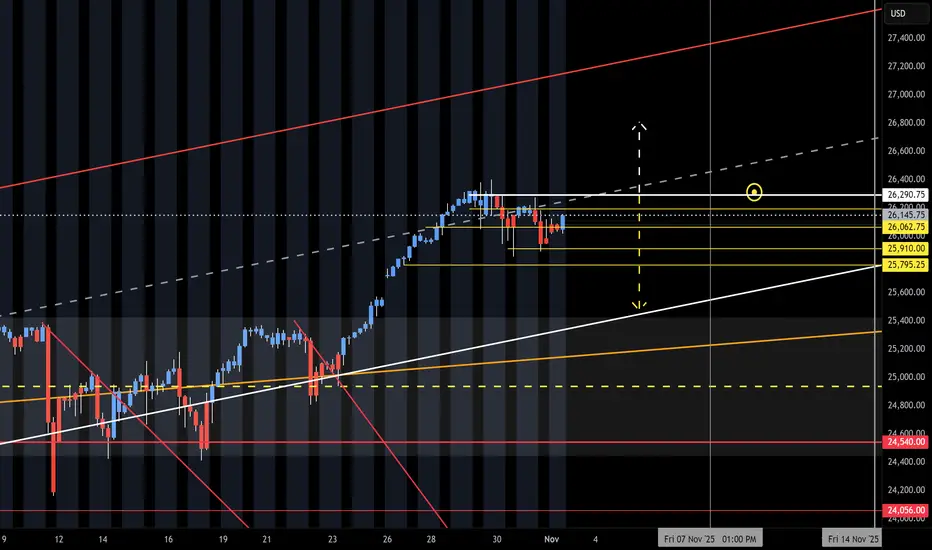

The F-M Long move is on with new month and O/N Gap Open UP. Curveball form Friday Close and late head fake. Again, the NAZ will have to use the O/N to lift it back up. Need to see how the Open Drive and Reg Session reacts to the low volume O/N lift. Run up to upper target above KL 26,290 and Short on reject of. Under 290 is a potential drop to 25k or 25,550.

Anmerkung

Here is what they did: KL 173 was actual Short or Flip Zone, at the last minute the O/N pumped it 100 points and at the Open the NAZ drops back to KL 173. The Upper turn was near KL 290, this is now the range and will go sideways to lower until the Off Session/O/N should we see a drop today.Anmerkung

This thing is juiced with 99% low volume off session bird seed (low quality). Still sticking with my flash crash on the way. Anmerkung

Under 120 is short signal, NAZ may try and get back to near 290, has to get passed 120-140 1st. Anmerkung

With O/N up next and should it lift again, NAZ will never drop. Need to see a lower O/N that is followed up by a sell off in the REG.Anmerkung

Still feel the drop on the way. The battle is with the BTD's, FOMO's, Captain Tweety, Dead Zone and O/N. Other than that, you are great. Or just go Long for the face lift. Anmerkung

415K on Futures volume, another lower volume day. Need to get some selling going (outside of the O/R).Anmerkung

Pop or Drop at 26,090Anmerkung

Just watch 730-795 for break out and head fake at 795Anmerkung

The O/N is The BOSS, Reg Session will stall out or start selling under KL 795.Anmerkung

The O/N BOSS comment is the next signal. The O/N tends to drive direction or change it. Recent move up was primarily moved and maintained the upward move by the O/N. Today, we have a change and it is by way of the O/N. The Reg Session direction will be key today and has been lower, typically. The Reg Session also tends to move sideways and inside the KL's of the O/N. Should today's RS go South do not expect the automatic lift back up. Anmerkung

Over the past 3 years the Overnight Price Action has easily taken over the PA of the NYSE. Today will be a major clue as to if we are making a direction change and we will need to see another drop in tonight's O/N Session. I highly doubt that the Reg Session will lift this and maintain it. The other period is the Dead Zone which is after the 1st hour. Should the DZ sell off and not lift, we are heading lower. The DZ may try or provide some head fakes to the upside. KL 910 and under is next rejection test and time for some games. Anmerkung

Back later, Notice how the price barley moves. O/N is The BOSS and wants/change the direction to lower or at least we should see a few drop tests. Anmerkung

Where is Tweety Bird? This Wash ST is going Short?Anmerkung

After seeing this selling PA movement, it is clear to me that both intraday buying and selling price action has changed. Both move slow and sneaky, this is new for selling. We see it snail lift, I have never seen it snail sell. New game and market structure.Anmerkung

My Flash Crash comment is a half joke. We may not see a Flash or a Crash but something is cooking with a move lower. It just may take more time than usual. Back Later. Anmerkung

25600 is major support so above may pop and below should drop bigger.Anmerkung

U Turn or Danger Zone under 483Anmerkung

Reg Session SELLING, looking for a pop or O/N may go lower again. Think they will defend that by the Close.Anmerkung

Needs to get under 688 1st, if are looking short on Pull Back. Look for after a pop spikeAnmerkung

Early in the day and if it can't get above 730 it will go lower to create some points, any hold may pop back up and retest.Anmerkung

Where is Tweety?Anmerkung

Dead Zone is in control and will keep trying to lift this, 730 is long above now.Anmerkung

Tricky here at 730, will see wiggles and noise and a move out on nowhere. No idea on direction. Back later. Anmerkung

Hard thing about trading is that you need to be a leader (taking trades against the crowd or followers). Then you need to be a follower (follow the trend). Flipping back and forth is the challenge. Many try to go short early (leader) and the crowd is following. Wait until the NAZ gets near KL's is best and can make things easier. Practice, you are correct usually, just early as the crowd is unaware and will change late and follow your lead. Anmerkung

May see Hook Short under 774Anmerkung

Battle at 774, one will break and watch head fake LongAnmerkung

525-470 is range to watchAnmerkung

285-360 is rangeAnmerkung

291 held so farAnmerkung

360 is key and NAZ needs to get above and stay or will go sideways to lowerAnmerkung

Long signal at 345, scalp RetracementAnmerkung

Head Fake so far use a stopAnmerkung

Needs to pass 260Anmerkung

Watch for a drop or pull back at 360Anmerkung

Back to 360 REJECTION is a potential major drop.Anmerkung

Under 410 is drop zone. To 370 or so. We do se divergence but FOMO's are buying the dip.Anmerkung

FYI, this PA looks very similar to the O/N lift and the lift during Reg Session yesterday, both dropped quickly. Not calling just a note.Anmerkung

Google and Apple are now dropping some or giving back some gains. Anmerkung

Near Close, sideways No Trade Zone as it has flattened out. Gamble at this point. 380-415, stronger move lower under 340-20Anmerkung

25,400 and under may be only clue with a Short or drop into Close. I am Flat.Anmerkung

Needs to stay under 378Anmerkung

Needs to break under 320 or may pop back up.Trade wurde manuell geschlossen

NAZ is slowing lifting and then rolling over. The change in pattern is Long Signal. I was expecting a strong heavy route lower. This appears to be a slow bleed. Not Short here and Looking for Long Entry for Retracement Trade. 24,800 is next pop target. Back Later but closing Post here, have to run out.Anmerkung

No pass 800 get outAnmerkung

This was 1st roll turn or change.Anmerkung

Just not feeling major crash here, seems weakAnmerkung

870 is pop or head fake.Anmerkung

Watch 25,015 very closely. Anmerkung

25102 is KL key, Needs to pass. This looks like yesterday and the day before.Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.