OPEN-SOURCE SCRIPT

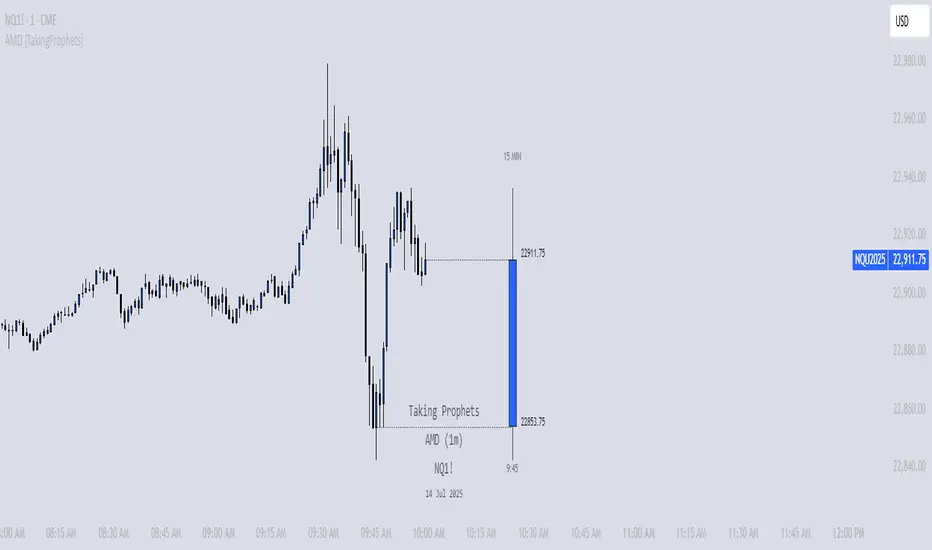

AMD [TakingProphets]

Overview

The AMD indicator is a real-time, high-resolution tool designed for traders following ICT methodology who want a clear visualization of higher timeframe (HTF) candles directly on their lower timeframe charts.

It overlays current HTF structure, including open, high, low, and close projections, allowing traders to align intraday decisions with institutional price delivery — all without switching timeframes.

Concept & Background

In ICT concepts, market behavior often follows a pattern of accumulation, manipulation, and distribution. Understanding these phases is essential for anticipating when price is likely to expand or reverse.

AMD automates this process by:

-Overlaying HTF candles directly on your lower timeframe chart.

-Projecting live levels like the current open, high, low, and close to map out evolving bias.

-Helping traders see whether price is accumulating orders, engineering liquidity sweeps, or distributing aggressively.

Key Features

Live HTF Candle Overlay

-Displays the full HTF candle — body, wicks, and directional bias — on your active chart in real time.

-Perfect for traders aligning intraday setups with broader HTF context.

Dynamic HTF Price Projections

-Plots the evolving open, high, low, and close for the current HTF candle.

-Each projection can be customized by color, style, labels, and visibility to fit your workflow.

Full Customization Control

-Adjust candle body widths, wick styles, and transparency.

-Configure projection lines and time labels in both 12h and 24h formats.

-Includes an optional Info Box showing instrument, timeframe, and session context.

Session Timing & Labeling

-Smart timestamping marks the start and close of each HTF candle.

-Helps traders anticipate potential expansions or reversals during killzones or liquidity events.

How to Use It

Select Your HTF Context

-Choose any timeframe overlay (e.g., 1H, 4H, 1D) to match your trading model.

-Monitor Live HTF Levels

-Watch how price interacts with current HTF highs, lows, and equilibrium levels in real time.

-Integrate With ICT Concepts

-Use alongside tools like SMT divergence, Order Blocks, or Liquidity Levels for confirmation and context.

-Refine Intraday Entries

-Check whether price is expanding in your favor before entering positions.

Best Practices

Combine AMD with ICT killzone sessions to monitor HTF behavior during high-liquidity periods.

Use it alongside correlated SMT divergence tools for stronger directional bias confirmation.

Who It’s For

Scalpers anchoring quick entries to HTF sentiment.

Intraday traders syncing 5m/15m setups with 1H/4H context.

Swing traders monitoring HTF ranges without switching charts.

Educators & analysts needing clean visual overlays for teaching and content creation.

Why It’s Useful

AMD doesn’t provide trading signals or predictive guarantees. Instead, it offers a clean, structured view of HTF price delivery — enabling traders to understand institutional intent as it unfolds and manage their execution with greater confidence.

The AMD indicator is a real-time, high-resolution tool designed for traders following ICT methodology who want a clear visualization of higher timeframe (HTF) candles directly on their lower timeframe charts.

It overlays current HTF structure, including open, high, low, and close projections, allowing traders to align intraday decisions with institutional price delivery — all without switching timeframes.

Concept & Background

In ICT concepts, market behavior often follows a pattern of accumulation, manipulation, and distribution. Understanding these phases is essential for anticipating when price is likely to expand or reverse.

AMD automates this process by:

-Overlaying HTF candles directly on your lower timeframe chart.

-Projecting live levels like the current open, high, low, and close to map out evolving bias.

-Helping traders see whether price is accumulating orders, engineering liquidity sweeps, or distributing aggressively.

Key Features

Live HTF Candle Overlay

-Displays the full HTF candle — body, wicks, and directional bias — on your active chart in real time.

-Perfect for traders aligning intraday setups with broader HTF context.

Dynamic HTF Price Projections

-Plots the evolving open, high, low, and close for the current HTF candle.

-Each projection can be customized by color, style, labels, and visibility to fit your workflow.

Full Customization Control

-Adjust candle body widths, wick styles, and transparency.

-Configure projection lines and time labels in both 12h and 24h formats.

-Includes an optional Info Box showing instrument, timeframe, and session context.

Session Timing & Labeling

-Smart timestamping marks the start and close of each HTF candle.

-Helps traders anticipate potential expansions or reversals during killzones or liquidity events.

How to Use It

Select Your HTF Context

-Choose any timeframe overlay (e.g., 1H, 4H, 1D) to match your trading model.

-Monitor Live HTF Levels

-Watch how price interacts with current HTF highs, lows, and equilibrium levels in real time.

-Integrate With ICT Concepts

-Use alongside tools like SMT divergence, Order Blocks, or Liquidity Levels for confirmation and context.

-Refine Intraday Entries

-Check whether price is expanding in your favor before entering positions.

Best Practices

Combine AMD with ICT killzone sessions to monitor HTF behavior during high-liquidity periods.

Use it alongside correlated SMT divergence tools for stronger directional bias confirmation.

Who It’s For

Scalpers anchoring quick entries to HTF sentiment.

Intraday traders syncing 5m/15m setups with 1H/4H context.

Swing traders monitoring HTF ranges without switching charts.

Educators & analysts needing clean visual overlays for teaching and content creation.

Why It’s Useful

AMD doesn’t provide trading signals or predictive guarantees. Instead, it offers a clean, structured view of HTF price delivery — enabling traders to understand institutional intent as it unfolds and manage their execution with greater confidence.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.