OPEN-SOURCE SCRIPT

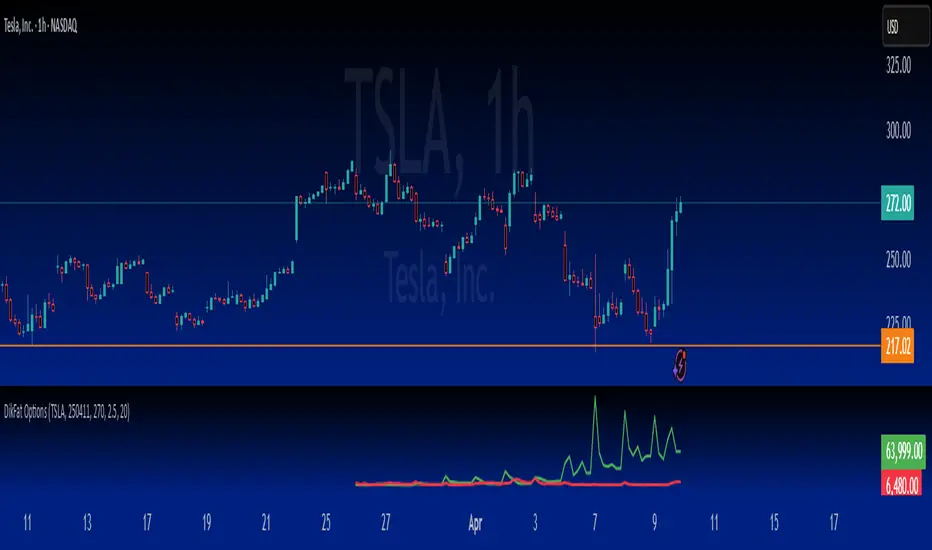

Aktualisiert Unusual Whale - Unusual Options Volume Data Screener

How to Use:

Benefits of Scanning Options Volume for Unusual Activity:

What to Do If Combinations Don't Yield Results:

Cumulative Call Volume is Green, Put Volume is Red

- Custom Expiration Date: Use the calendar/date picker to select the expiration date. The chosen date is automatically converted to the "YYMMDD" format.

- Custom Base Strike: Enter a round strike value from the options chain (for example, "270"). This value serves as the starting point (at-the-money) for the scan.

- Strike Increment: Select the increment (e.g., 0.50, 1.00, 2.5, 5, or 10) to determine how the scan moves outward from the custom base strike.

- Options per Side (Max 20): Choose the number of valid option strikes to scan on each side. The script scans downward (for calls) and upward (for puts) from the custom base strike.

- Base Symbol: The base symbol is always taken from the chart (using syminfo.ticker); no manual entry is needed.

- Scanning & Aggregation: The script automatically constructs option symbols using the base symbol, custom expiration date, option type (C or P), and the formatted strike. It retrieves volume data for these options and aggregates the cumulative volume for calls and puts separately.

- Plotting: Cumulative call volume is plotted in green, and cumulative put volume is plotted in red—only if the required number of valid options is found.

Benefits of Scanning Options Volume for Unusual Activity:

- Offers a comprehensive view of volume across multiple strikes, making unusual or extreme volume patterns easier to detect.

- Helps gauge market sentiment by comparing aggregated call and put volumes, which may signal shifts in investor behavior.

- Aggregating volume from several strike levels provides smoother, more reliable data than using a single strike, enhancing your analytical insights.

What to Do If Combinations Don't Yield Results:

- Verify Your Inputs: Ensure that the Custom Base Symbol, Expiration Date, and Custom Base Strike are entered correctly and correspond to an active options chain.

- Adjust Strike Increment: If the options aren’t loading as expected, try selecting a different strike increment that more closely matches the spacing in your options chain.

- Reduce Options per Side: Lower the number of Options per Side (e.g., from 20 to a lower value) if the scan fails to find enough valid strikes.

- Review Your Options Chain: Confirm that the contracts for the specified expiration and strike range exist and are available in your data feed.

- Check Data Subscription: Make sure your TradingView plan includes access to the options data required for the selected symbols.

Cumulative Call Volume is Green, Put Volume is Red

Versionshinweise

Updated chart imageVersionshinweise

Added Table for Unusual ActivityVersionshinweise

Further Optimized for performanceVersionshinweise

This script has been updated with dynamic tags to show which call or put strike has the most volume activity from all scanned strikes.Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

All opinions while deemed valid by its operators and shared on this board are not financial advice and are primarily for Entertainment Purposes.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

All opinions while deemed valid by its operators and shared on this board are not financial advice and are primarily for Entertainment Purposes.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.