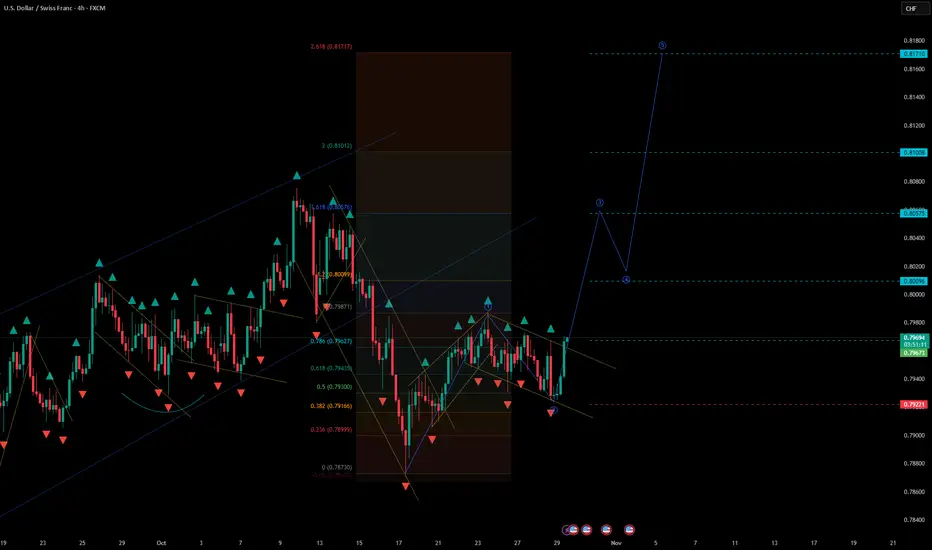

USDCHF – Potential Third Wave Formation

Current price: 0.7969

The U.S. dollar against the Swiss franc is showing a potential bullish reversal setup after completing a corrective decline. Price action structure suggests the start of an impulsive wave sequence, targeting higher Fibonacci extensions.

🧩 Technical Overview

• The pair successfully rebounded from 0.7910–0.7920 support, forming a clean base structure at the lower boundary of the short-term channel.

• A breakout above 0.7980–0.8000 signals early confirmation of a potential wave 3 development.

• The pattern is forming a symmetrical recovery phase consistent with Fibonacci expansion ratios.

📈 Scenario

• Stop-loss: below 0.7920, under the last structural low.

• Upside targets:

– 0.8095–0.8100 — short-term objective / 1.0 Fib projection

– 0.8085–0.8090 — possible consolidation / wave 4 area

– 0.8170–0.8180 — extended upside target (2.618 Fib projection)

• Break and 4H close above 0.8000 would confirm wave 3 continuation.

⚙️ Market Context

• USDCHF is recovering from oversold conditions within a broader consolidation phase.

• The recent correction likely completed a wave 2, setting the stage for renewed bullish momentum.

• Dollar demand remains supported by stable U.S. yields, while CHF underperforms amid reduced safe-haven flows.

🧭 Summary

USDCHF shows a clear potential wave 3 setup, with momentum shifting upward.

• As long as price holds above 0.7920, structure favors continuation toward 0.8095 → 0.8170.

• A confirmed breakout above 0.8000 will solidify the bullish scenario, while a return below 0.7920 invalidates it.

Current price: 0.7969

The U.S. dollar against the Swiss franc is showing a potential bullish reversal setup after completing a corrective decline. Price action structure suggests the start of an impulsive wave sequence, targeting higher Fibonacci extensions.

🧩 Technical Overview

• The pair successfully rebounded from 0.7910–0.7920 support, forming a clean base structure at the lower boundary of the short-term channel.

• A breakout above 0.7980–0.8000 signals early confirmation of a potential wave 3 development.

• The pattern is forming a symmetrical recovery phase consistent with Fibonacci expansion ratios.

📈 Scenario

• Stop-loss: below 0.7920, under the last structural low.

• Upside targets:

– 0.8095–0.8100 — short-term objective / 1.0 Fib projection

– 0.8085–0.8090 — possible consolidation / wave 4 area

– 0.8170–0.8180 — extended upside target (2.618 Fib projection)

• Break and 4H close above 0.8000 would confirm wave 3 continuation.

⚙️ Market Context

• USDCHF is recovering from oversold conditions within a broader consolidation phase.

• The recent correction likely completed a wave 2, setting the stage for renewed bullish momentum.

• Dollar demand remains supported by stable U.S. yields, while CHF underperforms amid reduced safe-haven flows.

🧭 Summary

USDCHF shows a clear potential wave 3 setup, with momentum shifting upward.

• As long as price holds above 0.7920, structure favors continuation toward 0.8095 → 0.8170.

• A confirmed breakout above 0.8000 will solidify the bullish scenario, while a return below 0.7920 invalidates it.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.