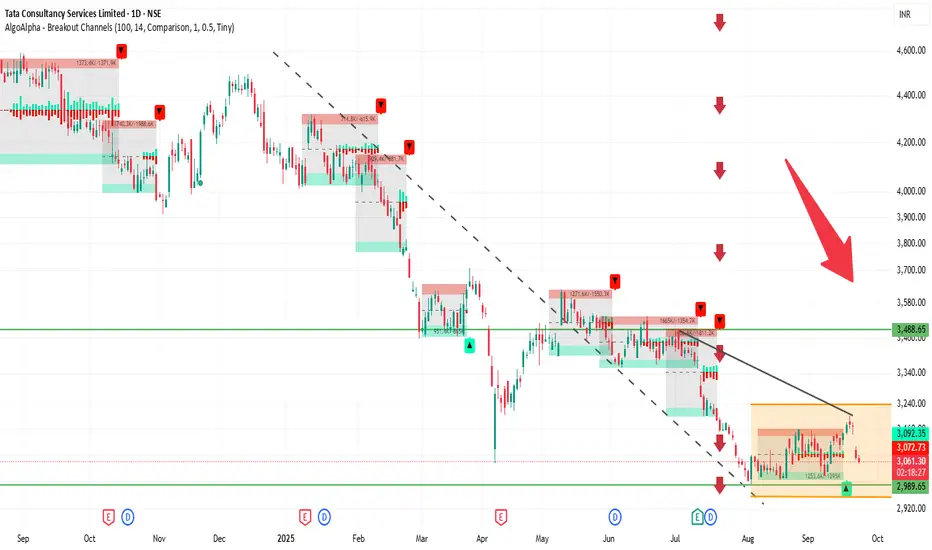

📍 Current Price & Range

Current price: ₹3,063.80

Day’s High / Low: ₹3,106.90 / ₹3,052.00

52-week High / Low: ₹4,494.90 / ₹2,991.60

🔍 Key Levels

Immediate resistance: ₹3,100–₹3,110

Next resistance: ₹3,200–₹3,250

Immediate support: ₹3,050–₹3,060

Psychological / strong support: ₹3,000

📊 Indicators & Momentum

Price is just below near-term resistance, showing hesitation.

Short-term trend is neutral to slightly bearish; momentum is weak.

RSI and MACD suggest neutral to weak momentum, no strong reversal yet.

Stock is trading well below its 52-week high, indicating it has already corrected significantly.

🔮 Possible Scenarios

Bullish breakout → Sustaining above ₹3,110 could push price toward ₹3,200–₹3,250.

Sideways / consolidation → Likely to trade between ₹3,050–₹3,110 if no strong catalyst.

Bearish pullback → Breaking below ₹3,050 may take price toward ₹3,000, and further down to ₹2,950–₹2,900 if weakness continues.

👉 Outlook: At the current level (₹3,073.80), TCS is in a neutral zone. The next directional move depends on either a breakout above resistance or a fall below support.

Current price: ₹3,063.80

Day’s High / Low: ₹3,106.90 / ₹3,052.00

52-week High / Low: ₹4,494.90 / ₹2,991.60

🔍 Key Levels

Immediate resistance: ₹3,100–₹3,110

Next resistance: ₹3,200–₹3,250

Immediate support: ₹3,050–₹3,060

Psychological / strong support: ₹3,000

📊 Indicators & Momentum

Price is just below near-term resistance, showing hesitation.

Short-term trend is neutral to slightly bearish; momentum is weak.

RSI and MACD suggest neutral to weak momentum, no strong reversal yet.

Stock is trading well below its 52-week high, indicating it has already corrected significantly.

🔮 Possible Scenarios

Bullish breakout → Sustaining above ₹3,110 could push price toward ₹3,200–₹3,250.

Sideways / consolidation → Likely to trade between ₹3,050–₹3,110 if no strong catalyst.

Bearish pullback → Breaking below ₹3,050 may take price toward ₹3,000, and further down to ₹2,950–₹2,900 if weakness continues.

👉 Outlook: At the current level (₹3,073.80), TCS is in a neutral zone. The next directional move depends on either a breakout above resistance or a fall below support.

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.