OPEN-SOURCE SCRIPT

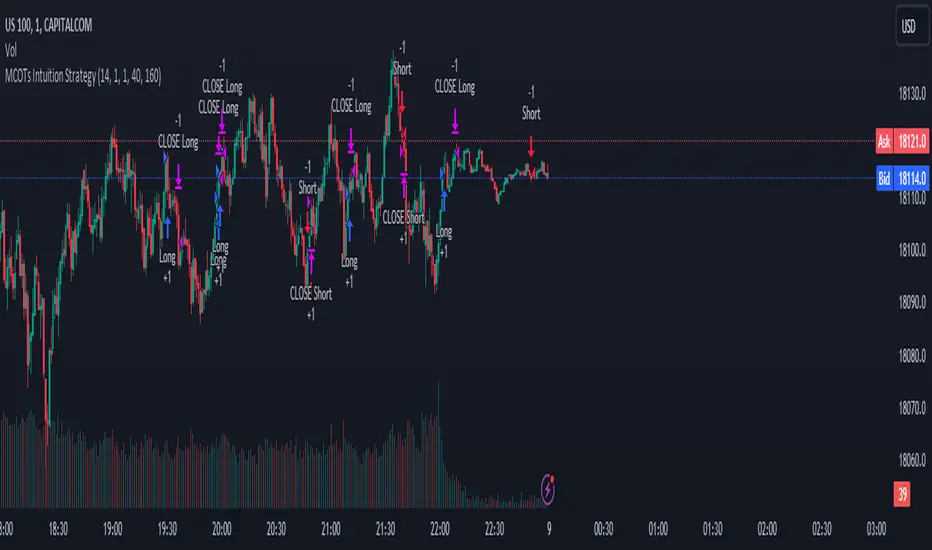

Aktualisiert MCOTs Intuition Strategy

Initial Capital: The strategy starts with an initial capital of $50,000.

Execution: Trades are executed on every price tick to capture all potential movements.

Contract Size: The default position size is one contract per trade.

Timeframe: Although not explicitly mentioned, this strategy is intended for a one-minute timeframe.

RSI Calculation: The Relative Strength Index (RSI) is calculated over a user-defined period (default is 14 periods).

Standard Deviation: The script calculates the standard deviation of the change in RSI values to determine the threshold for entering trades.

Exhaustion Detection: Before entering a long or short position, the script checks for exhaustion in the RSI’s momentum. This is to avoid entering trades during extreme conditions where a reversal is likely.

Entry Conditions: A long position is entered when the current RSI momentum exceeds the standard deviation threshold and is less than the previous momentum multiplied by an exhaustion factor. A short position is entered under the opposite conditions.

Limit Orders for Exit: Instead of traditional stop loss and take profit orders, the strategy uses limit orders to exit positions. This means the strategy sets a desired price level to close the position and waits for the market to reach this price.

Profit Target and Stop Loss: The script allows setting a profit target and stop loss in terms of ticks, which are the smallest measurable increments in price movement for the traded asset.

blah blah whatever

Execution: Trades are executed on every price tick to capture all potential movements.

Contract Size: The default position size is one contract per trade.

Timeframe: Although not explicitly mentioned, this strategy is intended for a one-minute timeframe.

RSI Calculation: The Relative Strength Index (RSI) is calculated over a user-defined period (default is 14 periods).

Standard Deviation: The script calculates the standard deviation of the change in RSI values to determine the threshold for entering trades.

Exhaustion Detection: Before entering a long or short position, the script checks for exhaustion in the RSI’s momentum. This is to avoid entering trades during extreme conditions where a reversal is likely.

Entry Conditions: A long position is entered when the current RSI momentum exceeds the standard deviation threshold and is less than the previous momentum multiplied by an exhaustion factor. A short position is entered under the opposite conditions.

Limit Orders for Exit: Instead of traditional stop loss and take profit orders, the strategy uses limit orders to exit positions. This means the strategy sets a desired price level to close the position and waits for the market to reach this price.

Profit Target and Stop Loss: The script allows setting a profit target and stop loss in terms of ticks, which are the smallest measurable increments in price movement for the traded asset.

blah blah whatever

Versionshinweise

Initial Capital: The strategy starts with an initial capital of $50,000.Execution: Trades are executed on every price tick to capture all potential movements.

Contract Size: The default position size is one contract per trade.

Timeframe: Although not explicitly mentioned, this strategy is intended for a one-minute timeframe.

RSI Calculation: The Relative Strength Index (RSI) is calculated over a user-defined period (default is 14 periods).

Standard Deviation: The script calculates the standard deviation of the change in RSI values to determine the threshold for entering trades.

Exhaustion Detection: Before entering a long or short position, the script checks for exhaustion in the RSI’s momentum. This is to avoid entering trades during extreme conditions where a reversal is likely.

Entry Conditions: A long position is entered when the current RSI momentum exceeds the standard deviation threshold and is less than the previous momentum multiplied by an exhaustion factor. A short position is entered under the opposite conditions.

Limit Orders for Exit: Instead of traditional stop loss and take profit orders, the strategy uses limit orders to exit positions. This means the strategy sets a desired price level to close the position and waits for the market to reach this price.

Profit Target and Stop Loss: The script allows setting a profit target and stop loss in terms of ticks, which are the smallest measurable increments in price movement for the traded asset.

blah blah whatever

Versionshinweise

Initial Capital: The strategy starts with an initial capital of $50,000.Execution: Trades are executed on every price tick to capture all potential movements.

Contract Size: The default position size is one contract per trade.

Timeframe: Although not explicitly mentioned, this strategy is intended for a one-minute timeframe.

RSI Calculation: The Relative Strength Index (RSI) is calculated over a user-defined period (default is 14 periods).

Standard Deviation: The script calculates the standard deviation of the change in RSI values to determine the threshold for entering trades.

Exhaustion Detection: Before entering a long or short position, the script checks for exhaustion in the RSI’s momentum. This is to avoid entering trades during extreme conditions where a reversal is likely.

Entry Conditions: A long position is entered when the current RSI momentum exceeds the standard deviation threshold and is less than the previous momentum multiplied by an exhaustion factor. A short position is entered under the opposite conditions.

Limit Orders for Exit: Instead of traditional stop loss and take profit orders, the strategy uses limit orders to exit positions. This means the strategy sets a desired price level to close the position and waits for the market to reach this price.

Profit Target and Stop Loss: The script allows setting a profit target and stop loss in terms of ticks, which are the smallest measurable increments in price movement for the traded asset.

blah blah whatever

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.