JUBLFOOD — Multi-Timeframe Technical Analysis

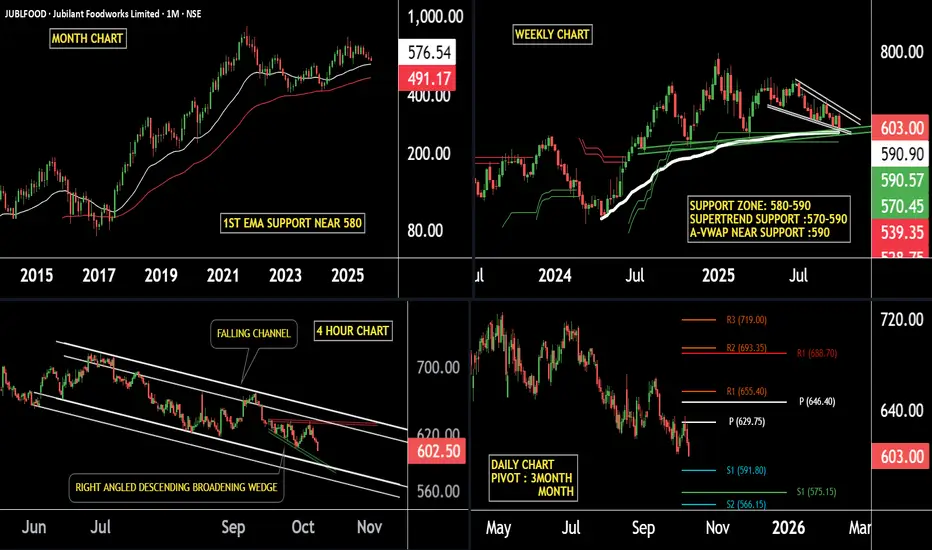

Monthly Timeframe:

JUBLFOOD is showing strong support on the EMA, with the first key support area positioned near the 580 level. This zone has historically acted as a major demand area, suggesting potential accumulation.

Weekly Timeframe:

The stock is currently trading near the 570–590 support zone, where the Supertrend indicator is also providing confirmation of support. Sustaining above this zone could trigger a potential reversal or upward momentum.

Daily Timeframe:

Both the quarterly and monthly pivot levels indicate strong support between 575–591, reinforcing this area as a crucial price base from a pivot-point perspective.

4-Hour Timeframe:

On the lower timeframe, JUBLFOOD is moving within a falling channel and forming a descending broadening wedge pattern near the 580 support zone. This structure suggests a possible bullish reversal if the price holds and breaks above the upper trendline.

if this level is sustain then we may see higher prices in stock.

thank you!!

Monthly Timeframe:

JUBLFOOD is showing strong support on the EMA, with the first key support area positioned near the 580 level. This zone has historically acted as a major demand area, suggesting potential accumulation.

Weekly Timeframe:

The stock is currently trading near the 570–590 support zone, where the Supertrend indicator is also providing confirmation of support. Sustaining above this zone could trigger a potential reversal or upward momentum.

Daily Timeframe:

Both the quarterly and monthly pivot levels indicate strong support between 575–591, reinforcing this area as a crucial price base from a pivot-point perspective.

4-Hour Timeframe:

On the lower timeframe, JUBLFOOD is moving within a falling channel and forming a descending broadening wedge pattern near the 580 support zone. This structure suggests a possible bullish reversal if the price holds and breaks above the upper trendline.

if this level is sustain then we may see higher prices in stock.

thank you!!

@RahulSaraoge

Connect us at t.me/stridesadvisory

Connect us at t.me/stridesadvisory

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

@RahulSaraoge

Connect us at t.me/stridesadvisory

Connect us at t.me/stridesadvisory

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.