OPEN-SOURCE SCRIPT

Aktualisiert Multiple Bollinger Bands + Volatility [AlgoTraderPro]

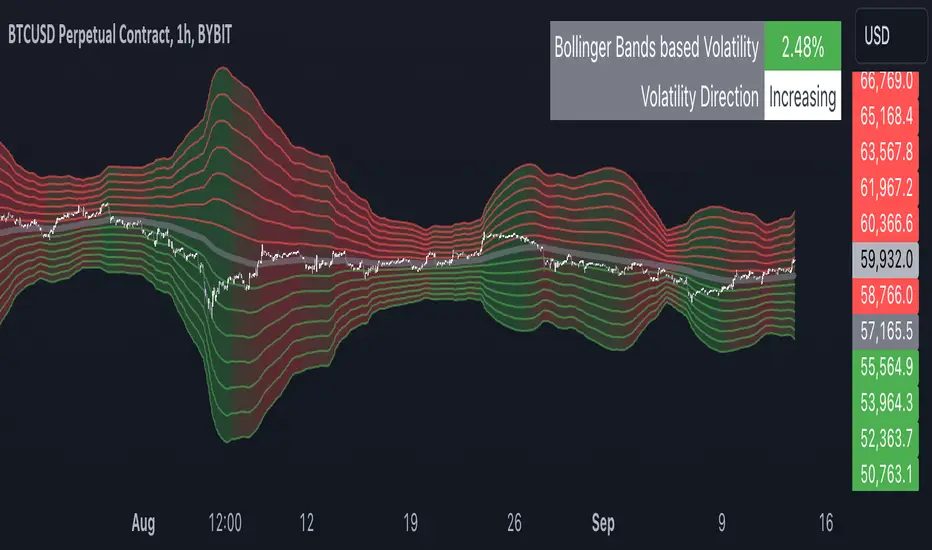

This indicator helps traders visualize price ranges and volatility changes. Designed to assist in identifying potential consolidation zones, the indicator uses multiple layers of Bollinger Bands combined with volatility-based shading. This can help traders spot periods of reduced price movement, which are often followed by breakouts or trend reversals.

█ FEATURES

█ HOW TO USE

█ NOTES

• The indicator is useful in consolidating markets where price movement is limited, offering insights into potential breakout areas.

• Adjust the settings based on asset and market conditions for optimal results.

█ FEATURES

- Multiple Bollinger Bands: Displays up to seven bands with customizable standard deviations, providing a layered view of price range activity.

- Volatility Measurement: Tracks changes in Bollinger Band width to display volatility percentage and direction (increasing, decreasing, or neutral).

- Volatility Shading: Uses color-coded shading between the outermost bands to indicate changes in volatility, helping to visualize potential consolidation zones.

- Customizable Inputs: Modify lookback periods, moving average lengths, and standard deviations for each band to tailor the analysis to your strategy.

- Volatility Table: Displays a table on the chart showing real-time volatility data and direction for quick reference.

█ HOW TO USE

- Add the Indicator: Apply it to your TradingView chart.

- Adjust Settings: Customize the Bollinger Bands’ parameters to suit your trading timeframe and strategy.

- Analyze Consolidation Zones: Use the multiple bands and volatility shading to identify areas of reduced price activity, signaling potential breakouts.

- Monitor Volatility: Refer to the volatility table to track real-time shifts in market volatility.

- Use in Different Markets: Adapt the settings for various assets and timeframes to assess market conditions effectively.

█ NOTES

• The indicator is useful in consolidating markets where price movement is limited, offering insights into potential breakout areas.

• Adjust the settings based on asset and market conditions for optimal results.

Versionshinweise

Bug fixes.Versionshinweise

Minor fixes.Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Trade Smarter, Not Harder!

TradeCreator9

algotraderpro.io/tradecreator9/

TradeCreator9

algotraderpro.io/tradecreator9/

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Trade Smarter, Not Harder!

TradeCreator9

algotraderpro.io/tradecreator9/

TradeCreator9

algotraderpro.io/tradecreator9/

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.