OPEN-SOURCE SCRIPT

Multi-Crypto Principal Component Analysis

Version 0.2

## 📌 Multi-Crypto Principal Component Analysis (PCA) — Indicator Summary

### 🎯 Purpose

This indicator identifies **cryptocurrency assets that are behaving differently** from the rest of the market, using a simplified approach inspired by Principal Component Analysis (PCA). It’s designed to help traders spot **cross-market divergences**, detect outliers, and improve asset selection and correlation-based strategies.

### ⚙️ How It Works

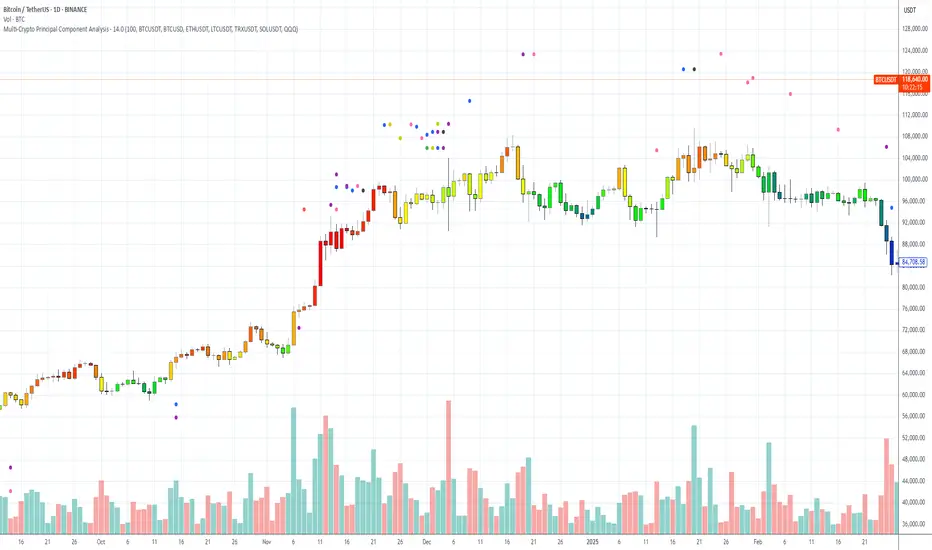

The indicator analyzes the **log returns** of up to 7 user-defined assets over a configurable lookback period (default: 100 bars). It computes the **z-score** (standardized deviation) for each asset’s return series and compares it against the average behavior of the group.

If an asset’s behavior deviates significantly (beyond a threshold of 1.5 standard deviations), it’s flagged as an **outlier**.

- Each outlier is plotted as a **colored dot horizontally spaced** above the price bar

- Up to **3 dots per bar** are shown for visual clarity

This PCA-style detection works in real time, directly on the chart, and gives you a quick overview of which assets are breaking correlation.

### 🔧 Inputs

- 🕒 **Lookback Period**: Number of bars to analyze (default: 100)

- 🔢 **Assets 1–7**: Choose any 7 crypto symbols from any exchange

- 🎨 **Colors**: Predefined per asset (e.g. BTCUSDT = red, ETHUSDT = yellow)

- 📈 **Threshold**: Internal (1.5 std dev); adjustable in code if needed

### 📊 Outputs

- 🟢 Dots above candles representing assets that are acting as outliers

- 🧠 Real-time clustering insight based on statistical deviation

- 🧭 Spatially spaced dots to avoid visual overlap when multiple outliers appear

### ⚠️ Limitations

- This is a **PCA-inspired approximation**, not true matrix-based PCA

- It does **not compute principal components or eigenvectors**

- Sensitivity may vary with asset volatility or sparse trading data

- Real PCA requires external tools like Python or R for full dimensional analysis

This tool is ideal for traders who want real-time crypto correlation insights without needing external data science platforms. It’s lightweight, fast, and highly visual — and gives you a powerful lens into market dislocations across multiple assets.

## 📌 Multi-Crypto Principal Component Analysis (PCA) — Indicator Summary

### 🎯 Purpose

This indicator identifies **cryptocurrency assets that are behaving differently** from the rest of the market, using a simplified approach inspired by Principal Component Analysis (PCA). It’s designed to help traders spot **cross-market divergences**, detect outliers, and improve asset selection and correlation-based strategies.

### ⚙️ How It Works

The indicator analyzes the **log returns** of up to 7 user-defined assets over a configurable lookback period (default: 100 bars). It computes the **z-score** (standardized deviation) for each asset’s return series and compares it against the average behavior of the group.

If an asset’s behavior deviates significantly (beyond a threshold of 1.5 standard deviations), it’s flagged as an **outlier**.

- Each outlier is plotted as a **colored dot horizontally spaced** above the price bar

- Up to **3 dots per bar** are shown for visual clarity

This PCA-style detection works in real time, directly on the chart, and gives you a quick overview of which assets are breaking correlation.

### 🔧 Inputs

- 🕒 **Lookback Period**: Number of bars to analyze (default: 100)

- 🔢 **Assets 1–7**: Choose any 7 crypto symbols from any exchange

- 🎨 **Colors**: Predefined per asset (e.g. BTCUSDT = red, ETHUSDT = yellow)

- 📈 **Threshold**: Internal (1.5 std dev); adjustable in code if needed

### 📊 Outputs

- 🟢 Dots above candles representing assets that are acting as outliers

- 🧠 Real-time clustering insight based on statistical deviation

- 🧭 Spatially spaced dots to avoid visual overlap when multiple outliers appear

### ⚠️ Limitations

- This is a **PCA-inspired approximation**, not true matrix-based PCA

- It does **not compute principal components or eigenvectors**

- Sensitivity may vary with asset volatility or sparse trading data

- Real PCA requires external tools like Python or R for full dimensional analysis

This tool is ideal for traders who want real-time crypto correlation insights without needing external data science platforms. It’s lightweight, fast, and highly visual — and gives you a powerful lens into market dislocations across multiple assets.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.