Description

Been tracking PLTR’s short-term setup and the options flow is starting to paint a pretty clean picture.

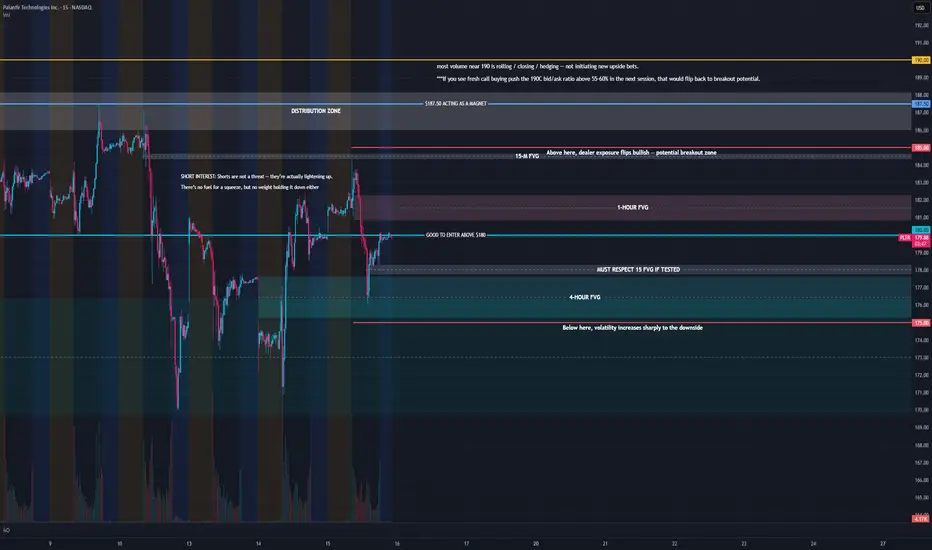

Most of the call interest for this week is stacked between $185–$195, with the heaviest concentration around $185–$190 — basically forming a near-term “gamma magnet.” Dealers tend to hedge long when price trades into that zone, which usually supports upside momentum rather than capping it.

Short interest sits around 2.3% of float, and the cost to borrow has stayed soft. That’s not a squeeze setup, but it’s enough to say there isn’t a heavy wall of short pressure right now. Meanwhile, the bid/ask ratios on the 195–200 calls are rising above 55–60%, showing traders are rolling exposure higher rather than closing out.

In short — we’re seeing a healthy rotation of call volume upward while the lower strikes (180–182.5) stay firm. That’s constructive for a potential 3–5 day continuation move.

My Plan:

Watching for a hold above $181–182 to stay in the bullish zone

If PLTR clears $185 with volume, expecting momentum to build toward $188–$190

Planning to take partials there — could stretch to $192 if the OI at 195–200 keeps growing

Cut below $179.50 if it loses call wall support

This isn’t a “rip your face off” squeeze setup — it’s more of a steady gamma-fueled drift higher while dealers stay long hedged.

Been tracking PLTR’s short-term setup and the options flow is starting to paint a pretty clean picture.

Most of the call interest for this week is stacked between $185–$195, with the heaviest concentration around $185–$190 — basically forming a near-term “gamma magnet.” Dealers tend to hedge long when price trades into that zone, which usually supports upside momentum rather than capping it.

Short interest sits around 2.3% of float, and the cost to borrow has stayed soft. That’s not a squeeze setup, but it’s enough to say there isn’t a heavy wall of short pressure right now. Meanwhile, the bid/ask ratios on the 195–200 calls are rising above 55–60%, showing traders are rolling exposure higher rather than closing out.

In short — we’re seeing a healthy rotation of call volume upward while the lower strikes (180–182.5) stay firm. That’s constructive for a potential 3–5 day continuation move.

My Plan:

Watching for a hold above $181–182 to stay in the bullish zone

If PLTR clears $185 with volume, expecting momentum to build toward $188–$190

Planning to take partials there — could stretch to $192 if the OI at 195–200 keeps growing

Cut below $179.50 if it loses call wall support

This isn’t a “rip your face off” squeeze setup — it’s more of a steady gamma-fueled drift higher while dealers stay long hedged.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.