Understanding Tools, Confluence & Today’s Setup

I’ve been getting a lot of DMs asking what the best indicator is. The truth? There is no universal “best indicator” because indicators are tools, and every tool serves a different purpose. Trading is like carrying a toolbox: the skill isn’t in having the tools, but in knowing when and how to use them.

Educational Segment: Why Fibonacci Should Be Your Foundation

After years of studying different systems, I’ve come to a very simple conclusion:

👉 Fibonacci tools are the most powerful and reliable in my entire arsenal.

Why?

Indicators like oscillators etc. are best used as confirmation, not as the primary signal.

If I had to pick one indicator besides Fibonacci, it would absolutely be the VWAP.

Why the Anchored VWAP Is Incredibly Underrated

Fibonacci + VWAP is one of the strongest forms of confluence you can build.

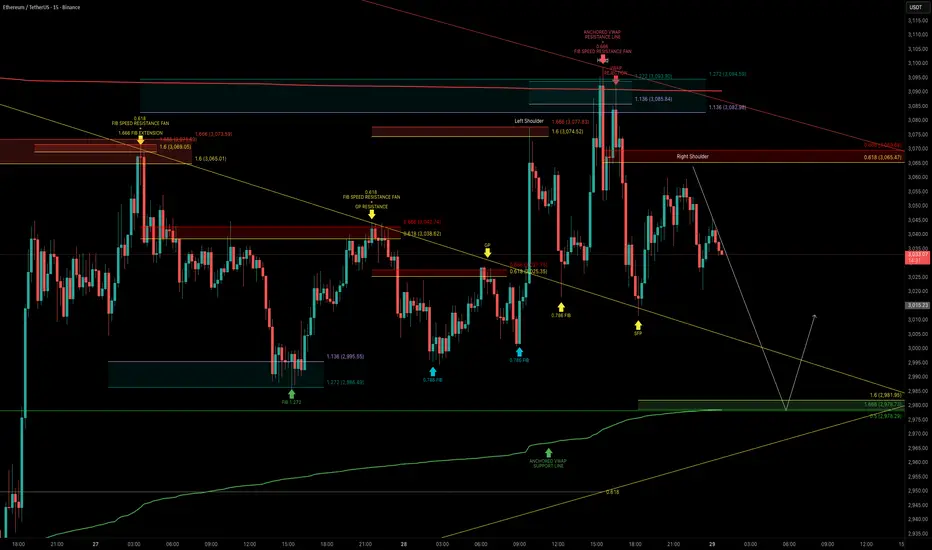

ETH Technical Breakdown

Today, ETH attempted a breakout but the move failed, and the rejection was clean.

ETH rejected at the anchored VWAP aligned with Fibonacci reversal zone:

Key Confluence Level Below:

My next major downside target lines up with a cluster of confluences:

Educational Takeaway → Confluence Is King

If there’s one lesson to internalize:

The more factors that align at the same level or zone, the higher the probability of a successful trade.

This ETH range has provided several high-quality setups for anyone who understands how to read price through Fibonacci.

Final Notes

ETH remains in a well-defined trading range use confluence, stay patient, and let the market come to your level.

_________________________________

💬 If you found this helpful, drop a like and comment!

I’ve been getting a lot of DMs asking what the best indicator is. The truth? There is no universal “best indicator” because indicators are tools, and every tool serves a different purpose. Trading is like carrying a toolbox: the skill isn’t in having the tools, but in knowing when and how to use them.

Educational Segment: Why Fibonacci Should Be Your Foundation

After years of studying different systems, I’ve come to a very simple conclusion:

👉 Fibonacci tools are the most powerful and reliable in my entire arsenal.

Why?

- They help you spot reversal zones with precision

- They work across all market conditions

- They are rooted in natural ratios that markets consistently gravitate toward

- They create predictable targets, retracements, extensions, and even timing when used correctly

Indicators like oscillators etc. are best used as confirmation, not as the primary signal.

If I had to pick one indicator besides Fibonacci, it would absolutely be the VWAP.

Why the Anchored VWAP Is Incredibly Underrated

- It shows where true volume-weighted market support + resistance lies

- It adapts dynamically

- It works extremely well as a dynamic support/resistance line

- It is fantastic as a trailing stop-loss tool

- It helps identify institutional footprints in price structure

Fibonacci + VWAP is one of the strongest forms of confluence you can build.

ETH Technical Breakdown

Today, ETH attempted a breakout but the move failed, and the rejection was clean.

ETH rejected at the anchored VWAP aligned with Fibonacci reversal zone:

- ETH tested the anchored VWAP near $3,090 twice, coinciding with the 1.136–1.272 Fibonacci Reversal Zone.

- This confluence acted as a strong resistance, leading to a swift selloff soon after.

Key Confluence Level Below:

My next major downside target lines up with a cluster of confluences:

- 1.6-1.666 Fibonacci extension

- 0.5 Fibonacci retracement

- Anchored VWAP (green support line)

- Liquidity zone (demand area)

- 0.618 Fibonacci speed fan support

Educational Takeaway → Confluence Is King

If there’s one lesson to internalize:

The more factors that align at the same level or zone, the higher the probability of a successful trade.

This ETH range has provided several high-quality setups for anyone who understands how to read price through Fibonacci.

Final Notes

ETH remains in a well-defined trading range use confluence, stay patient, and let the market come to your level.

_________________________________

💬 If you found this helpful, drop a like and comment!

Trade geschlossen: Ziel wurde erreicht

Idea played out well, came close to the target before reversing. The next level I'm watching is the weekly VWAP lining up with the 0.618 fib around $2950🏆 Mastering Fibonacci for precision trading

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

🏆 Mastering Fibonacci for precision trading

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.