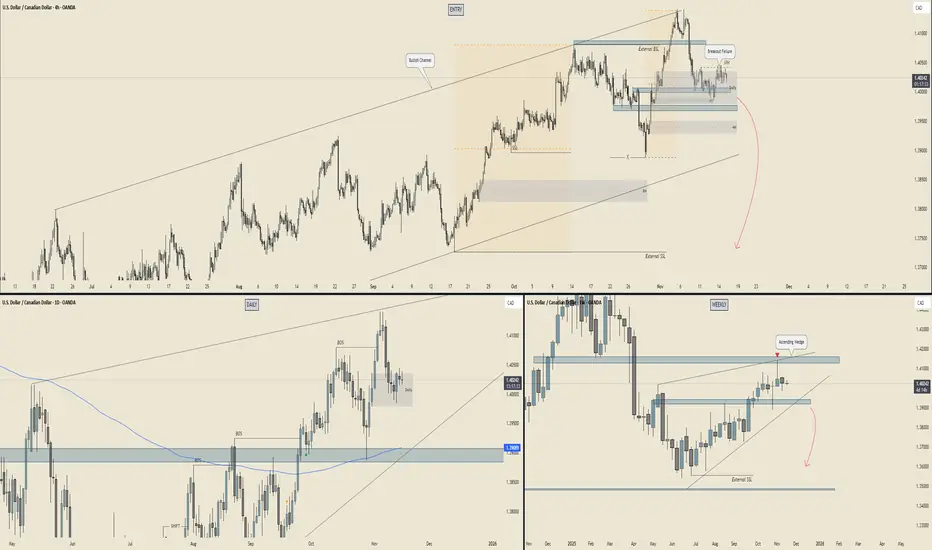

🧱 WEEKLY – The Big Dog View

Bias: 🐻 Bearish pressure building

Why:

Price is pushing into that massive weekly supply while sitting inside an ascending wedge — textbook distribution energy.

The wedge resistance + supply block is basically a double whammy ceiling.

Reaction wicks show buyers getting tired… sellers warming up.

Beneath current price? A HUGE vacuum of clean, unmitigated price action → easy liquidity to the downside.

🎯 Weekly Target Zones:

1.3900–1.3850 = first stop (mid-range demand)

1.3650–1.3550 = main deep target

External SSL much lower = long-term magnet

👉 Weekly says: “Yo… down only unless we get a breakout above supply.”

📆 DAILY – Internal Structure Rolling Over

Bias: 🐻 Turning bearish

Why: Daily BOS formed on the drop → clear bearish intent.

Price pulled back into a fresh daily supply, reacted cleanly, and is now stalling.

Daily is coiling under resistance = distribution micro-pattern.

As long as the daily mitigation block holds, rallies are just liquidity grabs.

🔥 Daily Key Levels:

Hold below 1.4070 = bearish continuation

Break below 1.3950 = flush into 1.3900

Lose 1.3900 = full send toward 1.38 → 1.37

👉 Daily is setting up the breakdown leg.

⏳ 4H – The Execution Chart (The Juice)

Bias: 🐻 Bearish retest + roll

Why: The 4H bullish channel got broken → structure shift.

We even have a breakout failure at the top = classic “trap the buyers then nuke it.”

4H supply stacking beautifully (Daily + 4H combo).

Price trapped sideways waiting for a trigger → likely a fake-out pop then drop, or a straight collapse.

📌 4H Key Areas:

4H supply: 1.4030–1.4060 = Sell zone

4H support: 1.3950 = Break this → waterfall

Next demand: 1.3880 then the huge imbalance to 1.3800

🎯 4H Targets:

Short-term: 1.3950

Medium: 1.3880

Main: 1.3800

🚀 SUMMARY – USD/CAD Forecast

🔥 Overall Bias: BEARISH (Weekly + Daily + 4H aligned)

🔽 Direction: Expect downside continuation

🎯 Main Target: 1.3800

🧯 Invalidation: Clean daily close above 1.4070 (rare unless oil nukes or USD goes parabolic)

✨ The Likely Path:

Small 4H pullback into supply

Break of 1.3950 internal floor

Fast slide into 1.3880

Larger drop toward 1.3800–1.3750

Bias: 🐻 Bearish pressure building

Why:

Price is pushing into that massive weekly supply while sitting inside an ascending wedge — textbook distribution energy.

The wedge resistance + supply block is basically a double whammy ceiling.

Reaction wicks show buyers getting tired… sellers warming up.

Beneath current price? A HUGE vacuum of clean, unmitigated price action → easy liquidity to the downside.

🎯 Weekly Target Zones:

1.3900–1.3850 = first stop (mid-range demand)

1.3650–1.3550 = main deep target

External SSL much lower = long-term magnet

👉 Weekly says: “Yo… down only unless we get a breakout above supply.”

📆 DAILY – Internal Structure Rolling Over

Bias: 🐻 Turning bearish

Why: Daily BOS formed on the drop → clear bearish intent.

Price pulled back into a fresh daily supply, reacted cleanly, and is now stalling.

Daily is coiling under resistance = distribution micro-pattern.

As long as the daily mitigation block holds, rallies are just liquidity grabs.

🔥 Daily Key Levels:

Hold below 1.4070 = bearish continuation

Break below 1.3950 = flush into 1.3900

Lose 1.3900 = full send toward 1.38 → 1.37

👉 Daily is setting up the breakdown leg.

⏳ 4H – The Execution Chart (The Juice)

Bias: 🐻 Bearish retest + roll

Why: The 4H bullish channel got broken → structure shift.

We even have a breakout failure at the top = classic “trap the buyers then nuke it.”

4H supply stacking beautifully (Daily + 4H combo).

Price trapped sideways waiting for a trigger → likely a fake-out pop then drop, or a straight collapse.

📌 4H Key Areas:

4H supply: 1.4030–1.4060 = Sell zone

4H support: 1.3950 = Break this → waterfall

Next demand: 1.3880 then the huge imbalance to 1.3800

🎯 4H Targets:

Short-term: 1.3950

Medium: 1.3880

Main: 1.3800

🚀 SUMMARY – USD/CAD Forecast

🔥 Overall Bias: BEARISH (Weekly + Daily + 4H aligned)

🔽 Direction: Expect downside continuation

🎯 Main Target: 1.3800

🧯 Invalidation: Clean daily close above 1.4070 (rare unless oil nukes or USD goes parabolic)

✨ The Likely Path:

Small 4H pullback into supply

Break of 1.3950 internal floor

Fast slide into 1.3880

Larger drop toward 1.3800–1.3750

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.