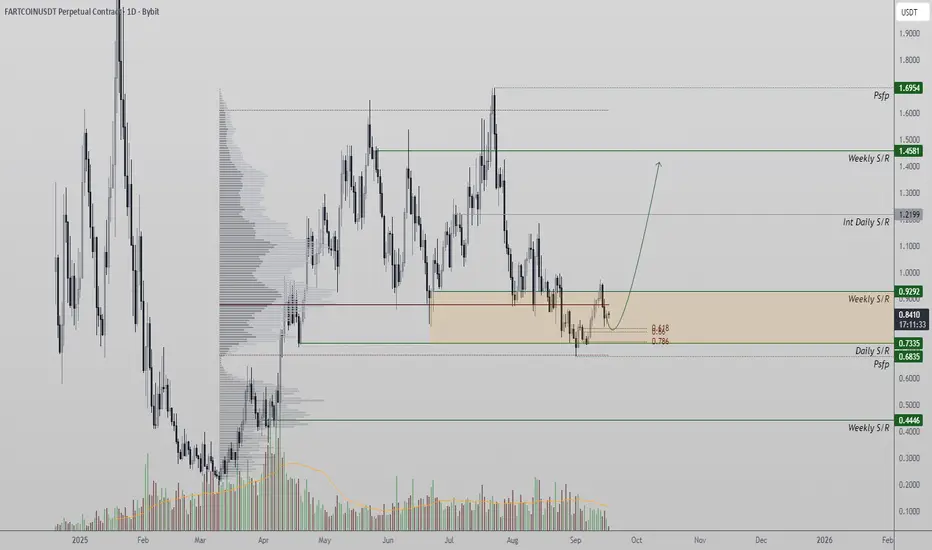

Fartcoin has retraced into a major confluence zone, with the 0.618 Fibonacci retracement, point of control, and daily support clustering near $0.73. This level could serve as the foundation for a reversal toward $1.45.

Introduction:

While recent price action has been corrective, Fartcoin’s current position highlights a potential bottoming zone. The confluence of multiple technical levels at $0.73 gives merit to a reversal scenario, provided the coin consolidates above support. Traders are now watching for a shift in structure that could spark the next leg higher.

Key Technical Points:

Testing the 0.618 Fibonacci retracement near $0.73.

Point of control and daily support reinforce the zone.

Breakout structure could accelerate toward $1.45.

Fartcoin’s retracement into $0.73 is significant, as this zone combines several technical supports into one dense region. The value area low, daily SR, and point of control all overlap here, creating a high-probability reversal area. If buyers step in and establish a base, the likelihood of a structural shift toward higher levels increases considerably.

For a bullish reversal to take shape, Fartcoin must consolidate above $0.73 and print a higher low. This would confirm market structure has flipped, paving the way for continuation toward $1.45. The latter level represents both psychological resistance and a target defined by the Fibonacci extensions of the prior impulse move.

On the other hand, failure to establish support here would undermine the bullish case. A breakdown beneath $0.73 could open the door to deeper declines, weakening the probability of recovery in the short term.

What to Expect in the Coming Price Action:

Fartcoin sits at a decisive support cluster, with a reversal toward $1.45 possible if the structure shifts bullish. Holding $0.73 is essential, making this level the battleground for the next directional move.

Introduction:

While recent price action has been corrective, Fartcoin’s current position highlights a potential bottoming zone. The confluence of multiple technical levels at $0.73 gives merit to a reversal scenario, provided the coin consolidates above support. Traders are now watching for a shift in structure that could spark the next leg higher.

Key Technical Points:

Testing the 0.618 Fibonacci retracement near $0.73.

Point of control and daily support reinforce the zone.

Breakout structure could accelerate toward $1.45.

Fartcoin’s retracement into $0.73 is significant, as this zone combines several technical supports into one dense region. The value area low, daily SR, and point of control all overlap here, creating a high-probability reversal area. If buyers step in and establish a base, the likelihood of a structural shift toward higher levels increases considerably.

For a bullish reversal to take shape, Fartcoin must consolidate above $0.73 and print a higher low. This would confirm market structure has flipped, paving the way for continuation toward $1.45. The latter level represents both psychological resistance and a target defined by the Fibonacci extensions of the prior impulse move.

On the other hand, failure to establish support here would undermine the bullish case. A breakdown beneath $0.73 could open the door to deeper declines, weakening the probability of recovery in the short term.

What to Expect in the Coming Price Action:

Fartcoin sits at a decisive support cluster, with a reversal toward $1.45 possible if the structure shifts bullish. Holding $0.73 is essential, making this level the battleground for the next directional move.

Join the Free Trading Group

Telegram: t.me/freetradingden 🔥

Claim $1000 Deposit Bonus 🎁

Trade with perks & support the community!

partner.blofin.com/d/TheAlchemist

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Telegram: t.me/freetradingden 🔥

Claim $1000 Deposit Bonus 🎁

Trade with perks & support the community!

partner.blofin.com/d/TheAlchemist

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Join the Free Trading Group

Telegram: t.me/freetradingden 🔥

Claim $1000 Deposit Bonus 🎁

Trade with perks & support the community!

partner.blofin.com/d/TheAlchemist

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Telegram: t.me/freetradingden 🔥

Claim $1000 Deposit Bonus 🎁

Trade with perks & support the community!

partner.blofin.com/d/TheAlchemist

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.