OPEN-SOURCE SCRIPT

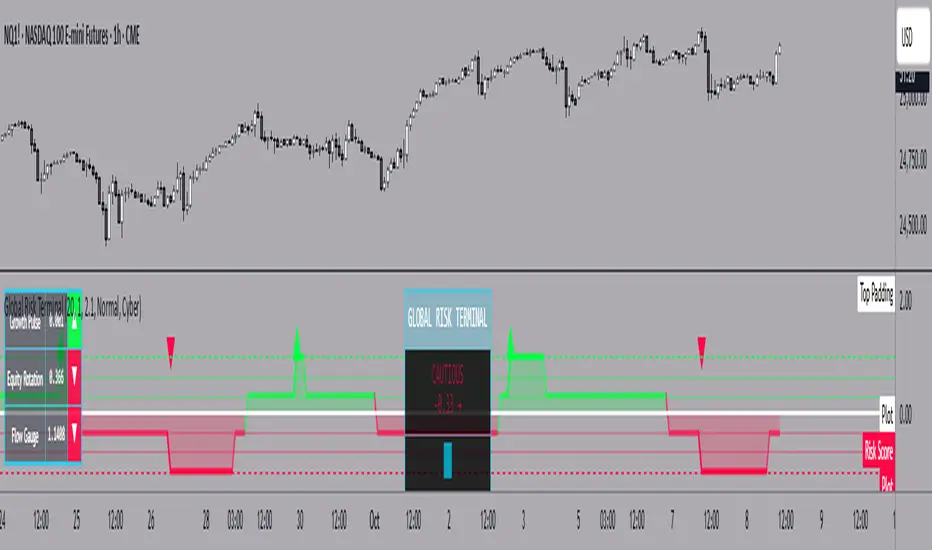

Global Risk Terminal – Multi-Asset Macro Sentiment Indicator

Description:

The Global Risk Terminal is a sophisticated macro sentiment indicator that synthesizes signals from three key cross-asset relationships to produce a single, actionable risk appetite score. It is designed to help traders and investors identify whether global markets are in a risk-on (growth-seeking) or risk-off (defensive) regime. The indicator analyzes the behavior of commodities, equities, bonds, and currencies to generate a comprehensive view of market conditions.

Indicator Output:

The Global Risk Terminal produces a normalized risk score ranging from -1 to +1:

Positive values indicate risk-on conditions (growth assets favored)

Negative values indicate risk-off conditions (safe-haven assets favored)

Core Components:

Growth Pulse (Copper to Gold Ratio, HG/GC)

Purpose: Measures investor preference for industrial growth versus safe-haven assets.

Interpretation:

Rising ratio → Copper outperforming gold → Risk-on environment

Falling ratio → Gold outperforming copper → Risk-off environment

Flat ratio → Transitional market phase

Technical Implementation: Dual moving average slope method (fast MA default 20, slow MA default 40). Positive slope = +1, negative slope = -1, flat slope = 0

Equity Rotation (Russell 2000 to S&P 500 Ratio, RTY/ES)

Purpose: Tracks rotation between small-cap and large-cap equities, revealing market risk appetite.

Interpretation:

Rising ratio → Small-caps outperforming → Strong risk-on

Falling ratio → Large-caps outperforming → Defensive positioning

Technical Implementation: Dual moving average slope method (same as Growth Pulse)

Flow Gauge (10-Year Treasury to US Dollar Index, ZN/DXY)

Purpose: Captures liquidity conditions and cross-asset capital flows.

Interpretation:

Rising ratio → Treasury prices rising or USD weakening → Liquidity expansion, risk-on environment

Falling ratio → Treasury prices falling or USD strengthening → Liquidity contraction, risk-off environment

Technical Implementation: Dual moving average slope method

Composite Risk Score Calculation:

Analyze each component for trend using dual moving averages

Assign signal values: +1 (risk-on), -1 (risk-off), 0 (neutral)

Average the three signals:

Risk Score = (Growth Pulse + Equity Rotation + Flow Gauge) / 3

Optional smoothing with exponential moving average (default 3 periods) to reduce noise

Interpreting the Risk Score:

+0.66 to +1.0: Full risk-on – favor cyclical sectors, small-caps, growth strategies

+0.33 to +0.66: Moderate risk-on – mostly bullish environment, watch for fading momentum

-0.33 to +0.33: Neutral/transition – markets in flux, signals mixed, exercise caution

-0.66 to -0.33: Cautious risk-off – favor defensive sectors, reduce high-beta exposure

-1.0 to -0.66: Full risk-off – strong defensive positioning, prioritize safe-haven assets

How to Use the Global Risk Terminal to Frame Trades:

Aligning Trades with Market Regime

Risk-On (+0.33 and above): Look for buying opportunities in cyclical stocks, high-beta equities, commodities, and emerging markets. Use long entries for swing trades or intraday positions, following confirmed price action.

Risk-Off (-0.33 and below): Shift focus to defensive sectors, large-cap quality stocks, U.S. Treasuries, and safe-haven currencies. Prefer short entries or reduced exposure in risky assets.

Entry and Exit Framing

Use the risk score as a macro filter before executing trades:

Example: The risk score is +0.7 (strong risk-on). Prefer long positions in equities or commodities that are showing bullish confirmation on your regular chart.

Conversely, if the risk score is -0.7 (strong risk-off), avoid aggressive longs and consider short or defensive trades.

Watch for threshold crossings (+/-0.33, +/-0.66) as potential inflection points for adjusting position size, stop-loss levels, or sector rotation.

Confirming Trade Decisions

Combine the Global Risk Terminal with price action, volume, and trend indicators:

If equities rally but the risk score is declining, this may indicate a fragile rally driven by few leaders—trade cautiously.

If equities fall but the risk score is rising, consider counter-trend entries or buying dips.

Risk Management and Position Sizing

Strong alignment across components → increase position size and hold with wider stops

Mixed or neutral signals → reduce exposure, tighten stops, or avoid new trades

Defensive regimes → rotate into stable, low-volatility assets and increase cash buffer

Framing Trades Across Timeframes

Use the indicator as a strategic guide rather than a precise timing tool. Even without the MTF table:

Daily trend alignment → Guide swing trade bias

Shorter timeframe price action → Refine entry points and stop placement

Example: Daily chart shows +0.6 risk score → identify high-probability long setups using intraday technical patterns (breakouts, trend continuation).

Sector and Asset Rotation

Risk-On: Focus on cyclical sectors (financials, industrials, materials, energy), small-caps, high-beta instruments

Risk-Off: Focus on defensive sectors (utilities, consumer staples, healthcare), large-caps, safe-haven instruments

Alert Integration

Set alerts on the risk score to notify you when markets move from neutral to risk-on or risk-off regimes. Use these alerts to plan entries, exits, or portfolio adjustments in advance.

Customization Options:

Moving Average Length (5–100): Adjust sensitivity of trend detection

Score Smoothing (1–10): Reduce noise or see raw risk score

Visual Themes: Six preset themes (Cyber, Ocean, Sunset, Monochrome, Matrix, Custom)

Display Options: Show or hide component dashboards, main header, risk level lines, gradient fill, and component signals

Label Size: Tiny, Small, Normal, Large

Alert Conditions:

Risk score crosses above +0.66 → Strong risk-on

Risk score crosses below -0.66 → Strong risk-off

Risk score crosses zero → Neutral line

Risk score crosses above +0.33 → Moderate risk-on

Risk score crosses below -0.33 → Moderate risk-off

Data Sources:

HG1! – Copper Futures (COMEX)

GC1! – Gold Futures (COMEX)

RTY1! – Russell 2000 E-mini Futures (CME)

ES1! – S&P 500 E-mini Futures (CME)

ZN1! – 10-Year U.S. Treasury Note Futures (CBOT)

DXY – U.S. Dollar Index (ICE)

Notes and Limitations:

Works best during clear macro regimes and aligned trends

Use with price action, volume, and other technical tools

Not a standalone trading system; serves as a macro context filter

Equal weighting assumes all three components are equally important, but market conditions may vary

Past performance does not guarantee future results

Conclusion:

The Global Risk Terminal consolidates complex cross-asset signals into a simple, actionable score that informs market regime, portfolio positioning, sector rotation, and trading decisions. Its user-friendly layout and extensive customization options make it suitable for traders of all experience levels seeking macro-driven insights. By framing trades around risk score thresholds and combining macro context with tactical execution, traders can identify higher-probability opportunities and optimize position sizing, entries, and exits across a wide range of market conditions.

The Global Risk Terminal is a sophisticated macro sentiment indicator that synthesizes signals from three key cross-asset relationships to produce a single, actionable risk appetite score. It is designed to help traders and investors identify whether global markets are in a risk-on (growth-seeking) or risk-off (defensive) regime. The indicator analyzes the behavior of commodities, equities, bonds, and currencies to generate a comprehensive view of market conditions.

Indicator Output:

The Global Risk Terminal produces a normalized risk score ranging from -1 to +1:

Positive values indicate risk-on conditions (growth assets favored)

Negative values indicate risk-off conditions (safe-haven assets favored)

Core Components:

Growth Pulse (Copper to Gold Ratio, HG/GC)

Purpose: Measures investor preference for industrial growth versus safe-haven assets.

Interpretation:

Rising ratio → Copper outperforming gold → Risk-on environment

Falling ratio → Gold outperforming copper → Risk-off environment

Flat ratio → Transitional market phase

Technical Implementation: Dual moving average slope method (fast MA default 20, slow MA default 40). Positive slope = +1, negative slope = -1, flat slope = 0

Equity Rotation (Russell 2000 to S&P 500 Ratio, RTY/ES)

Purpose: Tracks rotation between small-cap and large-cap equities, revealing market risk appetite.

Interpretation:

Rising ratio → Small-caps outperforming → Strong risk-on

Falling ratio → Large-caps outperforming → Defensive positioning

Technical Implementation: Dual moving average slope method (same as Growth Pulse)

Flow Gauge (10-Year Treasury to US Dollar Index, ZN/DXY)

Purpose: Captures liquidity conditions and cross-asset capital flows.

Interpretation:

Rising ratio → Treasury prices rising or USD weakening → Liquidity expansion, risk-on environment

Falling ratio → Treasury prices falling or USD strengthening → Liquidity contraction, risk-off environment

Technical Implementation: Dual moving average slope method

Composite Risk Score Calculation:

Analyze each component for trend using dual moving averages

Assign signal values: +1 (risk-on), -1 (risk-off), 0 (neutral)

Average the three signals:

Risk Score = (Growth Pulse + Equity Rotation + Flow Gauge) / 3

Optional smoothing with exponential moving average (default 3 periods) to reduce noise

Interpreting the Risk Score:

+0.66 to +1.0: Full risk-on – favor cyclical sectors, small-caps, growth strategies

+0.33 to +0.66: Moderate risk-on – mostly bullish environment, watch for fading momentum

-0.33 to +0.33: Neutral/transition – markets in flux, signals mixed, exercise caution

-0.66 to -0.33: Cautious risk-off – favor defensive sectors, reduce high-beta exposure

-1.0 to -0.66: Full risk-off – strong defensive positioning, prioritize safe-haven assets

How to Use the Global Risk Terminal to Frame Trades:

Aligning Trades with Market Regime

Risk-On (+0.33 and above): Look for buying opportunities in cyclical stocks, high-beta equities, commodities, and emerging markets. Use long entries for swing trades or intraday positions, following confirmed price action.

Risk-Off (-0.33 and below): Shift focus to defensive sectors, large-cap quality stocks, U.S. Treasuries, and safe-haven currencies. Prefer short entries or reduced exposure in risky assets.

Entry and Exit Framing

Use the risk score as a macro filter before executing trades:

Example: The risk score is +0.7 (strong risk-on). Prefer long positions in equities or commodities that are showing bullish confirmation on your regular chart.

Conversely, if the risk score is -0.7 (strong risk-off), avoid aggressive longs and consider short or defensive trades.

Watch for threshold crossings (+/-0.33, +/-0.66) as potential inflection points for adjusting position size, stop-loss levels, or sector rotation.

Confirming Trade Decisions

Combine the Global Risk Terminal with price action, volume, and trend indicators:

If equities rally but the risk score is declining, this may indicate a fragile rally driven by few leaders—trade cautiously.

If equities fall but the risk score is rising, consider counter-trend entries or buying dips.

Risk Management and Position Sizing

Strong alignment across components → increase position size and hold with wider stops

Mixed or neutral signals → reduce exposure, tighten stops, or avoid new trades

Defensive regimes → rotate into stable, low-volatility assets and increase cash buffer

Framing Trades Across Timeframes

Use the indicator as a strategic guide rather than a precise timing tool. Even without the MTF table:

Daily trend alignment → Guide swing trade bias

Shorter timeframe price action → Refine entry points and stop placement

Example: Daily chart shows +0.6 risk score → identify high-probability long setups using intraday technical patterns (breakouts, trend continuation).

Sector and Asset Rotation

Risk-On: Focus on cyclical sectors (financials, industrials, materials, energy), small-caps, high-beta instruments

Risk-Off: Focus on defensive sectors (utilities, consumer staples, healthcare), large-caps, safe-haven instruments

Alert Integration

Set alerts on the risk score to notify you when markets move from neutral to risk-on or risk-off regimes. Use these alerts to plan entries, exits, or portfolio adjustments in advance.

Customization Options:

Moving Average Length (5–100): Adjust sensitivity of trend detection

Score Smoothing (1–10): Reduce noise or see raw risk score

Visual Themes: Six preset themes (Cyber, Ocean, Sunset, Monochrome, Matrix, Custom)

Display Options: Show or hide component dashboards, main header, risk level lines, gradient fill, and component signals

Label Size: Tiny, Small, Normal, Large

Alert Conditions:

Risk score crosses above +0.66 → Strong risk-on

Risk score crosses below -0.66 → Strong risk-off

Risk score crosses zero → Neutral line

Risk score crosses above +0.33 → Moderate risk-on

Risk score crosses below -0.33 → Moderate risk-off

Data Sources:

HG1! – Copper Futures (COMEX)

GC1! – Gold Futures (COMEX)

RTY1! – Russell 2000 E-mini Futures (CME)

ES1! – S&P 500 E-mini Futures (CME)

ZN1! – 10-Year U.S. Treasury Note Futures (CBOT)

DXY – U.S. Dollar Index (ICE)

Notes and Limitations:

Works best during clear macro regimes and aligned trends

Use with price action, volume, and other technical tools

Not a standalone trading system; serves as a macro context filter

Equal weighting assumes all three components are equally important, but market conditions may vary

Past performance does not guarantee future results

Conclusion:

The Global Risk Terminal consolidates complex cross-asset signals into a simple, actionable score that informs market regime, portfolio positioning, sector rotation, and trading decisions. Its user-friendly layout and extensive customization options make it suitable for traders of all experience levels seeking macro-driven insights. By framing trades around risk score thresholds and combining macro context with tactical execution, traders can identify higher-probability opportunities and optimize position sizing, entries, and exits across a wide range of market conditions.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.