Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

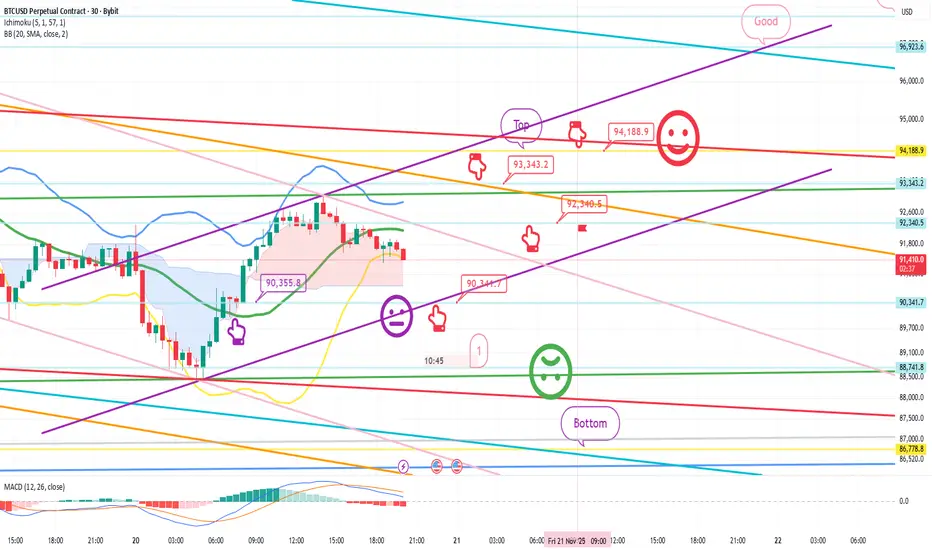

Here's a Bitcoin 30-minute chart.

Shortly, at 10:30 AM and 12 PM, the Nasdaq indicators will be released.

At the bottom left, the purple finger indicates the final long position entry point on the 19th, at $90,355.8. I've linked the strategy to that level.

The bottom area at the bottom is what I consider to be the major support line for this week.

(The center line of the Bollinger Bands monthly chart has moved from the previous $87,665.3.)

Everyone knows this and is waiting for it.

In my experience, if you wait at the bottom,

it generally doesn't come down easily. + Nasdaq volatility

Of course, we'll have to watch today's movement,

but please watch until the very end.

Because today could be a day with a significant move,

I kept my strategy as safe and simple as possible.

*Red Finger Movement Path:

One-Way Long Position Strategy

1. $90,341.7 long position entry point / Stop loss price if the purple support line is completely broken

2. $93,343.2 long position primary target -> Top, Good target price in that order

If the strategy is successful, you can utilize the 92.3K long position re-entry point indicated.

Since the 4-hour Bollinger Bands are repeatedly hitting the center line,

barring a sharp decline in the Nasdaq,

it is poised for a strong upward trend.

Note that the first point at the bottom is a double bottom.

If it falls to this level,

it is more likely to reach the bottom than to rebound.

Today, the Nasdaq and Bitcoin must move as far upward as possible to avoid falling to 86.7K this week. In the event of a weak sideways movement or correction,

I recommend keeping the bottom open until 9:00 AM next Monday.

Please use my analysis to this point for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here's a Bitcoin 30-minute chart.

Shortly, at 10:30 AM and 12 PM, the Nasdaq indicators will be released.

At the bottom left, the purple finger indicates the final long position entry point on the 19th, at $90,355.8. I've linked the strategy to that level.

The bottom area at the bottom is what I consider to be the major support line for this week.

(The center line of the Bollinger Bands monthly chart has moved from the previous $87,665.3.)

Everyone knows this and is waiting for it.

In my experience, if you wait at the bottom,

it generally doesn't come down easily. + Nasdaq volatility

Of course, we'll have to watch today's movement,

but please watch until the very end.

Because today could be a day with a significant move,

I kept my strategy as safe and simple as possible.

*Red Finger Movement Path:

One-Way Long Position Strategy

1. $90,341.7 long position entry point / Stop loss price if the purple support line is completely broken

2. $93,343.2 long position primary target -> Top, Good target price in that order

If the strategy is successful, you can utilize the 92.3K long position re-entry point indicated.

Since the 4-hour Bollinger Bands are repeatedly hitting the center line,

barring a sharp decline in the Nasdaq,

it is poised for a strong upward trend.

Note that the first point at the bottom is a double bottom.

If it falls to this level,

it is more likely to reach the bottom than to rebound.

Today, the Nasdaq and Bitcoin must move as far upward as possible to avoid falling to 86.7K this week. In the event of a weak sideways movement or correction,

I recommend keeping the bottom open until 9:00 AM next Monday.

Please use my analysis to this point for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

*비트코인가이드 공식텔레그램 Telegram

t.me/BTG_Group

*빙엑스 BingX 50%DC+$5,000 (총1회수수료)

bingx.com/invite/YBM3A4

*바이비트 Bybit 20%DC+$5,020

partner.bybit.com/b/Bitcoin_Guide

*앞으로는 하단의 네이버카페에서만 활동합니다.

cafe.naver.com/loanlife82

t.me/BTG_Group

*빙엑스 BingX 50%DC+$5,000 (총1회수수료)

bingx.com/invite/YBM3A4

*바이비트 Bybit 20%DC+$5,020

partner.bybit.com/b/Bitcoin_Guide

*앞으로는 하단의 네이버카페에서만 활동합니다.

cafe.naver.com/loanlife82

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

*비트코인가이드 공식텔레그램 Telegram

t.me/BTG_Group

*빙엑스 BingX 50%DC+$5,000 (총1회수수료)

bingx.com/invite/YBM3A4

*바이비트 Bybit 20%DC+$5,020

partner.bybit.com/b/Bitcoin_Guide

*앞으로는 하단의 네이버카페에서만 활동합니다.

cafe.naver.com/loanlife82

t.me/BTG_Group

*빙엑스 BingX 50%DC+$5,000 (총1회수수료)

bingx.com/invite/YBM3A4

*바이비트 Bybit 20%DC+$5,020

partner.bybit.com/b/Bitcoin_Guide

*앞으로는 하단의 네이버카페에서만 활동합니다.

cafe.naver.com/loanlife82

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.