OPEN-SOURCE SCRIPT

Aktualisiert Directional Sentiment Line

Repost with explanation and description:

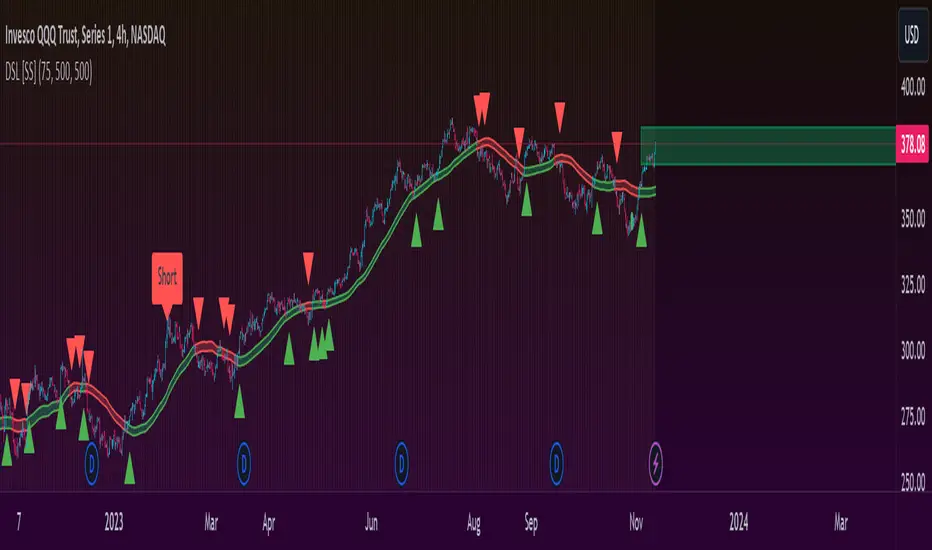

This is a simple SMA based indicator that I have, for lack of a better term, called directional sentiment line.

How it works:

The ribbon/band:

The main band tracks 4 SMAs, the Open, High, Low and Close.

The user can input the length for lookback time, I do 75 and I have it defaulted at 75, however you can do whatever time frame you prefer.

The color of the indicator changes based on the overall trend. Green means an uptrend and red means a downtrend.

When the stock is trading within the band, you generally want to avoid a trend until you see a break out one way or the other. In the image below, you see the green arrow pointing to an area where it re-tests the band but the band remains green to affirm there is support. It then bounces off.

The red arrow, you see that the band is flashing red, meaning that it seems to be losing support and its best to wait for a break out one way or the other prior to taking the trade:

The outer lines:

You will see the two outer bands which generally appear blue while a stock is trading within them.

These are the SMAs of the highest high and lowest low in your defined period (default 75).

They can act as moving targets.

When the colour of one of them changes orange, it means the stock is trading above or below them. If the highest high turns orange, it means the stock is trading high above the bands and highest high SMA. Inverse for the lowest low. See the image below:

The purple arrows are pointing to these max band lines and show how they change colour depending on the location of the highest high.

How to use it:

So I made this simply to give me a reference point for day trades off open. However, looking at the large timeframes, I do see there is quite a lot of potential for larger timeframe analyses as well.

I recommend playing around with it and seeing what you like. But I can give you the rules I use for this as a day trading aid:

My Rules:

1. If stock opens below DSL, wait to see if it will retest. It naturally likes to continually make contact with the DSL line at random intervals:

2. If stock opens above DSL, again wait for re-test:

A hold above DSL = Bullish

A break and hold below DSL = bearish

3. When playing a breakout (sentiment shift from bearish to bullish or vice versa), wait for a retest of the line because frequently, there are fakeouts:

A re-test and bounce off the line confirms a breakout. A re-test and fails confirms a continuation of the predominate sentiment.

For further reference, I have done a tutorial video below:

Let me know your questions, comments and suggestions below!

Thanks!

This is a simple SMA based indicator that I have, for lack of a better term, called directional sentiment line.

How it works:

The ribbon/band:

The main band tracks 4 SMAs, the Open, High, Low and Close.

The user can input the length for lookback time, I do 75 and I have it defaulted at 75, however you can do whatever time frame you prefer.

The color of the indicator changes based on the overall trend. Green means an uptrend and red means a downtrend.

When the stock is trading within the band, you generally want to avoid a trend until you see a break out one way or the other. In the image below, you see the green arrow pointing to an area where it re-tests the band but the band remains green to affirm there is support. It then bounces off.

The red arrow, you see that the band is flashing red, meaning that it seems to be losing support and its best to wait for a break out one way or the other prior to taking the trade:

The outer lines:

You will see the two outer bands which generally appear blue while a stock is trading within them.

These are the SMAs of the highest high and lowest low in your defined period (default 75).

They can act as moving targets.

When the colour of one of them changes orange, it means the stock is trading above or below them. If the highest high turns orange, it means the stock is trading high above the bands and highest high SMA. Inverse for the lowest low. See the image below:

The purple arrows are pointing to these max band lines and show how they change colour depending on the location of the highest high.

How to use it:

So I made this simply to give me a reference point for day trades off open. However, looking at the large timeframes, I do see there is quite a lot of potential for larger timeframe analyses as well.

I recommend playing around with it and seeing what you like. But I can give you the rules I use for this as a day trading aid:

My Rules:

1. If stock opens below DSL, wait to see if it will retest. It naturally likes to continually make contact with the DSL line at random intervals:

2. If stock opens above DSL, again wait for re-test:

A hold above DSL = Bullish

A break and hold below DSL = bearish

3. When playing a breakout (sentiment shift from bearish to bullish or vice versa), wait for a retest of the line because frequently, there are fakeouts:

A re-test and bounce off the line confirms a breakout. A re-test and fails confirms a continuation of the predominate sentiment.

For further reference, I have done a tutorial video below:

Let me know your questions, comments and suggestions below!

Thanks!

Versionshinweise

DSL 2.0 Updated and revised with new features and look:

Update includes:

- Plot Crossovers and unders with Arrows

- ATR Range Targets for Crossovers and Crossunders displayed by a target box

- Cleaned the look and softened the colours.

Versionshinweise

Quick fix.Versionshinweise

Last fix, promise!Versionshinweise

Modified the crossover condition to filter false signals.Versionshinweise

Added buy and sell signals based on distance from the ribbon. You can toggle the train time in the settings menu. The default is 500 candles back.

You can also disable and enable all of the functions you want/don't want. If you want to use the traditional version, you can disable the added features!

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Get:

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Get:

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.