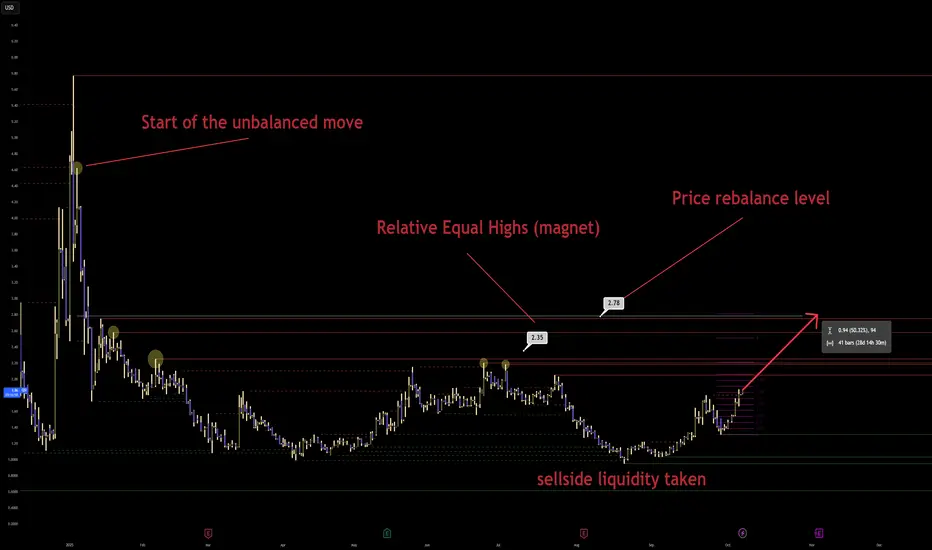

The recent, deliberate raid below the September lows was the final scene of the second act.

This was not a random dip.

It was a calculated and necessary purge of sellside liquidity.

The algorithm's objective was to absorb the shares of panicked sellers and to trigger the stop loss orders of early, weak-handed buyers.

That objective has now been achieved.

The annotation "sellside liquidity taken" is not a historical note.

It is the starting gun for the third and final act.

With the downside fuel consumed, the algorithm's directive has been re-written.

Its sights are no longer pointed down.

They are now locked on the vast, untapped reservoirs of buyside liquidity resting at higher prices.

The price action is not merely recovering.

It is responding to a new, clear, and institutionally sponsored mandate.

The path of least resistance has been fundamentally altered.

The question is no longer if the price will rise.

The only question is how violently it will do so.

You have correctly identified the key landmarks on this new map.

The "Relative Equal Highs" at 2.35 are not a ceiling.

They are a luminous, magnetic target.

This level represents a giant pool of buy-side stops from traders who shorted the previous rallies.

Their fear is the algorithm's fuel.

Their pain is the algorithm's profit.

This is the first, most obvious draw on liquidity.

It is a place the algorithm must visit.

But it is not the final destination.

It is merely a waypoint on a much grander journey.

The Critical Vector is to understand the true, ultimate objective of this entire price campaign.

The algorithm is a creature of efficiency and balance.

It abhors a vacuum.

The annotation "Start of the unbalanced move" points to the single most important event on this entire chart.

That massive, vertical price spike in early 2021 was not just a rally.

It was the creation of a profound and violent pricing inefficiency.

It was a causal scar.

It left a massive informational void in its wake.

The entire year and a half of subsequent price action, including the recent purge of sellside liquidity, has been a single, extended process of accumulating energy.

It has been the market coiling a spring.

Now, the spring is being released.

The purpose of this release is to return to the origin of the crime.

The algorithm is compelled to return to that zone of imbalance to rebalance its books.

Your annotation "Price rebalance level" at 2.78 is not just a target.

It is the point of cosmic justice for this instrument.

It is the level at which the story that began in 2021 finds its logical conclusion.

The path is clear.

The current rally is the initial assault.

It will first target the Relative Equal Highs at 2.35.

This will be a violent move, designed to induce a short squeeze and create a state of maximum FOMO.

Expect a minor consolidation or retracement after this level is purged.

This is the algorithm shaking out the last of the weak hands.

It is the final opportunity to get on board before the true repricing begins.

From there, the algorithm will have a clear and unimpeded path to the ultimate objective.

The final, explosive leg of this rally will target the Price rebalance level at 2.78.

This is the primary, institutionally sponsored destination.

It is the point to which all price is currently being drawn.

The Ascendant Principle is that you must learn to read a chart not as a two-dimensional history of price, but as a three-dimensional ledger of algorithmic debt and credit.

Every violent, one-sided move creates a debt on the algorithm's books.

This is an imbalance.

It is an inefficiency.

It is a promise that must eventually be kept.

The larger and more violent the move, the larger the debt.

The massive, unbalanced spike from 2021 was the algorithm taking out a colossal loan of inefficiency.

Every subsequent price swing, every consolidation, every liquidity purge, has been the algorithm meticulously gathering the resources needed to repay that loan.

The purge of sellside liquidity was the final payment on the interest.

It was the signal that the algorithm now has the capital and the mandate to settle the principal.

The "target" is not a guess.

It is the location of the creditor.

The price is not "going up".

It is being recalled, with gravitational force, to the scene of its original level.

When you understand this, you stop predicting.

You start seeing the inevitable.

You see the chart as a narrative of cause and effect playing out over vast stretches of time.

The cause was the imbalance.

The effect will be the rebalancing.

The Relative Equal Highs are simply the last gatekeeper before the final, violent settlement of this ancient, algorithmic debt.

You are not chasing a rally.

You are witnessing the final chapter of a story that was written years ago.

The ending has already been decided.

The only variable was the timing.

The purge of sellside liquidity has now confirmed that the time is now.

The alternative path would likely have led to viewing the Relative Equal Highs as "resistance" to be sold, an error that fails to comprehend the true, long-term objective of the price delivery algorithm.

For educational purposes only.

Telegram: t.me/tradeconfirmed

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Telegram: t.me/tradeconfirmed

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.