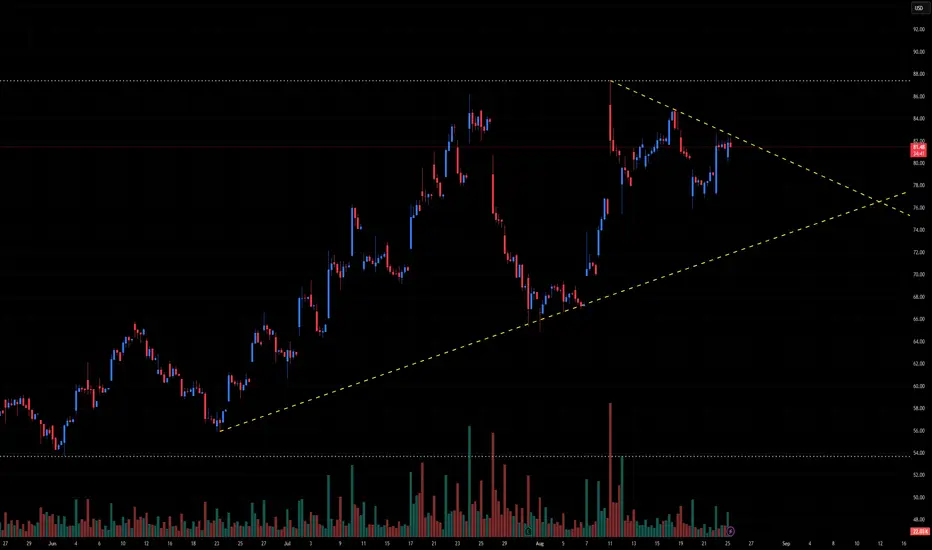

⚡ ALB Technical Outlook – Symmetrical Triangle at Key Inflection

Ticker: ALB (Albemarle Corp.)

Timeframe: 30-minute candles

🔍 Current Setup

ALB has been in a long-term uptrend, holding an ascending support trendline since late June. After peaking near ~87, price has pulled back and is now consolidating within a symmetrical triangle.

Descending resistance: ~84–85.

Ascending support: ~76–77.

Current price: ~81.40, sitting inside the triangle and nearing the apex.

This structure reflects compression — energy building for a decisive breakout.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 85.

Intermediate Targets:

87–88 → Prior swing high.

90+ → Psychological round number.

Measured Move Target: ~92–94 (triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Break below 77, confirmation under 76.

Intermediate Supports:

74–73 → First demand zone.

70–68 → Stronger support.

Measured Move Target: ~67 (triangle height projection downward).

📈 Volume Analysis

Volume has been declining during the triangle formation — normal for consolidation.

Expect a sharp volume expansion once price escapes the triangle.

⚖️ Probability Bias

The broader trend has been upward, which slightly favors a bullish continuation if resistance at 85 is cleared.

However, a failure below 76–77 would invalidate the bullish structure and trigger a breakdown.

✅ Takeaway

ALB is at a critical decision point within a symmetrical triangle:

Bullish Break > 85: Targets 88 → 90 → 92–94

Bearish Break < 76–77: Targets 74 → 70 → 67

The breakout direction — confirmed by volume — will likely define ALB’s next major move.

Ticker: ALB (Albemarle Corp.)

Timeframe: 30-minute candles

🔍 Current Setup

ALB has been in a long-term uptrend, holding an ascending support trendline since late June. After peaking near ~87, price has pulled back and is now consolidating within a symmetrical triangle.

Descending resistance: ~84–85.

Ascending support: ~76–77.

Current price: ~81.40, sitting inside the triangle and nearing the apex.

This structure reflects compression — energy building for a decisive breakout.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 85.

Intermediate Targets:

87–88 → Prior swing high.

90+ → Psychological round number.

Measured Move Target: ~92–94 (triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Break below 77, confirmation under 76.

Intermediate Supports:

74–73 → First demand zone.

70–68 → Stronger support.

Measured Move Target: ~67 (triangle height projection downward).

📈 Volume Analysis

Volume has been declining during the triangle formation — normal for consolidation.

Expect a sharp volume expansion once price escapes the triangle.

⚖️ Probability Bias

The broader trend has been upward, which slightly favors a bullish continuation if resistance at 85 is cleared.

However, a failure below 76–77 would invalidate the bullish structure and trigger a breakdown.

✅ Takeaway

ALB is at a critical decision point within a symmetrical triangle:

Bullish Break > 85: Targets 88 → 90 → 92–94

Bearish Break < 76–77: Targets 74 → 70 → 67

The breakout direction — confirmed by volume — will likely define ALB’s next major move.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.