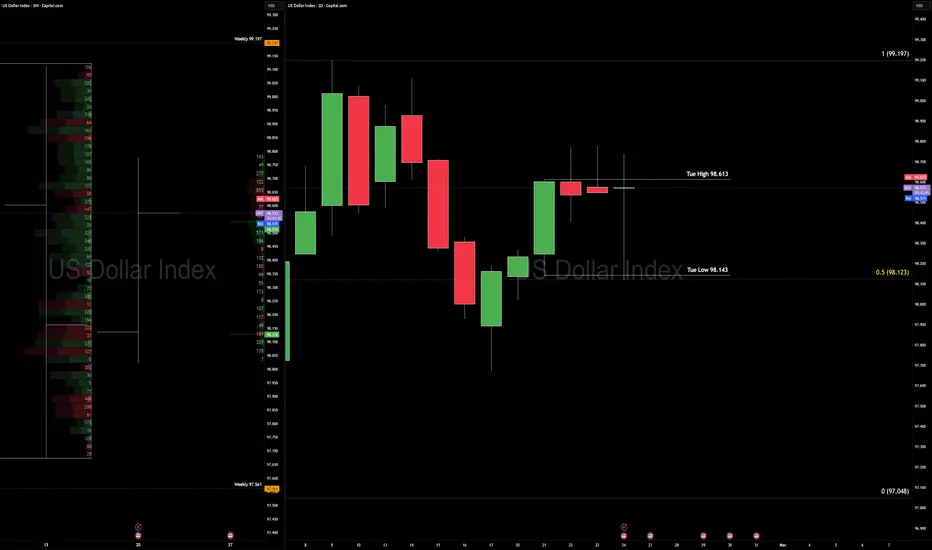

The U.S. Dollar Index is locking in tight — 3rd consecutive weekly inside bar, and a 4th possible daily inside bar — as U.S. inflation holds firm and Japan’s core inflation uptick adds fuel.

Context

We’re locked in structural compression: three weeks of internal price action, and today presents a 4th daily inside bar formation.

Weekly key range: low 97.561 and high 99.197. Price is stuck in the mid-zone, patiently waiting.

For bias confirmation: Break of Tuesday’s 21 Oct daily candle low at 98.143 or high at 98.613 will signal directional bias.

Macro queue: Big data hits next week (inflation prints, central-bank focus). Volatility is coiled.

Technical

Weekly frame: Still inside the bearish range (97.561 – 99.197).

Daily frame: Bias leans bullish until the range breaks — think “bullish inside bar pending expansion”.

In symmetrical measures: Risk of overbought cognition; if today’s low holds and Monday fails to trade through it, we may see a higher low setup. Execution: Wait for clean breakout of the inside bar structure; use volume confirmation; avoid getting sucked into a false squeeze.

Fundamentals

U.S. inflation: The Consumer Price Index for September is published today (24 Oct) after delay due to shutdown.

Bureau of Labor Statistics +2

The Financial Express +2

Japan inflation: September core inflation rose to 2.9% YoY, moving above the Bank of Japan target and adding pressure to the JPY‐rate story.

Trading Economics

+2

Bloomberg

+2

Impact mechanism: Sticky inflation → reduces odds of immediate rate cuts → supports USD strength; yet structural squeeze in DXY means the market is holding its breath for breakout.

Plan & Mindset

Plan: Hold off trading until Monday’s price action gives clarity through breakout of the inside-bar structure. Then map cross-assets (EURUSD, GBPUSD) accordingly.

Mindset

Structure rules story. Don’t fight a tight coil. Today you “wait with purpose.” If price breaks, act decisively; if it breaks wrong, adapt quickly.

- Like waiting for the popcorn — you don’t eat the kernels while still heating.

Daniel Fadeley — Trader & Coach | Founder of CORE5 Tradecraft™

Data-driven strategies connecting market structure, volume flow, and real economic drivers.

Institutional Logic. Modern Technology. Real Freedom.

Data-driven strategies connecting market structure, volume flow, and real economic drivers.

Institutional Logic. Modern Technology. Real Freedom.

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Daniel Fadeley — Trader & Coach | Founder of CORE5 Tradecraft™

Data-driven strategies connecting market structure, volume flow, and real economic drivers.

Institutional Logic. Modern Technology. Real Freedom.

Data-driven strategies connecting market structure, volume flow, and real economic drivers.

Institutional Logic. Modern Technology. Real Freedom.

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.