OPEN-SOURCE SCRIPT

LSVR - Liquidity Sweep & Volume Reversal

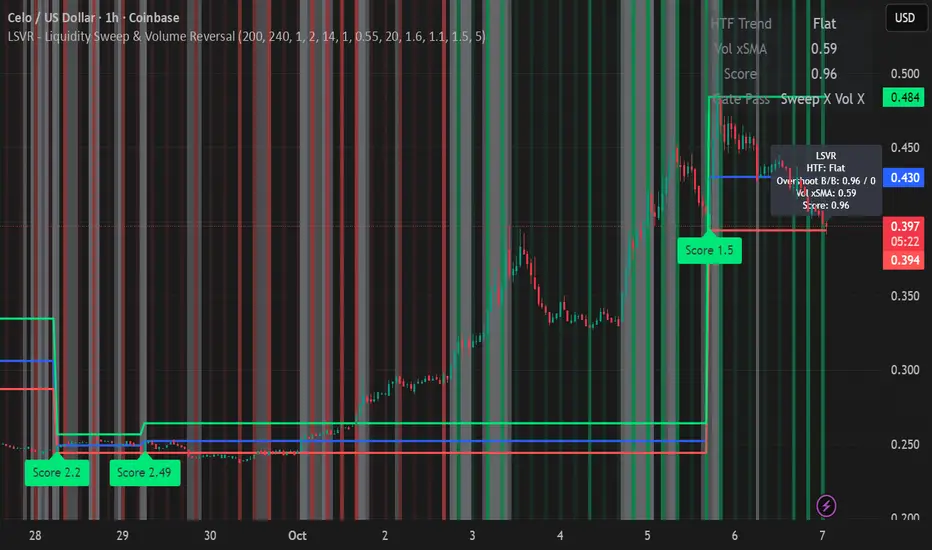

LSVR condenses a pro workflow into one visual overlay: Higher-Timeframe (HTF) Trend → Liquidity Sweep & Reclaim → Volume Confirmation. A signal only prints when all three gates align at bar close, and the chart shows everything you need—trend context, the sweep “trap” candle, and a projected Entry/SL/TP based on your chosen R multiple.

How it works

HTF Trend Filter: Projects a smoothed KAMA/EMA from a higher timeframe to the chart using a safe, lookahead-off request. Long signals are considered only above the HTF line; shorts only below.

Liquidity Sweep & Reclaim: Finds confirmed swing highs/lows, then detects an ATR-scaled overshoot through that swing followed by a reclaim (close back inside a configurable % of the bar range).

Volume Confirmation: Requires either a volume spike over Volume SMA × multiplier or optional OBV divergence. No participation = no signal.

Score: Each setup is scored: trend (0/1) + overshoot strength (0..1.5) + conviction (0/1). Signals fire only when the score ≥ Min Signal Score.

What you see

HTF Ribbon (subtle green/red backdrop) for bias.

Sweep Box on the signal candle (green = long, red = short).

Signal markers (“L” / “S”) with a small score label.

Projected lines that persist until the next signal: Entry (close), Stop (beyond swept swing), Target (R multiple).

Heatmap that intensifies when the score crosses your threshold.

Dashboard (top-right): HTF direction, Volume×SMA, current Score, gate pass status.

Tooltip on the last bar with quick stats.

Quick start

Apply to any liquid symbol and set HTF to ~3–6× your chart timeframe (e.g., 15m chart → 1H–4H).

Trade with the HTF trend: take L signals above the HTF line and S signals below it.

Entry = signal bar close, SL = beyond the swept swing, TP = your Projected Take-Profit (R).

Tighten or loosen selectivity with Min Signal Score, Reclaim %, Overshoot (ATR×), and Cooldown.

Recommended presets

Choppy/crypto 15m: minScore 1.25, reclaimPct 0.60–0.65, overshootATR 1.0–1.2, useOBVDiv=false, cooldown 8.

FX 5m / session trend: minScore 1.0–1.1, reclaimPct 0.50–0.55, overshootATR 0.8–1.0, useOBVDiv=true, cooldown 5.

Indices 1m (RTH): minScore 1.2, reclaimPct 0.55–0.60, useOBVDiv=false, cooldown 10.

Non-repainting by design

HTF values use lookahead_off with realtime offset.

Swings are confirmed pivots (no “forming” pivots).

Signals print at bar close only.

Notes

OBV divergence can add sensitivity on liquid markets; keep it off for stricter filtering.

Use Cooldown to avoid clustered sweeps.

This is an overlay/analysis tool, not financial advice. Test settings in Replay/Paper Trading before using live.

How it works

HTF Trend Filter: Projects a smoothed KAMA/EMA from a higher timeframe to the chart using a safe, lookahead-off request. Long signals are considered only above the HTF line; shorts only below.

Liquidity Sweep & Reclaim: Finds confirmed swing highs/lows, then detects an ATR-scaled overshoot through that swing followed by a reclaim (close back inside a configurable % of the bar range).

Volume Confirmation: Requires either a volume spike over Volume SMA × multiplier or optional OBV divergence. No participation = no signal.

Score: Each setup is scored: trend (0/1) + overshoot strength (0..1.5) + conviction (0/1). Signals fire only when the score ≥ Min Signal Score.

What you see

HTF Ribbon (subtle green/red backdrop) for bias.

Sweep Box on the signal candle (green = long, red = short).

Signal markers (“L” / “S”) with a small score label.

Projected lines that persist until the next signal: Entry (close), Stop (beyond swept swing), Target (R multiple).

Heatmap that intensifies when the score crosses your threshold.

Dashboard (top-right): HTF direction, Volume×SMA, current Score, gate pass status.

Tooltip on the last bar with quick stats.

Quick start

Apply to any liquid symbol and set HTF to ~3–6× your chart timeframe (e.g., 15m chart → 1H–4H).

Trade with the HTF trend: take L signals above the HTF line and S signals below it.

Entry = signal bar close, SL = beyond the swept swing, TP = your Projected Take-Profit (R).

Tighten or loosen selectivity with Min Signal Score, Reclaim %, Overshoot (ATR×), and Cooldown.

Recommended presets

Choppy/crypto 15m: minScore 1.25, reclaimPct 0.60–0.65, overshootATR 1.0–1.2, useOBVDiv=false, cooldown 8.

FX 5m / session trend: minScore 1.0–1.1, reclaimPct 0.50–0.55, overshootATR 0.8–1.0, useOBVDiv=true, cooldown 5.

Indices 1m (RTH): minScore 1.2, reclaimPct 0.55–0.60, useOBVDiv=false, cooldown 10.

Non-repainting by design

HTF values use lookahead_off with realtime offset.

Swings are confirmed pivots (no “forming” pivots).

Signals print at bar close only.

Notes

OBV divergence can add sensitivity on liquid markets; keep it off for stricter filtering.

Use Cooldown to avoid clustered sweeps.

This is an overlay/analysis tool, not financial advice. Test settings in Replay/Paper Trading before using live.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.