OPEN-SOURCE SCRIPT

Kleinmann's Trend Following Strategy (Cryptocurrency)

Description:

Kleinmann's Trend Following Strategy (Cryptocurrency) is a technical indicator designed to identify and capitalize on trends in the price of various cryptocurrency. Inspired by the philosophy of trader George Kleinmann, who advocates for the use of moving averages to determine trends and maximize profits systematically, this strategy leverages a Simple Moving Average (SMA) to gauge the direction of the trend.

How it Works:

Simple Moving Average (SMA): The heart of the strategy is the SMA, a commonly used technical indicator that smooths out price data by calculating the average closing price over a specified period. In this script, the length of the SMA is customizable through the sma_length input parameter.

Trend Identification: The script compares the current price of the cryptocurrency with the SMA to determine the prevailing trend. If the current price is above the SMA, it suggests a bullish trend, indicating potential buying opportunities. Conversely, if the price is below the SMA, it suggests a bearish trend, indicating potential selling opportunities.

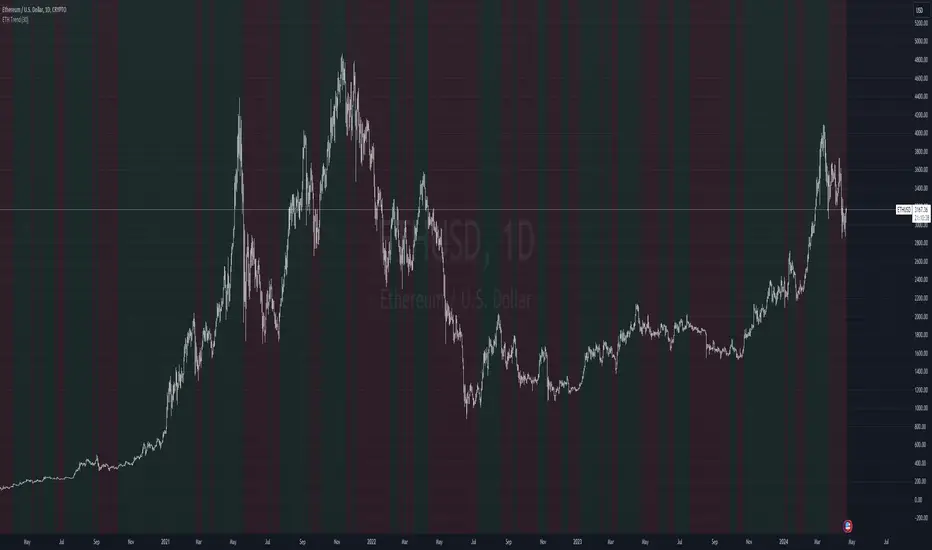

Color-Coded Visualization: To provide a visual representation of the trend, the script colors the background of the chart. During bullish periods, the background is colored green, while during bearish periods, it is colored red. This color-coded visualization allows traders to quickly identify the prevailing trend at a glance.

Components:

Indicator Declaration: The script starts with a declaration statement (indicator()) to define it as a Pine Script indicator, ensuring compatibility with the TradingView platform.

Input Parameters: Traders can customize the behavior of the indicator through input parameters. The sma_length parameter allows users to adjust the length of the SMA, catering to different timeframes and trading styles.

SMA Calculation: The script calculates the SMA using the ta.sma() function, which takes the closing price of Ethereum and the specified SMA length as inputs.

Trend Identification: By comparing the current price with the SMA, the script determines whether the cryptocurrency is in a bullish or bearish trend.

Color-Coded Visualization: The bgcolor() function is used to color the background of the chart based on the detected trend. Green indicates a bullish trend, while red indicates a bearish trend. This visual representation helps traders to easily interpret the trend direction.

Philosophy:

Kleinmann's Trend Following Strategy (Cryptocurrency) embodies the philosophy of George Kleinmann, who believes that moving averages are the best technical tool for trend identification and profit maximization. By systematically following trends using a simple yet effective indicator like the SMA, traders can make informed trading decisions and capitalize on market movements with confidence.

Kleinmann believes there is a middle ground "best of both worlds methodology" when managing your position according to market action by first calculating both the 23 and 30 day moving averages on the daily chart. Kleinmann belielves that in today's trading world the big funds have become the most significant market moving factor. Despite no hard data, the belief is that the majority of fund managers utilize moving averages of various lengths and varieties. Those managers with a shorter term perspective seem to prefer at or less than a 20 period, and those with a longer term perspective tend to prefer at or above the 50.

The theory is to use an intermediate approach to attain somewhat of an advantage to stay out of the way of the thundering herd, and therefore, react in a more agile manner. He beliees the 23 to 30 period to be a perfect combination to use with the daily charts that has a dynamic time period (useful over a variety of non-correlated markets in one's portfolio). Use the 23 to 30 day moving average to determine the major trend of the market.

Conclusion:

Kleinmann's Trend Following Strategy (Cryptocurrency) is a powerful tool for traders seeking to navigate the dynamic cryptocurrency markets. With its focus on trend identification and systematic approach to trading, this indicator empowers traders to stay ahead of market trends and maximize their profit potential in trading.

Kleinmann's Trend Following Strategy (Cryptocurrency) is a technical indicator designed to identify and capitalize on trends in the price of various cryptocurrency. Inspired by the philosophy of trader George Kleinmann, who advocates for the use of moving averages to determine trends and maximize profits systematically, this strategy leverages a Simple Moving Average (SMA) to gauge the direction of the trend.

How it Works:

Simple Moving Average (SMA): The heart of the strategy is the SMA, a commonly used technical indicator that smooths out price data by calculating the average closing price over a specified period. In this script, the length of the SMA is customizable through the sma_length input parameter.

Trend Identification: The script compares the current price of the cryptocurrency with the SMA to determine the prevailing trend. If the current price is above the SMA, it suggests a bullish trend, indicating potential buying opportunities. Conversely, if the price is below the SMA, it suggests a bearish trend, indicating potential selling opportunities.

Color-Coded Visualization: To provide a visual representation of the trend, the script colors the background of the chart. During bullish periods, the background is colored green, while during bearish periods, it is colored red. This color-coded visualization allows traders to quickly identify the prevailing trend at a glance.

Components:

Indicator Declaration: The script starts with a declaration statement (indicator()) to define it as a Pine Script indicator, ensuring compatibility with the TradingView platform.

Input Parameters: Traders can customize the behavior of the indicator through input parameters. The sma_length parameter allows users to adjust the length of the SMA, catering to different timeframes and trading styles.

SMA Calculation: The script calculates the SMA using the ta.sma() function, which takes the closing price of Ethereum and the specified SMA length as inputs.

Trend Identification: By comparing the current price with the SMA, the script determines whether the cryptocurrency is in a bullish or bearish trend.

Color-Coded Visualization: The bgcolor() function is used to color the background of the chart based on the detected trend. Green indicates a bullish trend, while red indicates a bearish trend. This visual representation helps traders to easily interpret the trend direction.

Philosophy:

Kleinmann's Trend Following Strategy (Cryptocurrency) embodies the philosophy of George Kleinmann, who believes that moving averages are the best technical tool for trend identification and profit maximization. By systematically following trends using a simple yet effective indicator like the SMA, traders can make informed trading decisions and capitalize on market movements with confidence.

Kleinmann believes there is a middle ground "best of both worlds methodology" when managing your position according to market action by first calculating both the 23 and 30 day moving averages on the daily chart. Kleinmann belielves that in today's trading world the big funds have become the most significant market moving factor. Despite no hard data, the belief is that the majority of fund managers utilize moving averages of various lengths and varieties. Those managers with a shorter term perspective seem to prefer at or less than a 20 period, and those with a longer term perspective tend to prefer at or above the 50.

The theory is to use an intermediate approach to attain somewhat of an advantage to stay out of the way of the thundering herd, and therefore, react in a more agile manner. He beliees the 23 to 30 period to be a perfect combination to use with the daily charts that has a dynamic time period (useful over a variety of non-correlated markets in one's portfolio). Use the 23 to 30 day moving average to determine the major trend of the market.

Conclusion:

Kleinmann's Trend Following Strategy (Cryptocurrency) is a powerful tool for traders seeking to navigate the dynamic cryptocurrency markets. With its focus on trend identification and systematic approach to trading, this indicator empowers traders to stay ahead of market trends and maximize their profit potential in trading.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.