Hello friends.

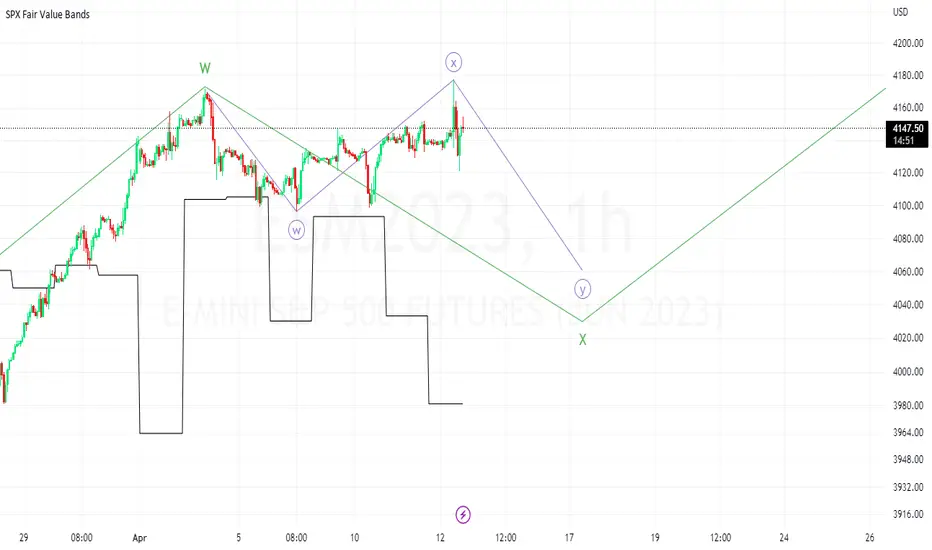

We are heavily short on risk now. We specifically bought some puts on the SPY that will expire tomorrow at a strike of four hundred ten, but we also have some longer-term plays targeting a decline into around the ~17th where we expect that a reversal may occur based on wave theory.

The market is currently quite overvalued relative to liquidity. Since Monday this week, the liquidity has been being drained while risk markets have been being pumped. This is a classic liquidity divergence type setup where we would want to short risk and see it reconnect with the liquidity.

Today featured some news about a lower-than-expected CPI inflation print, which markets initially read as bullish and ran up strongly, only to enter into an even stronger correction following that move up. Traditional market wisdom tells us that following a 'bullish' news event if the market tanks, this is a strong bearish signal. I've seen this type of setup work out extremely well several times. We can also see from the chart that lots of short stop losses were 'taken' by the big CPI print, as is often the case with these news events. The market manipulators use these low-liquidity environments to seek out pain, and then they tend to create reversals after they have had their fill of liquidity. We keep seeing this pattern over and over.

So, we are bearish based on wave theory and market liquidity as well as the reaction to this recent inflation print.

We are heavily short on risk now. We specifically bought some puts on the SPY that will expire tomorrow at a strike of four hundred ten, but we also have some longer-term plays targeting a decline into around the ~17th where we expect that a reversal may occur based on wave theory.

The market is currently quite overvalued relative to liquidity. Since Monday this week, the liquidity has been being drained while risk markets have been being pumped. This is a classic liquidity divergence type setup where we would want to short risk and see it reconnect with the liquidity.

Today featured some news about a lower-than-expected CPI inflation print, which markets initially read as bullish and ran up strongly, only to enter into an even stronger correction following that move up. Traditional market wisdom tells us that following a 'bullish' news event if the market tanks, this is a strong bearish signal. I've seen this type of setup work out extremely well several times. We can also see from the chart that lots of short stop losses were 'taken' by the big CPI print, as is often the case with these news events. The market manipulators use these low-liquidity environments to seek out pain, and then they tend to create reversals after they have had their fill of liquidity. We keep seeing this pattern over and over.

So, we are bearish based on wave theory and market liquidity as well as the reaction to this recent inflation print.

Anmerkung

Instant bag on our puts, cashed out at around +100%Anmerkung

The move down is finished/nearly finished we think. It's a good time to be positioned neutral and wait.Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.