Reasoning

- The stock has corrected significantly (from its highs) and is seen by some analysts to be forming technical reversal signs.

- A support zone around ₹1,178 is considered strong; it has held recently after pulling back.

- A breakout above ₹1,420 is seen as critical by some for pushing toward higher targets.

- On the fundamentals side, KPIT is seen as well-positioned in the automotive / mobility / electric / AI / embedded software space, which is expected to drive growth.

- Margins, revenue growth near term are mixed: in latest quarter, revenue grew ~12-13% YoY, but net profit was down due to factors like currency fluctuations.

Risk Factors / What Could Go Wrong - Failing to break above critical resistance levels (e.g. ~₹1,420) could lead to renewed downside pressure.

- If macro / global automotive demand weakens, or input costs (salary, software, etc.) rise sharply, margin compression is possible.

- Currency volatility already showed some impact.

- Execution risk: Integration of new technologies (EV, connected/autonomous, AI) requires investment; delays or competition may hurt.

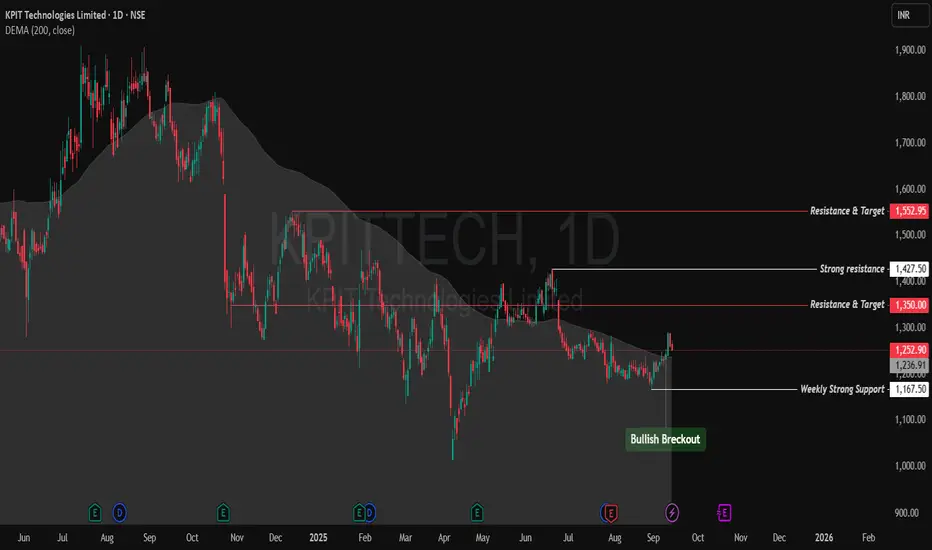

KPITTECH Technical Projection

Key Levels - Immediate Support: ₹1,180-₹1,200 (recent strong base; multiple analysts highlighted ~₹1,178 as key).

- Secondary Support: ₹1,100 (if correction deepens).

- Immediate Resistance: ₹1,350 (short-term hurdle).

- Major Resistance: ₹1,420 (critical breakout zone; above this, big momentum expected).

- Medium-term Target Resistance: ₹1,500-₹1,550.

1. Bullish Case (most likely, if sustains above ₹1,200 & breaks ₹1,420): - Short term (2-4 weeks): ₹1,350-₹1,400

- Medium term (2-3 months): ₹1,500-₹1,550

- Long term (6-12 months): ₹1,600-₹1,650+ (aligns with high analyst targets)

2. Neutral / Range-bound: - If price trades between ₹1,200 and ₹1,350, it may consolidate before the next breakout.

- Swing traders can buy near support and book profit near ₹1,350.

3. Bearish Case (if closes below ₹1,180): - Downside to ₹1,100-₹1,120 is possible.

- Break below ₹1,100 could extend correction toward ₹1,050.

Trading Approach - Entry Zone: ₹1,220-₹1,250 (if it sustains above ₹1,200 support).

- Stop-Loss (SL): ₹1,175 (below major support).

- Target (Short term): ₹1,350, then trail SL to ₹1,250 for higher targets.

- Risk/Reward: ~1:2 or better if played for ₹1,500+

Disclaimer:lnkd.in/gJJDnvn2

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.