OPEN-SOURCE SCRIPT

Volume DI Diff + ADX Coloreado por AO

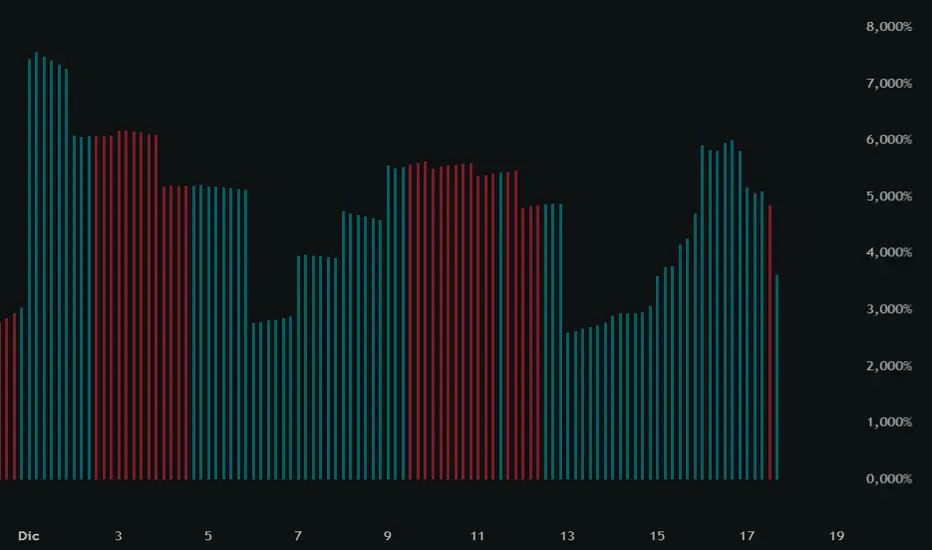

InterpretationIf +DI > -DI (positive DI+ - DI- difference) → Upward trend pressure (bullish signal).

If -DI > +DI (negative DI+ - DI- difference) → Downward trend pressure (bearish signal).

Crossovers between +DI and -DI generate buy/sell signals, often filtered by ADX for reliability.

This setup is widely used in technical analysis to identify trending markets and avoid whipsaws in ranging conditions. It's part of the broader Average Directional Movement System (ADX/DMI).

Key ComponentsADX line: Measures overall trend strength (non-directional).

+DI line: Strength of upward movement.

-DI line: Strength of downward movement.

Trend direction is determined by which DI line is dominant:+DI > -DI: Bullish trend (upward pressure).

-DI > +DI: Bearish trend (downward pressure).

Crossovers between +DI and -DI can signal potential trend changes, but they are most reliable when ADX confirms sufficient strength.ADX Trend Strength Levels (Common Interpretations)ADX Value

Trend Strength

Recommendation

0–20

Weak or no trend (ranging/sideways market)

Avoid trend-following strategies; consider range-bound or oscillator-based trades.

20–25

Emerging or moderate trend (gray zone)

Monitor for confirmation; potential start of trend.

25–50

Strong trend

Ideal for trend-following strategies (e.g., moving averages, breakouts).

50–75

Very strong trend

High momentum; good for riding trends, but watch for exhaustion.

75–100

Extremely strong trend (rare)

Often overextended; risk of reversal or correction.

Rising ADX: Trend is strengthening.

Falling ADX: Trend is weakening (even if still high).

If -DI > +DI (negative DI+ - DI- difference) → Downward trend pressure (bearish signal).

Crossovers between +DI and -DI generate buy/sell signals, often filtered by ADX for reliability.

This setup is widely used in technical analysis to identify trending markets and avoid whipsaws in ranging conditions. It's part of the broader Average Directional Movement System (ADX/DMI).

Key ComponentsADX line: Measures overall trend strength (non-directional).

+DI line: Strength of upward movement.

-DI line: Strength of downward movement.

Trend direction is determined by which DI line is dominant:+DI > -DI: Bullish trend (upward pressure).

-DI > +DI: Bearish trend (downward pressure).

Crossovers between +DI and -DI can signal potential trend changes, but they are most reliable when ADX confirms sufficient strength.ADX Trend Strength Levels (Common Interpretations)ADX Value

Trend Strength

Recommendation

0–20

Weak or no trend (ranging/sideways market)

Avoid trend-following strategies; consider range-bound or oscillator-based trades.

20–25

Emerging or moderate trend (gray zone)

Monitor for confirmation; potential start of trend.

25–50

Strong trend

Ideal for trend-following strategies (e.g., moving averages, breakouts).

50–75

Very strong trend

High momentum; good for riding trends, but watch for exhaustion.

75–100

Extremely strong trend (rare)

Often overextended; risk of reversal or correction.

Rising ADX: Trend is strengthening.

Falling ADX: Trend is weakening (even if still high).

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.