OPEN-SOURCE SCRIPT

Aktualisiert Adaptive Fisherized ROC

Introduction

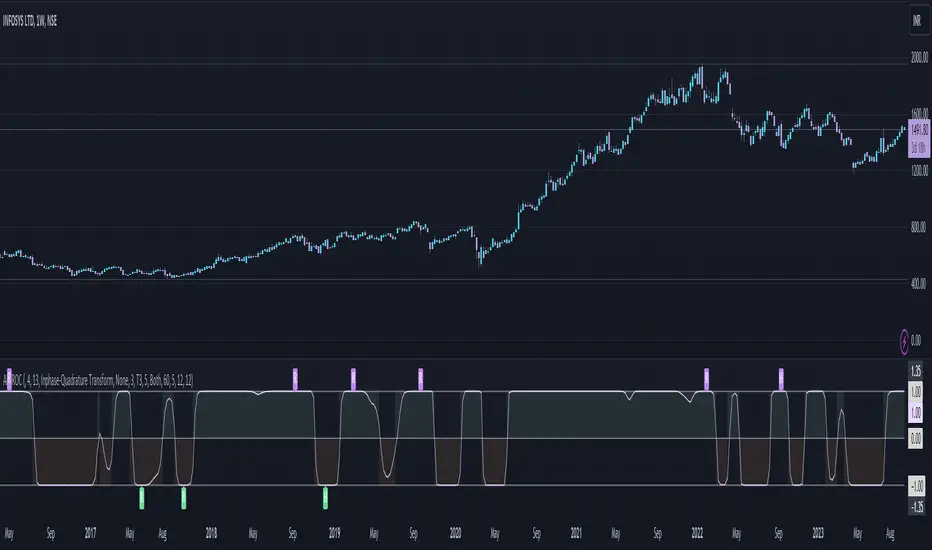

Hello community, here I applied the Inverse Fisher Transform, Ehlers dominant cycle determination and smoothing methods on a simple Rate of Change (ROC) indicator

You have a lot of options to adjust the indicator.

Usage

The rate of change is most often used to measure the change in a security's price over time.

That's why it is a momentum indicator.

When it is positive, prices are accelerating upward; when negative, downward.

It is useable on every timeframe and could be a potential filter for you your trading system.

IMO it could help you to confirm entries or find exits (e.g. you have a long open, roc goes negative, you exit).

If you use a trend-following strategy, you could maybe look out for red zones in an in uptrend or green zones in a downtrend to confirm your entry on a pullback.

Signals

ROC above 0 => confirms bullish trend

ROC below 0 => confirms bearish trend

ROC hovers near 0 => price is consolidating

Enjoy! 🚀

Hello community, here I applied the Inverse Fisher Transform, Ehlers dominant cycle determination and smoothing methods on a simple Rate of Change (ROC) indicator

You have a lot of options to adjust the indicator.

Usage

The rate of change is most often used to measure the change in a security's price over time.

That's why it is a momentum indicator.

When it is positive, prices are accelerating upward; when negative, downward.

It is useable on every timeframe and could be a potential filter for you your trading system.

IMO it could help you to confirm entries or find exits (e.g. you have a long open, roc goes negative, you exit).

If you use a trend-following strategy, you could maybe look out for red zones in an in uptrend or green zones in a downtrend to confirm your entry on a pullback.

Signals

ROC above 0 => confirms bullish trend

ROC below 0 => confirms bearish trend

ROC hovers near 0 => price is consolidating

Enjoy! 🚀

Versionshinweise

Updated default valuesFixed hilber transform calculation bug

Versionshinweise

Updated default valuesAdded min length check

Fixed Inphase-Quadrature Transform calculation

Fixed adaptive mode selection bug

Versionshinweise

Decreased lag of Hann Window smoothing by applying it to the price instead of the indicator itself.Increased linewidth and decreased transparency on background colors

Versionshinweise

Updated plotVersionshinweise

Just to update the chartVersionshinweise

- Added divergence detection

- Removed wrong Kalman filter

- Reworked smoothing system -> Now you can apply the smoothing methods on the source price (which is close[1]) or on the indicator itself depending on what your goal is with the smoothing.

Versionshinweise

Applied the IFT after the smoothing to stick to the scale of -1 to 1Versionshinweise

Removed 34 as max length of Homodyne DiscriminatorVersionshinweise

Fixed that T3 Normal wasn't selectale.Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.