OPEN-SOURCE SCRIPT

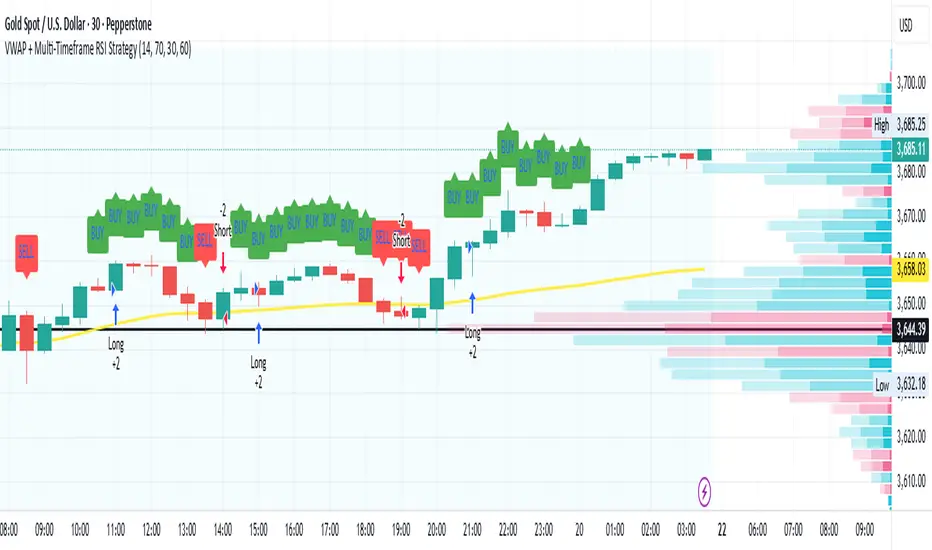

VWAP + Multi-Timeframe RSI Strategy

This strategy combines VWAP trend direction with confirmation from RSI on a higher timeframe. The idea is to only take trades when both intraday momentum and higher-timeframe trend are aligned, increasing accuracy.

LONG Entry:

Price above VWAP (bullish environment).

RSI on the current timeframe is below overbought (room to rise).

RSI on the higher timeframe (default H1) is above 50 (bullish confirmation).

SHORT Entry:

Price below VWAP (bearish environment).

RSI on the current timeframe is above oversold (room to fall).

RSI on the higher timeframe is below 50 (bearish confirmation).

Exit Rule:

Stop-loss near VWAP.

Take-profit at ~2x risk or when major levels are reached.

Best Timeframes:

Use 15m or 30m chart with H1 RSI for intraday trading.

Use 1H chart with Daily RSI for swing trading.

⚡ The higher-timeframe RSI filter reduces false signals and aligns trades with institutional flow.

LONG Entry:

Price above VWAP (bullish environment).

RSI on the current timeframe is below overbought (room to rise).

RSI on the higher timeframe (default H1) is above 50 (bullish confirmation).

SHORT Entry:

Price below VWAP (bearish environment).

RSI on the current timeframe is above oversold (room to fall).

RSI on the higher timeframe is below 50 (bearish confirmation).

Exit Rule:

Stop-loss near VWAP.

Take-profit at ~2x risk or when major levels are reached.

Best Timeframes:

Use 15m or 30m chart with H1 RSI for intraday trading.

Use 1H chart with Daily RSI for swing trading.

⚡ The higher-timeframe RSI filter reduces false signals and aligns trades with institutional flow.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.