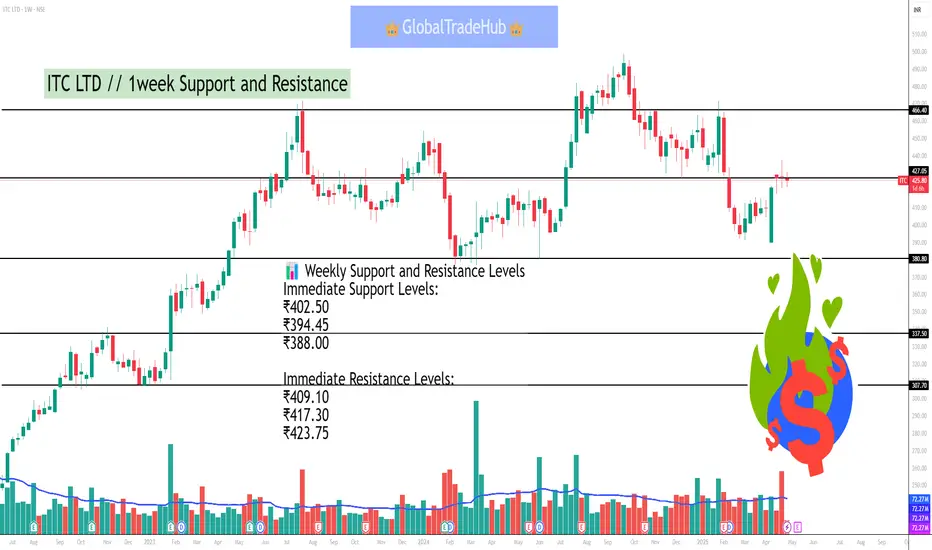

As of May 1, 2025, at 10:20 AM IST, ITC Ltd (NSE: ITC) is trading at ₹403.05. Based on recent technical analysis, here are the key support and resistance levels for the stock on a weekly (1W) chart:

📊 Weekly Support and Resistance Levels

Immediate Support Levels:

₹402.50

₹394.45

₹388.00

Immediate Resistance Levels:

₹409.10

₹417.30

₹423.75

These levels suggest that if the stock price declines below ₹402.50, it may find support around ₹394.45 and ₹388.00. Conversely, if the price rises above ₹409.10, it could encounter resistance near ₹417.30 and ₹423.75.

🔍 Technical Indicators

ADX (Average Directional Index): 29.19 – indicates a trending market.

RSI (Relative Strength Index): 47.4 – suggests neutral momentum.

MACD (Moving Average Convergence Divergence): -4.66 – indicates a negative trend.

CCI (Commodity Channel Index): 2.74 – suggests neutral momentum.

These indicators suggest a neutral to slightly bearish outlook for ITC in the short term.

📈 Summary

ITC is currently trading near its immediate support levels. A break below ₹402.50 could lead to a decline towards ₹394.45 and ₹388.00. On the upside, resistance is observed at ₹409.10, ₹417.30, and ₹423.75. Traders should monitor these levels closely, as a decisive move beyond these support or resistance levels could signal the next directional move.

📊 Weekly Support and Resistance Levels

Immediate Support Levels:

₹402.50

₹394.45

₹388.00

Immediate Resistance Levels:

₹409.10

₹417.30

₹423.75

These levels suggest that if the stock price declines below ₹402.50, it may find support around ₹394.45 and ₹388.00. Conversely, if the price rises above ₹409.10, it could encounter resistance near ₹417.30 and ₹423.75.

🔍 Technical Indicators

ADX (Average Directional Index): 29.19 – indicates a trending market.

RSI (Relative Strength Index): 47.4 – suggests neutral momentum.

MACD (Moving Average Convergence Divergence): -4.66 – indicates a negative trend.

CCI (Commodity Channel Index): 2.74 – suggests neutral momentum.

These indicators suggest a neutral to slightly bearish outlook for ITC in the short term.

📈 Summary

ITC is currently trading near its immediate support levels. A break below ₹402.50 could lead to a decline towards ₹394.45 and ₹388.00. On the upside, resistance is observed at ₹409.10, ₹417.30, and ₹423.75. Traders should monitor these levels closely, as a decisive move beyond these support or resistance levels could signal the next directional move.

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.