OPEN-SOURCE SCRIPT

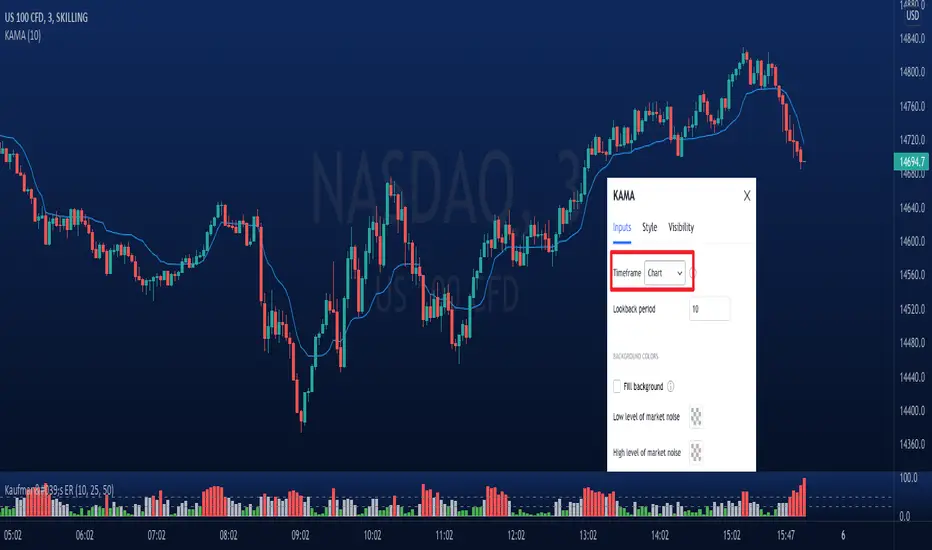

Aktualisiert Kaufman's Adaptive Moving Average (KAMA) - Multi timeframe

Kaufman's Adaptive Moving Average (KAMA)

KAMA was developed by Perry Kaufman to give better directions of short term market trends.

Idea is similar to an EMA, but it makes adjustments to the smoothing factor by taking Market Noise into consideration. Levels of noise in KAMA is modelled using Kaufman's Efficiency Ratio.

The problem with traditional of moving averages (ie. SMA/EMA) is that they are very sensitive to sudden price movements.

Applications:

- Less prone to false signals compared to other types of moving averages. When price suddenly surges or tanks, KAMA will lag behind telling us that the move is rather abnormal.

- On the other hand, when volatility of price movements is low, KAMA will be close to the ranging candles with a slope approximate to zero. KAMA can be used for filtering out choppy markets.

Other features:

- Multi-timeframe.

- Can visualize levels of market noise with background color mode turned on.

KAMA was developed by Perry Kaufman to give better directions of short term market trends.

Idea is similar to an EMA, but it makes adjustments to the smoothing factor by taking Market Noise into consideration. Levels of noise in KAMA is modelled using Kaufman's Efficiency Ratio.

The problem with traditional of moving averages (ie. SMA/EMA) is that they are very sensitive to sudden price movements.

Applications:

- Less prone to false signals compared to other types of moving averages. When price suddenly surges or tanks, KAMA will lag behind telling us that the move is rather abnormal.

- On the other hand, when volatility of price movements is low, KAMA will be close to the ranging candles with a slope approximate to zero. KAMA can be used for filtering out choppy markets.

Other features:

- Multi-timeframe.

- Can visualize levels of market noise with background color mode turned on.

Versionshinweise

New feature: Coded candles to identify price crossing with MA.Versionshinweise

Amended line 43, calling of nz(src=kama, replacement=close). Previously, param. replacement==0Versionshinweise

Features:- Added: Option to show smooth KAMA (least of squares over same KAMA period).

- Added: Low/high thresholds for background colors linked to noise (if turned on)

- Removed: bar colors during crosses

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.