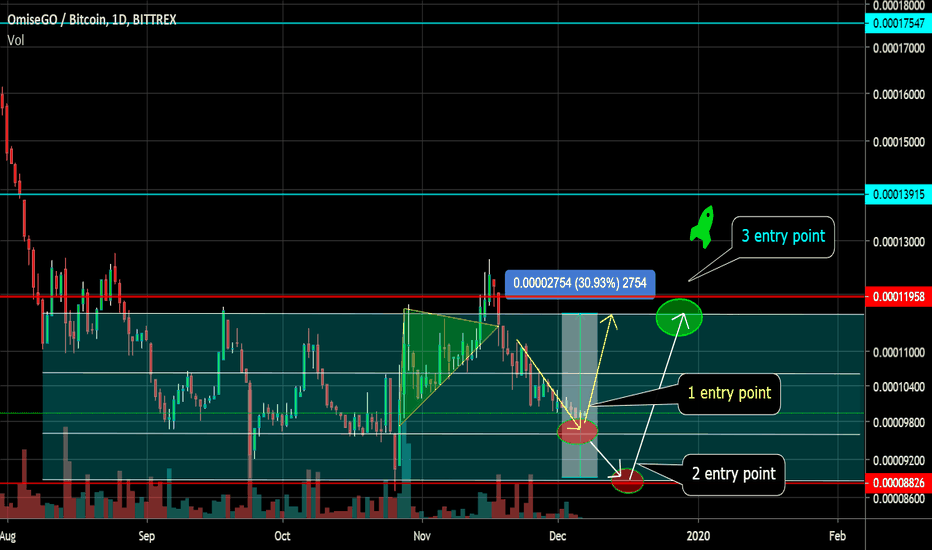

OMG Ascending Triangle. + 21% Channel + 30%. Entry points.

Aktualisiert

OMG Ascending Triangle. Earnings with different price movements.

Rising triangles mostly work up. Perhaps this upward triangle will become a reversal pattern of a downtrend. A break of the triangle up and working it out to the widest part + 21% will mean a break of the channel. Just at a height of + 21% is the first resistance. If this happens and the price consolidates above the accumulation channel, a trend reversal may occur.

1 entry option.

We trade a triangle. Entrance on the breakthrough of the triangle or on the rollback after the breakthrough, depending on your strategy. The potential is from + 21% and the target is above the channel if the price can consolidate above the accumulation channel. And a trend reversal will occur.

2 entry option.

We trade channel potential. This is if a triangle is struck down. (Low probability). Entrance at the bottom of the horizontal channel, with confirmation of support. The potential to the upper boundary of the horizontal channel + 30%.

The pivot points of the price, on which this or that movement will depend, I showed on the chart.

____________________________________

Ascending triangle.

The ascending triangle is a figure of growth. This means that no matter what movements were in front of the figur, after the completion and confirmation of the figure, the price on the trading instrument goes up in 90% of cases. You need to understand that if one person (or group by conspiracy) controls a fully defined instrument (coin), then there is a high probability of fraudulent movements against logic and rules. But in 90% of cases it works up.

An ascending triangle is a bullish pattern and is formed on an uptrend as a figure of the continuation of the trend. It should be noted that in some fairly rare cases, the upward triangle may complete the downtrend (bearish) trend and act as a reversal pattern. However, regardless of whether it was formed on an uptrend or downtrend, its appearance is an indicator of accumulation, preceding the upward movement of prices. Very rarely there are exceptions.

Unlike neutral figures, an ascending triangle can be identified until the upper resistance line is broken.

In fact, the bulls encounter a strong level of resistance and make a number of attempts to break through it, forming approximately the same maximums on the chart. However, each subsequent correction will be less and less deep, which indicates a weakening bear pressure on the market and an upcoming continuation of the bull trend. Everything has its own reasons. You need to understand for what reasons and how one or the other figures are formed.

___________________________________________

Target

To determine the purpose of the price movement, it is necessary to measure the distance of the widest part of the figure and put it up at the breakpoint of the triangle. If we take the entire width as 100%, then we must leave the position at a distance of about 80% of the planned movement. It’s better to get out before everyone else. I always do that, especially when the position is big.

___________________________________________

Rules for all shapes of Triangles.

1) Price breaking is likely to occur in the direction of the previous trend.

2) An odd number of vibrations (waves) usually occurs inside a triangle. It is desirable that their number be at least five (three down and two up or vice versa). The more waves, the stronger the signal.

3) It is believed that if the last wave of the triangle did not touch the border and developed earlier, then this will lead to a sharp price movement when one of the parties breaks through.

4) It is not recommended to trade inside the triangle figure.

5) During the movement of the price inside the triangle, the volume indicators should decrease, and during the break through of one of the sides increase. If the price after a breakthrough of the border is trying to return, then for the model to be successful this return should occur on a declining volume.

6) If, after breaking through one of the sides of the triangle, the price “tries” to return, then this should happen with decreasing volume indicators (otherwise this serves as a “not good” signal).

7) To confirm the opening of a position, when a triangle is broken, it is advisable to wait until the closing price of the Japanese candlestick is outside the triangle and only then open the position.

8) It is desirable that the price breakout occurs at a distance from 1/5 to 3/4 of the horizontal length of the triangle. If this happened later, then the triangle loses its breakthrough momentum and further price movement may be uncertain.

9) If the angle of inclination of the triangle is more directed upwards, then most likely the price will go up and vice versa, if the angle of inclination of the triangle is more directed downwards, then most likely the price will also go down.

10) It is believed that the fastest way out of a triangle occurs when the last wave of the triangle does not touch its border, but unfolds earlier.

11) After breaking through one of the sides of the triangle, very often this side becomes the level of support / resistance (depending on where the price broke up or down).

12) After breaking through, the price will go towards breaking through at a distance equal to at least the height of the triangle in its largest part.

Rising triangles mostly work up. Perhaps this upward triangle will become a reversal pattern of a downtrend. A break of the triangle up and working it out to the widest part + 21% will mean a break of the channel. Just at a height of + 21% is the first resistance. If this happens and the price consolidates above the accumulation channel, a trend reversal may occur.

1 entry option.

We trade a triangle. Entrance on the breakthrough of the triangle or on the rollback after the breakthrough, depending on your strategy. The potential is from + 21% and the target is above the channel if the price can consolidate above the accumulation channel. And a trend reversal will occur.

2 entry option.

We trade channel potential. This is if a triangle is struck down. (Low probability). Entrance at the bottom of the horizontal channel, with confirmation of support. The potential to the upper boundary of the horizontal channel + 30%.

The pivot points of the price, on which this or that movement will depend, I showed on the chart.

____________________________________

Ascending triangle.

The ascending triangle is a figure of growth. This means that no matter what movements were in front of the figur, after the completion and confirmation of the figure, the price on the trading instrument goes up in 90% of cases. You need to understand that if one person (or group by conspiracy) controls a fully defined instrument (coin), then there is a high probability of fraudulent movements against logic and rules. But in 90% of cases it works up.

An ascending triangle is a bullish pattern and is formed on an uptrend as a figure of the continuation of the trend. It should be noted that in some fairly rare cases, the upward triangle may complete the downtrend (bearish) trend and act as a reversal pattern. However, regardless of whether it was formed on an uptrend or downtrend, its appearance is an indicator of accumulation, preceding the upward movement of prices. Very rarely there are exceptions.

Unlike neutral figures, an ascending triangle can be identified until the upper resistance line is broken.

In fact, the bulls encounter a strong level of resistance and make a number of attempts to break through it, forming approximately the same maximums on the chart. However, each subsequent correction will be less and less deep, which indicates a weakening bear pressure on the market and an upcoming continuation of the bull trend. Everything has its own reasons. You need to understand for what reasons and how one or the other figures are formed.

___________________________________________

Target

To determine the purpose of the price movement, it is necessary to measure the distance of the widest part of the figure and put it up at the breakpoint of the triangle. If we take the entire width as 100%, then we must leave the position at a distance of about 80% of the planned movement. It’s better to get out before everyone else. I always do that, especially when the position is big.

___________________________________________

Rules for all shapes of Triangles.

1) Price breaking is likely to occur in the direction of the previous trend.

2) An odd number of vibrations (waves) usually occurs inside a triangle. It is desirable that their number be at least five (three down and two up or vice versa). The more waves, the stronger the signal.

3) It is believed that if the last wave of the triangle did not touch the border and developed earlier, then this will lead to a sharp price movement when one of the parties breaks through.

4) It is not recommended to trade inside the triangle figure.

5) During the movement of the price inside the triangle, the volume indicators should decrease, and during the break through of one of the sides increase. If the price after a breakthrough of the border is trying to return, then for the model to be successful this return should occur on a declining volume.

6) If, after breaking through one of the sides of the triangle, the price “tries” to return, then this should happen with decreasing volume indicators (otherwise this serves as a “not good” signal).

7) To confirm the opening of a position, when a triangle is broken, it is advisable to wait until the closing price of the Japanese candlestick is outside the triangle and only then open the position.

8) It is desirable that the price breakout occurs at a distance from 1/5 to 3/4 of the horizontal length of the triangle. If this happened later, then the triangle loses its breakthrough momentum and further price movement may be uncertain.

9) If the angle of inclination of the triangle is more directed upwards, then most likely the price will go up and vice versa, if the angle of inclination of the triangle is more directed downwards, then most likely the price will also go down.

10) It is believed that the fastest way out of a triangle occurs when the last wave of the triangle does not touch its border, but unfolds earlier.

11) After breaking through one of the sides of the triangle, very often this side becomes the level of support / resistance (depending on where the price broke up or down).

12) After breaking through, the price will go towards breaking through at a distance equal to at least the height of the triangle in its largest part.

Anmerkung

After breaking through the triangle + 10%, there is a rollback of the price to support (the former resistance of the triangle).If support is sustained, you can enter the long. It is better to enter when the upward movement from support has already begun.

If support fails and becomes resistance again, then trading in the previous accumulation channel from trend lines.

Anmerkung

After a false breakdown of the triangle, the price moved according to option 2 - trading in the channel.

OMG / BTC Operation in the horizontal accumulation channel in increments of 30%.

Pivot points breakthrough / retention of important support / resistance levels on which further movement I will depend on the chart.

I also showed various options for entering the market after confirming support for a certain local level.

The target are all on the chart depending on what price movement is confirmed.

A breakthrough of the channel and fixing the price above the resistance of the channel will open upside potential to higher targets than the potential of the channel.

Stop loss

Under key support levels during your entry into the market.

Do not forget to move Stop Loss during the price increase, but take into account the volatility of the coin.

✅ Telegram. Finance + Trading: t.me/SpartaBTC_1318

✅ Telegram. Сrypto trading only: t.me/SpartaBTC_tradingview

✅ Instagram: instagram.com/spartabtc_1318

✅ YouTube (Rus): goo.su/vpRzRa2

✅ Telegram. Сrypto trading only: t.me/SpartaBTC_tradingview

✅ Instagram: instagram.com/spartabtc_1318

✅ YouTube (Rus): goo.su/vpRzRa2

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.