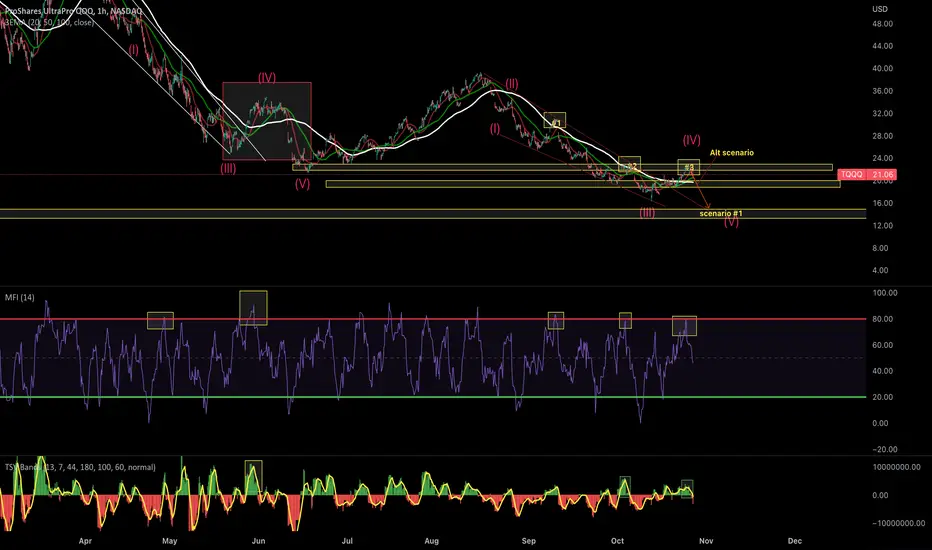

1. So looking back on the chart when the MFI has hit over bought it has been a good time to short the market, in a downtrend when things become over bought it usually represents a good shorting opportunity

2. If you go back on our last leg down we hit a wave 4 @ the 38% fib level with a descending wedge breakout then dropped to new lows to wave 5 before rallying

3. We had obvious divergences on the MFI( started trending down as prices moved up) also on the tsv( your volume was decreasing)

4. I don't expect earnings to be any good this week and the market will react in a negative way, after earnings are done we should be priced in for the rest of the year, that being said i think november will be our rally month

This is just my opinion, now there is a bullish scenario to this, if we can manage to hold 19.50 support we can maybe see higher highs but as for now i see a lot of resistances,

Please if u have a different opinion i would love to hear it,

thanks

Happy trading and god bless

2. If you go back on our last leg down we hit a wave 4 @ the 38% fib level with a descending wedge breakout then dropped to new lows to wave 5 before rallying

3. We had obvious divergences on the MFI( started trending down as prices moved up) also on the tsv( your volume was decreasing)

4. I don't expect earnings to be any good this week and the market will react in a negative way, after earnings are done we should be priced in for the rest of the year, that being said i think november will be our rally month

This is just my opinion, now there is a bullish scenario to this, if we can manage to hold 19.50 support we can maybe see higher highs but as for now i see a lot of resistances,

Please if u have a different opinion i would love to hear it,

thanks

Happy trading and god bless

Anmerkung

watching this $19.9-19 range, might take some profits off the tableHaftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.