OPEN-SOURCE SCRIPT

Aktualisiert COT Index by Niels

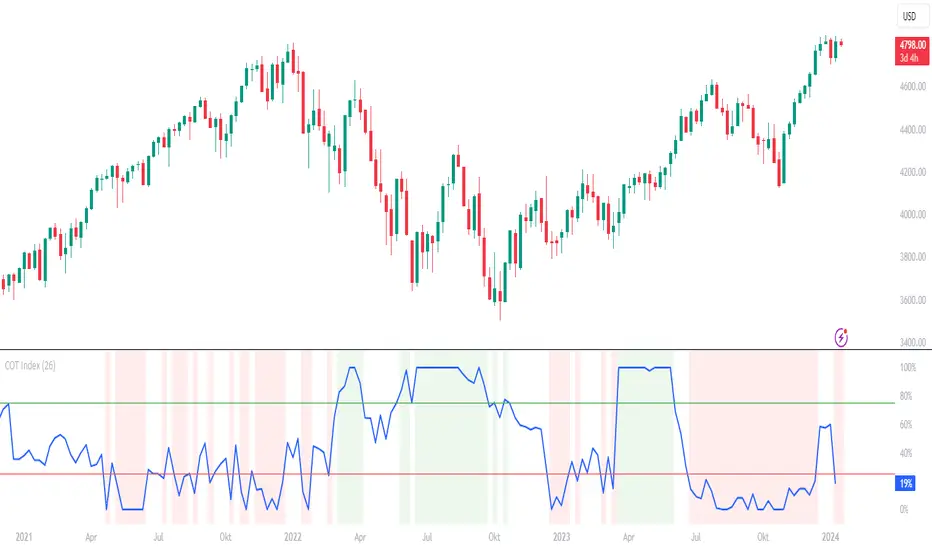

The COT index is an indicator for determining trend reversals based on the net positions of commercials from the CFTC COT report.

A time frame of 26 weeks is selected as the basis. If the value is greater than or equal to 75, this is a bullish sign; if it is less than or equal to 25, this is a bearish sign.

You can select the number of weeks to be used for the calculation.

As the CFTC data is only published on Fridays at 21:30, the value of the current week is hidden until the market closes.

In addition, the background changes color when the index reaches an extreme range.

Both functions can be deactivated in the settings.

A time frame of 26 weeks is selected as the basis. If the value is greater than or equal to 75, this is a bullish sign; if it is less than or equal to 25, this is a bearish sign.

You can select the number of weeks to be used for the calculation.

As the CFTC data is only published on Fridays at 21:30, the value of the current week is hidden until the market closes.

In addition, the background changes color when the index reaches an extreme range.

Both functions can be deactivated in the settings.

Versionshinweise

Added correction for the copper futures to show the correct value.Versionshinweise

Two functions have been added:1. A COT proxy function has been added, which calculates COT data using the price range without the CFTC report. This is enabled by default for the DAX future and can be applied to all other futures through the options if needed. The formula was developed by Larry Williams.

2. It is now also possible to view the change of the COT index compared to the previous week. This can also be activated in the options.

Versionshinweise

Added "Hide Until New Data" (default enabled):The COT Index is now only displayed if the data for the current week differs from the previous week. Prevents showing unchanged or outdated data.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.