Chaikin Money Flow (CMF)

Indikatoren, Strategien und Bibliotheken

This indicator is intended to measure selling and buying pressure, calculates accumulation/distribution levels and suggests current trend intensity and direction. Core calculations are based on open source script by cI8DH which was not updated ever since 2018. Also, it implements the technique to avoid price gaps issues as described in Twiggs® Money Flow . The...

Chaikin Money Flow (CMF)

Lesen Sie mehr über den Chaikin Money Flow

The ‘YD_Divergence_RSI+CMF’ indicator can find divergence using RSI (Relative Strength Index) and CMF (Chaikin Money Flow) indicators. 📌 Key functions 1. Search pivot high and pivot low points in a certain length of price. 2. Connect pivot high to pivot high , pivot low to pivot low , forming two standards for divergence in result....

The Discrete Fourier Transform Money Flow Index indicator integrates the Money Flow Index (MFI) with Discrete Fourier Transform (credit to author wbburgin - May 26 2023 ) smoothing to offer a refined and smoothed depiction of the MFI's underlying trend. The MFI is calculated using the formula: MFI = 100 - (100 / (1 + MR)), where a high MFI value indicates robust...

**Vorse4 Indicator** The Vorse4 Indicator is a technical analysis tool that combines Chaikin Oscillator, Intraday Momentum Index (IMI), MACD, and Parabolic SAR indicators. This indicator generates trading signals when all four indicators simultaneously provide buy or sell signals and visually presents these signals on the chart. **How to Use:** 1. Buy signal: A...

Chaikin Money Flow is a well-known Indicator for gauging buying/selling pressure. Marc Chaikin intended this to be used on the daily timeframe to capture the behavior of price action at or near the daily close when larger-scale actors influence the market. The calculation is straight forward as described within the built-in TradingView "CMF" indicator: 1. Period...

This overlays CMF of the underlying (solid histogram) and a CMF of the ticker you are comparing it too. The pink line is the correlation coefficient of both CMFs. Experiment/work in progress.

Description: Chaikin Money Flow was an indicator that measuring of the volume-weighted average of accumulation and distribution over a specified period (as cited from Fidelity) developed by Marc Chaikin, aim to identify the changes in buying or selling momentum of an asset that leads to the increase or decrease of asset prices. In the original format, the...

The Volume Accumulator is used in technical analysis to identify strengths and weaknesses in a market. It is derived from the On Balance Volume indicator, except that instead of giving all the volume to bears on red days and bulls on green days it gives a proportional amount to both depending on the relative close price. As with many trading indicators, classic...

Modified Version of In-Built Chaikin Money Flow Indicator. Aggregated Volume is used for it's calculation + a couple of other features. Aggregation code originally from Crypt0rus ***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually*** ***The indicator can be used with specific symbol data only by disabling the...

Here I present you on of Trade Pro's Trading Idea: Chaikin Money Flow + MACD + ATR. This strategy is not as profitable as it can be seen in one of his videos. In the forex market, the strategy could reach a maximum of 35% profitability. I have, as some of my followers have requested, created an overview of the current position, risk and leverage settings in the...

This is a demonstration of my new Indicator - CMF Velocity - in a profitable trading strategy. It is able to take shorts when the close is less than the 200 EMA, and longs when the close is greater than the 200 EMA.

CMF Velocity informs the trader of the speed at which the CMF Indicator is changing. This allows the trader to anticipate reversals in price action. Buy and Sell signals are generated when the value crosses the zero-line. This indicator is best used in combination with another indicator (Stochastic, MACD), although it does work quite nicely by itself. The...

This study is intented to be used as a part of buy/sell strategy. Smooth feature: enable this to make CMF line smooth using MA Bg Highlight: highlights the background depending on the bull/bear condition

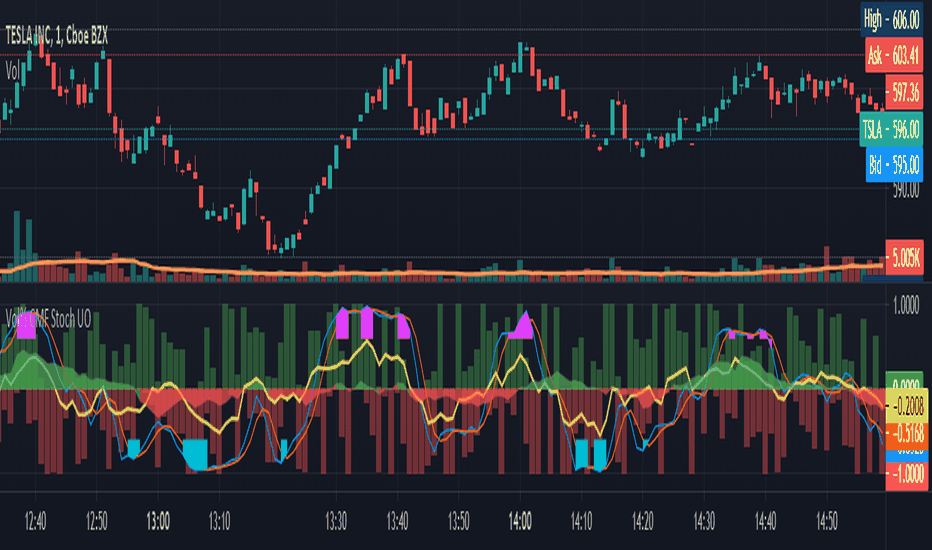

Plots % Buy / Sell Volume , Chaikin Money Flow , Stochastic Oscillator, and Ultimate Oscillator on same axis, bound -1 to 1. Show Volume Percentage, displaying buying as green and positive, selling as red and negative. Showing the CMF, with green / red fill for positive / negative values. Modified Stochastic Oscillator, converting bounds to -1 and 1, moving...

Showing the CMF, with green / red fill for positive / negative values, overlaid with Volume Percentage, displaying buying as green and positive, selling as red and negative.

Shading the area of positive CMF with green and negative with red.

This is an adaptation of the popular Chaikin Money Flow. The original calculation looks at closing price in relation to high and low. I developed a new calculation that includes the relationship of close and open. One issue with the original calculation is that if the open = close then the calculation omits that bar. My calculation would include that bar and...

This is a strategy made from ichimoku cloud , together with MACD, Chaiking Money FLOW and True Strenght Index. It can be adapted to any timeframe and any type of financial markets. The idea behind its very simple, We combine the long / short strategy from ichimoku, like cross between lines and below/above cloud together with histogram from MACD for...

![Multi Timeframe Chaikin Money Flow [Takazudo] AUDUSD: Multi Timeframe Chaikin Money Flow [Takazudo]](https://s3.tradingview.com/b/B1SGdS8j_mid.png)