OPEN-SOURCE SCRIPT

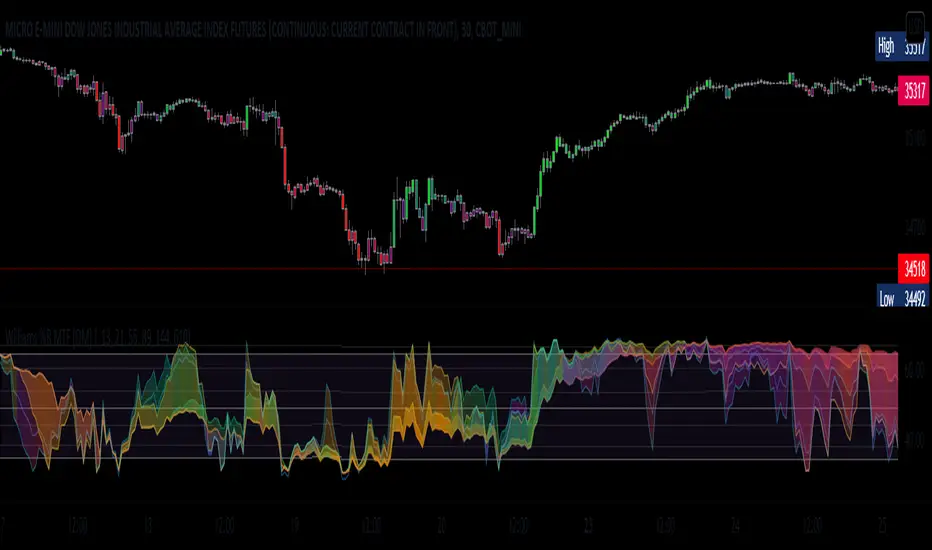

Aktualisiert William %R MTF [DM]

Greeting Colleagues

Today I share The Wlliams %R

Extras=

- 5 diferent length

- 1 extra signal with the technique used in the ultimate oscillator

- Fibo Leves based on ob os leves "width it's automatic"

- Colored bars bassed en average strength

- The indicator that is modified now has the same range as the ultimate oscillator.

Enjoy [;-)

//The Williams %R (%R) indicator was created by famed commodities trader and author Larry Williams.

//

//Calculation

//%R = (CurrentClose - Highest High) / (Highest High - Lowest Low) x -100

//

//Highest High = Highest High for the user defined look-back period.

//Lowest Low = Lowest Low for the user defined look-back period.

//

//The basics

//As previously mentioned, the %R is used to measure momentum. %R oscillates

//within a fixed range between the values of 0 and -100. Williams himself set the

//parameters of overbought as any reading between 0 and -20. His oversold

//parameters were readings between -80 and -100. It is important to note that these

//values are traditional examples. It may be beneficial for the technical analyst

//to set different parameters based on the specific instrument being analyzed. Wider

//or narrower overbought and oversold levels may be appropriate based on historical analysis.

//

//What to look for

//There are two major conditions identified by using the %R indicator.

//The first is standard overbought and oversold conditions. The second is momentum

//changes characterized by momentum failures.

//

//Overbought/Oversold

//Overbought and Oversold conditions are a very common signal generated by momentum oscillators.

//The %R indicator is no different.

Today I share The Wlliams %R

Extras=

- 5 diferent length

- 1 extra signal with the technique used in the ultimate oscillator

- Fibo Leves based on ob os leves "width it's automatic"

- Colored bars bassed en average strength

- The indicator that is modified now has the same range as the ultimate oscillator.

Enjoy [;-)

//The Williams %R (%R) indicator was created by famed commodities trader and author Larry Williams.

//

//Calculation

//%R = (CurrentClose - Highest High) / (Highest High - Lowest Low) x -100

//

//Highest High = Highest High for the user defined look-back period.

//Lowest Low = Lowest Low for the user defined look-back period.

//

//The basics

//As previously mentioned, the %R is used to measure momentum. %R oscillates

//within a fixed range between the values of 0 and -100. Williams himself set the

//parameters of overbought as any reading between 0 and -20. His oversold

//parameters were readings between -80 and -100. It is important to note that these

//values are traditional examples. It may be beneficial for the technical analyst

//to set different parameters based on the specific instrument being analyzed. Wider

//or narrower overbought and oversold levels may be appropriate based on historical analysis.

//

//What to look for

//There are two major conditions identified by using the %R indicator.

//The first is standard overbought and oversold conditions. The second is momentum

//changes characterized by momentum failures.

//

//Overbought/Oversold

//Overbought and Oversold conditions are a very common signal generated by momentum oscillators.

//The %R indicator is no different.

Versionshinweise

Minor changesVersionshinweise

Added butterfly color rules to plotsAdded switch to hide parcels

Versionshinweise

Minor changesVersionshinweise

Added black background for use in the white chartsOpen-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.