OPEN-SOURCE SCRIPT

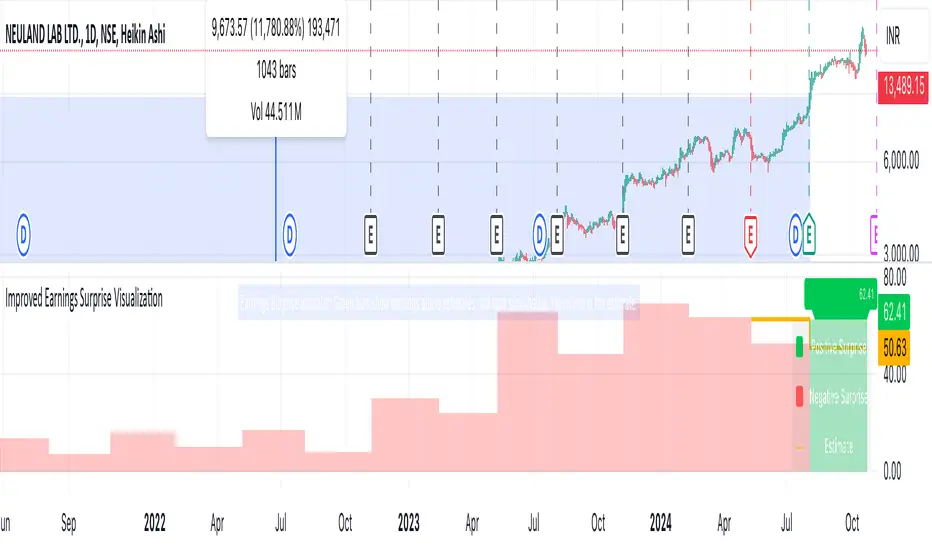

Earnings Surprise Indicator (Post-Earnings Announcement Drift)

What It Does:

- Displays a company's actual earnings vs. analysts' estimates over time

- Shows "earnings surprises" - when actual results beat or miss expectations

- Helps identify trends in a company's financial performance

How It Works:

- Green bars: Positive surprise (earnings beat estimates)

- Red bars: Negative surprise (earnings missed estimates)

- Yellow line: Analysts' earnings estimates

Correlation with Post Earnings Announcement Drift (PEAD): PEAD is the tendency for a stock's price to drift in the direction of an earnings surprise for several weeks or months after the announcement.

Why It Matters:

- Positive surprises often lead to upward price drift

- Negative surprises often lead to downward price drift

- This drift can create trading opportunities

How to Use It:

1. Spot Trends:

- Consistent beats may indicate strong company performance

- Consistent misses may signal underlying issues

2. Gauge Market Expectations:

- Large surprises may lead to significant price movements

3. Timing Decisions:

- Consider long positions after positive surprises

- Consider short positions or exits after negative surprises

4. Risk Management:

- Be cautious of reversal if the drift seems excessive

- Use in conjunction with other technical and fundamental analysis

Key Takeaways:

- Earnings surprises can be fundamental-leading indicators of future stock performance, especially when correlated with analyst projections

- PEAD suggests that markets often underreact to earnings news initially

- This indicator helps visualize the magnitude and direction of surprises

- It can be a valuable tool for timing entry and exit points in trades

- Displays a company's actual earnings vs. analysts' estimates over time

- Shows "earnings surprises" - when actual results beat or miss expectations

- Helps identify trends in a company's financial performance

How It Works:

- Green bars: Positive surprise (earnings beat estimates)

- Red bars: Negative surprise (earnings missed estimates)

- Yellow line: Analysts' earnings estimates

Correlation with Post Earnings Announcement Drift (PEAD): PEAD is the tendency for a stock's price to drift in the direction of an earnings surprise for several weeks or months after the announcement.

Why It Matters:

- Positive surprises often lead to upward price drift

- Negative surprises often lead to downward price drift

- This drift can create trading opportunities

How to Use It:

1. Spot Trends:

- Consistent beats may indicate strong company performance

- Consistent misses may signal underlying issues

2. Gauge Market Expectations:

- Large surprises may lead to significant price movements

3. Timing Decisions:

- Consider long positions after positive surprises

- Consider short positions or exits after negative surprises

4. Risk Management:

- Be cautious of reversal if the drift seems excessive

- Use in conjunction with other technical and fundamental analysis

Key Takeaways:

- Earnings surprises can be fundamental-leading indicators of future stock performance, especially when correlated with analyst projections

- PEAD suggests that markets often underreact to earnings news initially

- This indicator helps visualize the magnitude and direction of surprises

- It can be a valuable tool for timing entry and exit points in trades

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.