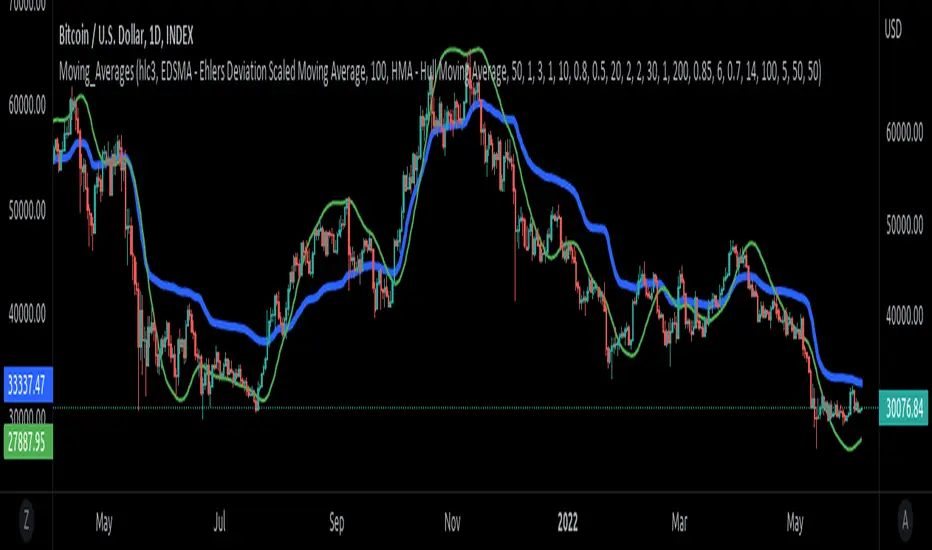

Moving_Averages

This library contains majority important moving average functions with int series support. Which means that they can be used with variable length input. For conventional use, please use tradingview built-in ta functions for moving averages as they are more precise. I'll use functions in this library for my other scripts with dynamic length inputs.

ema(src, len)

Exponential Moving Average (EMA)

Parameters:

src: Source

len: Period

Returns: Exponential Moving Average with Series Int Support (EMA)

alma(src, len, a_offset, a_sigma)

Arnaud Legoux Moving Average (ALMA)

Parameters:

src: Source

len: Period

a_offset: Arnaud Legoux offset

a_sigma: Arnaud Legoux sigma

Returns: Arnaud Legoux Moving Average (ALMA)

covwema(src, len)

Coefficient of Variation Weighted Exponential Moving Average (COVWEMA)

Parameters:

src: Source

len: Period

Returns: Coefficient of Variation Weighted Exponential Moving Average (COVWEMA)

covwma(src, len)

Coefficient of Variation Weighted Moving Average (COVWMA)

Parameters:

src: Source

len: Period

Returns: Coefficient of Variation Weighted Moving Average (COVWMA)

dema(src, len)

DEMA - Double Exponential Moving Average

Parameters:

src: Source

len: Period

Returns: DEMA - Double Exponential Moving Average

edsma(src, len, ssfLength, ssfPoles)

EDSMA - Ehlers Deviation Scaled Moving Average

Parameters:

src: Source

len: Period

ssfLength: EDSMA - Super Smoother Filter Length

ssfPoles: EDSMA - Super Smoother Filter Poles

Returns: Ehlers Deviation Scaled Moving Average (EDSMA)

eframa(src, len, FC, SC)

Ehlrs Modified Fractal Adaptive Moving Average (EFRAMA)

Parameters:

src: Source

len: Period

FC: Lower Shift Limit for Ehlrs Modified Fractal Adaptive Moving Average

SC: Upper Shift Limit for Ehlrs Modified Fractal Adaptive Moving Average

Returns: Ehlrs Modified Fractal Adaptive Moving Average (EFRAMA)

ehma(src, len)

EHMA - Exponential Hull Moving Average

Parameters:

src: Source

len: Period

Returns: Exponential Hull Moving Average (EHMA)

etma(src, len)

Exponential Triangular Moving Average (ETMA)

Parameters:

src: Source

len: Period

Returns: Exponential Triangular Moving Average (ETMA)

frama(src, len)

Fractal Adaptive Moving Average (FRAMA)

Parameters:

src: Source

len: Period

Returns: Fractal Adaptive Moving Average (FRAMA)

hma(src, len)

HMA - Hull Moving Average

Parameters:

src: Source

len: Period

Returns: Hull Moving Average (HMA)

jma(src, len, jurik_phase, jurik_power)

Jurik Moving Average - JMA

Parameters:

src: Source

len: Period

jurik_phase: Jurik (JMA) Only - Phase

jurik_power: Jurik (JMA) Only - Power

Returns: Jurik Moving Average (JMA)

kama(src, len, k_fastLength, k_slowLength)

Kaufman's Adaptive Moving Average (KAMA)

Parameters:

src: Source

len: Period

k_fastLength: Number of periods for the fastest exponential moving average

k_slowLength: Number of periods for the slowest exponential moving average

Returns: Kaufman's Adaptive Moving Average (KAMA)

kijun(_high, _low, len, kidiv)

Kijun v2

Parameters:

_high: High value of bar

_low: Low value of bar

len: Period

kidiv: Kijun MOD Divider

Returns: Kijun v2

lsma(src, len, offset)

LSMA/LRC - Least Squares Moving Average / Linear Regression Curve

Parameters:

src: Source

len: Period

offset: Offset

Returns: Least Squares Moving Average (LSMA)/ Linear Regression Curve (LRC)

mf(src, len, beta, feedback, z)

MF - Modular Filter

Parameters:

src: Source

len: Period

beta: Modular Filter, General Filter Only - Beta

feedback: Modular Filter Only - Feedback

z: Modular Filter Only - Feedback Weighting

Returns: Modular Filter (MF)

rma(src, len)

RMA - RSI Moving average

Parameters:

src: Source

len: Period

Returns: RSI Moving average (RMA)

sma(src, len)

SMA - Simple Moving Average

Parameters:

src: Source

len: Period

Returns: Simple Moving Average (SMA)

smma(src, len)

Smoothed Moving Average (SMMA)

Parameters:

src: Source

len: Period

Returns: Smoothed Moving Average (SMMA)

stma(src, len)

Simple Triangular Moving Average (STMA)

Parameters:

src: Source

len: Period

Returns: Simple Triangular Moving Average (STMA)

tema(src, len)

TEMA - Triple Exponential Moving Average

Parameters:

src: Source

len: Period

Returns: Triple Exponential Moving Average (TEMA)

thma(src, len)

THMA - Triple Hull Moving Average

Parameters:

src: Source

len: Period

Returns: Triple Hull Moving Average (THMA)

vama(src, len, volatility_lookback)

VAMA - Volatility Adjusted Moving Average

Parameters:

src: Source

len: Period

volatility_lookback: Volatility lookback length

Returns: Volatility Adjusted Moving Average (VAMA)

vidya(src, len)

Variable Index Dynamic Average (VIDYA)

Parameters:

src: Source

len: Period

Returns: Variable Index Dynamic Average (VIDYA)

vwma(src, len)

Volume-Weighted Moving Average (VWMA)

Parameters:

src: Source

len: Period

Returns: Volume-Weighted Moving Average (VWMA)

wma(src, len)

WMA - Weighted Moving Average

Parameters:

src: Source

len: Period

Returns: Weighted Moving Average (WMA)

zema(src, len)

Zero-Lag Exponential Moving Average (ZEMA)

Parameters:

src: Source

len: Period

Returns: Zero-Lag Exponential Moving Average (ZEMA)

zsma(src, len)

Zero-Lag Simple Moving Average (ZSMA)

Parameters:

src: Source

len: Period

Returns: Zero-Lag Simple Moving Average (ZSMA)

evwma(src, len)

EVWMA - Elastic Volume Weighted Moving Average

Parameters:

src: Source

len: Period

Returns: Elastic Volume Weighted Moving Average (EVWMA)

tt3(src, len, a1_t3)

Tillson T3

Parameters:

src: Source

len: Period

a1_t3: Tillson T3 Volume Factor

Returns: Tillson T3

gma(src, len)

GMA - Geometric Moving Average

Parameters:

src: Source

len: Period

Returns: Geometric Moving Average (GMA)

wwma(src, len)

WWMA - Welles Wilder Moving Average

Parameters:

src: Source

len: Period

Returns: Welles Wilder Moving Average (WWMA)

ama(src, _high, _low, len, ama_f_length, ama_s_length)

AMA - Adjusted Moving Average

Parameters:

src: Source

_high: High value of bar

_low: Low value of bar

len: Period

ama_f_length: Fast EMA Length

ama_s_length: Slow EMA Length

Returns: Adjusted Moving Average (AMA)

cma(src, len)

Corrective Moving average (CMA)

Parameters:

src: Source

len: Period

Returns: Corrective Moving average (CMA)

gmma(src, len)

Geometric Mean Moving Average (GMMA)

Parameters:

src: Source

len: Period

Returns: Geometric Mean Moving Average (GMMA)

ealf(src, len, LAPercLen_, FPerc_)

Ehler's Adaptive Laguerre filter (EALF)

Parameters:

src: Source

len: Period

LAPercLen_: Median Length

FPerc_: Median Percentage

Returns: Ehler's Adaptive Laguerre filter (EALF)

elf(src, len, LAPercLen_, FPerc_)

ELF - Ehler's Laguerre filter

Parameters:

src: Source

len: Period

LAPercLen_: Median Length

FPerc_: Median Percentage

Returns: Ehler's Laguerre Filter (ELF)

edma(src, len)

Exponentially Deviating Moving Average (MZ EDMA)

Parameters:

src: Source

len: Period

Returns: Exponentially Deviating Moving Average (MZ EDMA)

pnr(src, len, rank_inter_Perc_)

PNR - percentile nearest rank

Parameters:

src: Source

len: Period

rank_inter_Perc_: Rank and Interpolation Percentage

Returns: Percentile Nearest Rank (PNR)

pli(src, len, rank_inter_Perc_)

PLI - Percentile Linear Interpolation

Parameters:

src: Source

len: Period

rank_inter_Perc_: Rank and Interpolation Percentage

Returns: Percentile Linear Interpolation (PLI)

rema(src, len)

Range EMA (REMA)

Parameters:

src: Source

len: Period

Returns: Range EMA (REMA)

sw_ma(src, len)

Sine-Weighted Moving Average (SW-MA)

Parameters:

src: Source

len: Period

Returns: Sine-Weighted Moving Average (SW-MA)

vwap(src, len)

Volume Weighted Average Price (VWAP)

Parameters:

src: Source

len: Period

Returns: Volume Weighted Average Price (VWAP)

mama(src, len)

MAMA - MESA Adaptive Moving Average

Parameters:

src: Source

len: Period

Returns: MESA Adaptive Moving Average (MAMA)

fama(src, len)

FAMA - Following Adaptive Moving Average

Parameters:

src: Source

len: Period

Returns: Following Adaptive Moving Average (FAMA)

hkama(src, len)

HKAMA - Hilbert based Kaufman's Adaptive Moving Average

Parameters:

src: Source

len: Period

Returns: Hilbert based Kaufman's Adaptive Moving Average (HKAMA)

Pine Bibliothek

Ganz im Sinne von TradingView hat dieser Autor seinen/ihren Pine Code als Open-Source-Bibliothek veröffentlicht. Auf diese Weise können nun auch andere Pine-Programmierer aus unserer Community den Code verwenden. Vielen Dank an den Autor! Sie können diese Bibliothek privat oder in anderen Open-Source-Veröffentlichungen verwenden. Die Nutzung dieses Codes in einer Veröffentlichung wird in unseren Hausregeln reguliert.

Haftungsausschluss

Pine Bibliothek

Ganz im Sinne von TradingView hat dieser Autor seinen/ihren Pine Code als Open-Source-Bibliothek veröffentlicht. Auf diese Weise können nun auch andere Pine-Programmierer aus unserer Community den Code verwenden. Vielen Dank an den Autor! Sie können diese Bibliothek privat oder in anderen Open-Source-Veröffentlichungen verwenden. Die Nutzung dieses Codes in einer Veröffentlichung wird in unseren Hausregeln reguliert.