OPEN-SOURCE SCRIPT

EMA Distance & Sector Info

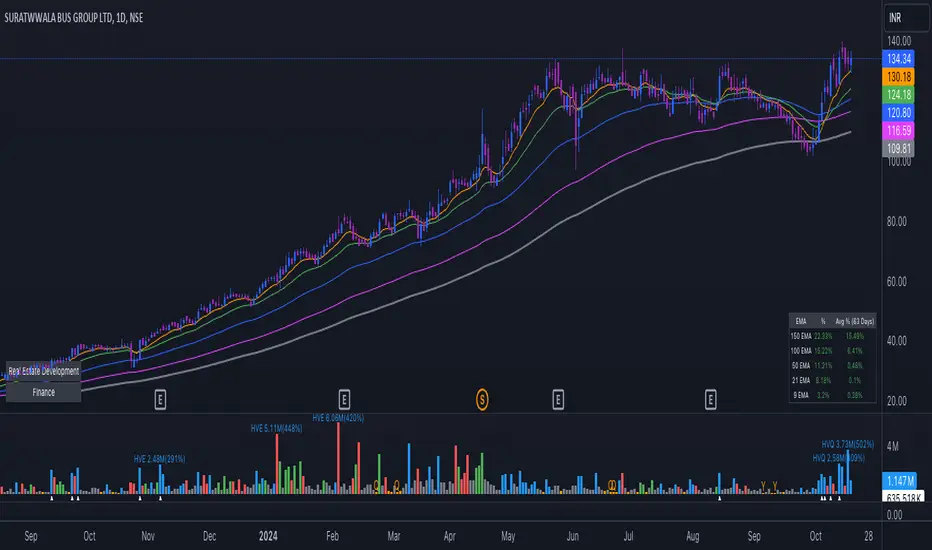

This indicator provides insights into price trends relative to Exponential Moving Averages (EMAs) and displays sector/industry information about the asset. Below is a detailed explanation of its purpose and what it is designed to achieve:

Purpose of the Code

The indicator offers two key functionalities:

1. Analyzing Price Distance from Multiple EMAs:

• Helps traders understand how far the current price is from key EMAs, expressed as a percentage.

• Calculates average percentage distances over a specified period (default: 63 days) to spot consistent trends or mean reversion opportunities.

• Useful for trend-following strategies, allowing the trader to see when the price is above or below important EMAs (e.g., 9, 21, 50, 100, and 150-period EMAs).

2. Displaying Asset Sector and Industry Information:

• Displays the sector and industry of the asset being analyzed (e.g., Technology, Consumer Goods).

• Provides additional context when evaluating performance across a specific sector or comparing an asset to its peers.

Who Would Use This Indicator?

This indicator is particularly helpful for:

1. Swing Traders and Positional Traders:

• They can use it to track whether the price is trading significantly above or below critical EMAs, which often signals overbought/oversold conditions or trend strength.

• The average percentage distances help to identify momentum shifts or pullback opportunities.

2. Sector/Industry-Focused Investors:

• Understanding an asset’s sector and industry helps investors gauge how the asset fits into the broader market context.

• This is valuable for sector rotation strategies, where investors shift funds between sectors based on performance trends.

How It Helps in Trading Decisions

1. Entry and Exit Points:

• If the price is far above an EMA (e.g., 21 EMA), it might indicate an overbought condition or a strong trend, while a negative percentage could signal a pullback or reversal opportunity.

• The average percentage distances smooth the fluctuations and reveal longer-term trends.

2. Contextual Information:

• Knowing the sector and industry is useful when analyzing trends. For example, if Technology stocks are doing well, and this asset belongs to that sector, it could indicate sector-wide momentum.

Summary of the Indicator’s Purpose

This code provides:

• EMA trend monitoring: Visualizes the price position relative to multiple EMAs and averages those distances for smoother insights.

• Sector and industry information: Adds valuable context for asset performance analysis.

• Decision-making support: Helps traders identify overbought/oversold levels and assess the asset within the broader market landscape.

In essence, this indicator is a multi-purpose tool that combines technical analysis (through EMA distances) with fundamental context (via sector/industry info), making it valuable for traders and investors aiming to time entries/exits or understand market behavior better.

Purpose of the Code

The indicator offers two key functionalities:

1. Analyzing Price Distance from Multiple EMAs:

• Helps traders understand how far the current price is from key EMAs, expressed as a percentage.

• Calculates average percentage distances over a specified period (default: 63 days) to spot consistent trends or mean reversion opportunities.

• Useful for trend-following strategies, allowing the trader to see when the price is above or below important EMAs (e.g., 9, 21, 50, 100, and 150-period EMAs).

2. Displaying Asset Sector and Industry Information:

• Displays the sector and industry of the asset being analyzed (e.g., Technology, Consumer Goods).

• Provides additional context when evaluating performance across a specific sector or comparing an asset to its peers.

Who Would Use This Indicator?

This indicator is particularly helpful for:

1. Swing Traders and Positional Traders:

• They can use it to track whether the price is trading significantly above or below critical EMAs, which often signals overbought/oversold conditions or trend strength.

• The average percentage distances help to identify momentum shifts or pullback opportunities.

2. Sector/Industry-Focused Investors:

• Understanding an asset’s sector and industry helps investors gauge how the asset fits into the broader market context.

• This is valuable for sector rotation strategies, where investors shift funds between sectors based on performance trends.

How It Helps in Trading Decisions

1. Entry and Exit Points:

• If the price is far above an EMA (e.g., 21 EMA), it might indicate an overbought condition or a strong trend, while a negative percentage could signal a pullback or reversal opportunity.

• The average percentage distances smooth the fluctuations and reveal longer-term trends.

2. Contextual Information:

• Knowing the sector and industry is useful when analyzing trends. For example, if Technology stocks are doing well, and this asset belongs to that sector, it could indicate sector-wide momentum.

Summary of the Indicator’s Purpose

This code provides:

• EMA trend monitoring: Visualizes the price position relative to multiple EMAs and averages those distances for smoother insights.

• Sector and industry information: Adds valuable context for asset performance analysis.

• Decision-making support: Helps traders identify overbought/oversold levels and assess the asset within the broader market landscape.

In essence, this indicator is a multi-purpose tool that combines technical analysis (through EMA distances) with fundamental context (via sector/industry info), making it valuable for traders and investors aiming to time entries/exits or understand market behavior better.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.