⚠️ Unbalanced GEX & Institutional Hedging – A Closer Look

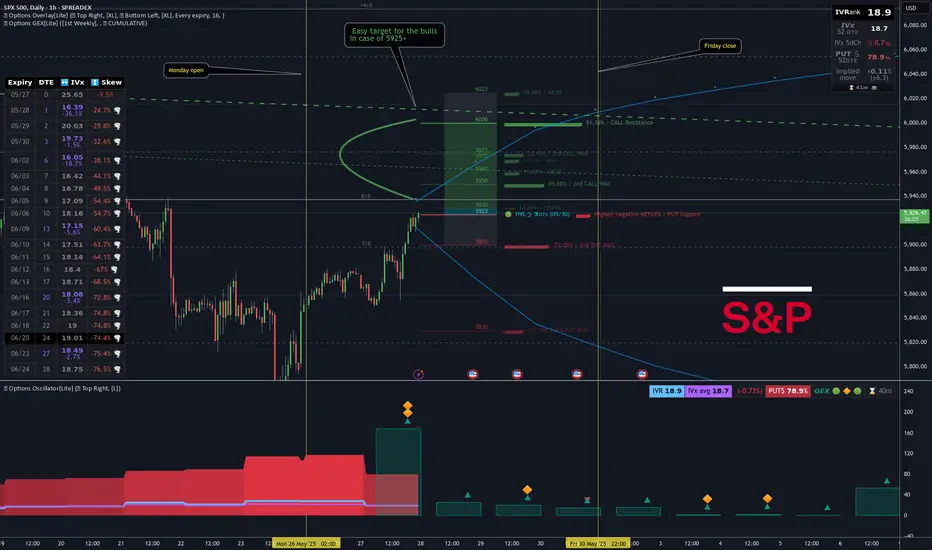

I haven’t seen such an asymmetric GEX setup in quite a while — and it’s definitely not a pretty one 😬. The current profile suggests a highly skewed positioning in the market:

📍 Massive upside expectation:

It feels like the market is almost exclusively preparing for a move toward 6000.

🛑 Limited downside protection:

Below the current level, there's very little hedging in place — especially unusual with Friday’s expiry approaching.

🔻 Current Key Zone: 5925-5930

The largest put open interest is sitting right around 5925, which is also close to spot.

Below that? Things get murky. The GEX profile becomes fragmented and mixed, with no clear put support until much lower.

Interestingly, most of the current downside hedging is clustered around the 5900–5925 range, which includes ITM puts — not OTM, as you’d typically expect from retail.

🧠 Institutional Footprint vs. Retail

This hedging pattern — closer to ATM rather than deep OTM — suggests institutional players are managing downside risk with precision.

In contrast, retail traders don’t seem to be actively hedging the downside with OTM puts, which is a notable shift from typical behavior in high-IV weeks like this.

🔼 What to Watch: The 5930 Breakout

If SPX can break and hold above 5930, it enters a clear, call-dominated zone.

From there, the path to 6000 looks much cleaner, with lighter resistance and the potential for a gamma-driven push 📈.

The details show the same picture when examining more details:

SPX conclusion

😬 In short: we’re at a tipping point.

Below 5900, hedging is tactical and institutional.

Above 5900, the path is open to 6000 — but only if bulls can take control at 5930!

I haven’t seen such an asymmetric GEX setup in quite a while — and it’s definitely not a pretty one 😬. The current profile suggests a highly skewed positioning in the market:

📍 Massive upside expectation:

It feels like the market is almost exclusively preparing for a move toward 6000.

🛑 Limited downside protection:

Below the current level, there's very little hedging in place — especially unusual with Friday’s expiry approaching.

🔻 Current Key Zone: 5925-5930

The largest put open interest is sitting right around 5925, which is also close to spot.

Below that? Things get murky. The GEX profile becomes fragmented and mixed, with no clear put support until much lower.

Interestingly, most of the current downside hedging is clustered around the 5900–5925 range, which includes ITM puts — not OTM, as you’d typically expect from retail.

🧠 Institutional Footprint vs. Retail

This hedging pattern — closer to ATM rather than deep OTM — suggests institutional players are managing downside risk with precision.

In contrast, retail traders don’t seem to be actively hedging the downside with OTM puts, which is a notable shift from typical behavior in high-IV weeks like this.

🔼 What to Watch: The 5930 Breakout

If SPX can break and hold above 5930, it enters a clear, call-dominated zone.

From there, the path to 6000 looks much cleaner, with lighter resistance and the potential for a gamma-driven push 📈.

The details show the same picture when examining more details:

SPX conclusion

😬 In short: we’re at a tipping point.

Below 5900, hedging is tactical and institutional.

Above 5900, the path is open to 6000 — but only if bulls can take control at 5930!

Boost up your charts with Options PRO!

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Boost up your charts with Options PRO!

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

Verbundene Veröffentlichungen

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.