OPEN-SOURCE SCRIPT

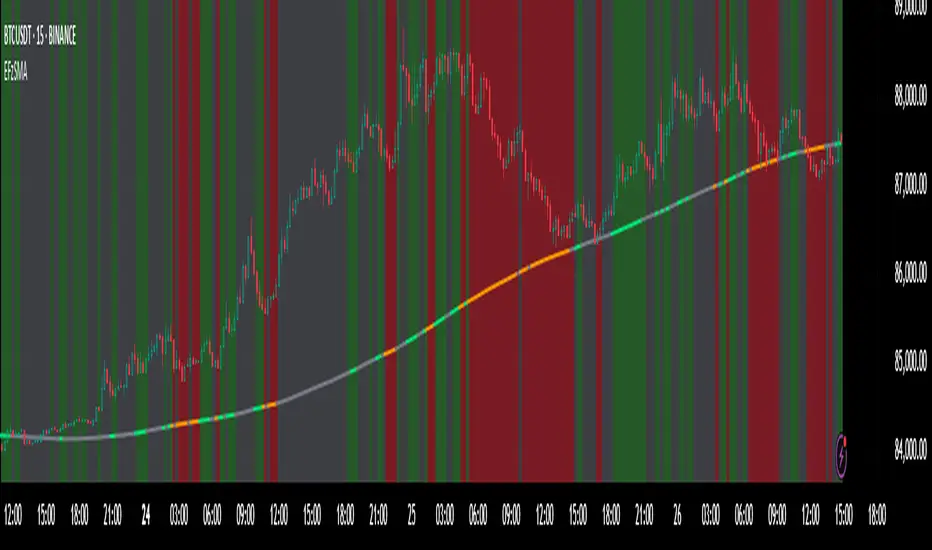

Enhanced Fuzzy SMA Analyzer (Multi-Output Proxy) [FibonacciFlux]

EFzSMA: Decode Trend Quality, Conviction & Risk Beyond Simple Averages

Stop Relying on Lagging Averages Alone. Gain a Multi-Dimensional Edge.

The Challenge: Simple Moving Averages (SMAs) tell you where the price was, but they fail to capture the true quality, conviction, and sustainability of a trend. Relying solely on price crossing an average often leads to chasing weak moves, getting caught in choppy markets, or missing critical signs of trend exhaustion. Advanced traders need a more sophisticated lens to navigate complex market dynamics.

The Solution: Enhanced Fuzzy SMA Analyzer (EFzSMA)

EFzSMA is engineered to address these limitations head-on. It moves beyond simple price-average comparisons by employing a sophisticated Fuzzy Inference System (FIS) that intelligently integrates multiple critical market factors:

Price deviation from the SMA (adaptively normalized for market volatility)

Momentum (Rate of Change - ROC)

Market Sentiment/Overheat (Relative Strength Index - RSI)

Market Volatility Context (Average True Range - ATR, optional)

Volume Dynamics (Volume relative to its MA, optional)

Instead of just a line on a chart, EFzSMA delivers a multi-dimensional assessment designed to give you deeper insights and a quantifiable edge.

Why EFzSMA? Gain Deeper Market Insights

EFzSMA empowers you to make more informed decisions by providing insights that simple averages cannot:

Interpreting the Multi-Dimensional Output

The true power of EFzSMA lies in analyzing its outputs together:

A high Trend Score (+0.8) is significant, but its reliability is amplified by high Conviction (0.9) and low Reversal Risk (0.2). This indicates a strong, well-supported trend.

Conversely, the same high Trend Score (+0.8) coupled with low Conviction (0.3) and high Reversal Risk (0.7) signals caution – the trend might look strong superficially, but internal factors suggest weakness or impending exhaustion.

Use these combined insights to:

Core Technology (Briefly)

EFzSMA leverages a Mamdani-style Fuzzy Inference System. Crisp inputs (normalized deviation, ROC, RSI, ATR%, Vol Ratio) are mapped to linguistic fuzzy sets ("Low", "High", "Positive", etc.). A rules engine evaluates combinations (e.g., "IF Deviation is LargePositive AND Momentum is StrongPositive THEN Trend is StrongBullish"). Modifiers based on Volatility and Volume context adjust rule strengths. Finally, the system aggregates these and defuzzifies them into the Trend Score, Conviction Proxy, and Reversal Risk Proxy. The key is the system's ability to handle ambiguity and combine multiple, potentially conflicting factors in a nuanced way, much like human expert reasoning.

Customization

While designed with robust defaults, EFzSMA offers granular control:

Recommended Use & Caveats

EFzSMA is a sophisticated analytical tool, not a standalone "buy/sell" signal generator.

Use it to complement your existing strategy and analysis.

Always validate signals with price action, market structure, and other confirming factors.

Thorough backtesting and forward testing are essential to understand its behavior and tune parameters for your specific instruments and timeframes.

Fuzzy logic parameters (membership functions, rules) are based on general heuristics and may require optimization for specific market niches.

Disclaimer

Trading involves substantial risk. EFzSMA is provided for informational and analytical purposes only and does not constitute financial advice. No guarantee of profit is made or implied. Past performance is not indicative of future results. Use rigorous risk management practices.

Stop Relying on Lagging Averages Alone. Gain a Multi-Dimensional Edge.

The Challenge: Simple Moving Averages (SMAs) tell you where the price was, but they fail to capture the true quality, conviction, and sustainability of a trend. Relying solely on price crossing an average often leads to chasing weak moves, getting caught in choppy markets, or missing critical signs of trend exhaustion. Advanced traders need a more sophisticated lens to navigate complex market dynamics.

The Solution: Enhanced Fuzzy SMA Analyzer (EFzSMA)

EFzSMA is engineered to address these limitations head-on. It moves beyond simple price-average comparisons by employing a sophisticated Fuzzy Inference System (FIS) that intelligently integrates multiple critical market factors:

Price deviation from the SMA (adaptively normalized for market volatility)

Momentum (Rate of Change - ROC)

Market Sentiment/Overheat (Relative Strength Index - RSI)

Market Volatility Context (Average True Range - ATR, optional)

Volume Dynamics (Volume relative to its MA, optional)

Instead of just a line on a chart, EFzSMA delivers a multi-dimensional assessment designed to give you deeper insights and a quantifiable edge.

Why EFzSMA? Gain Deeper Market Insights

EFzSMA empowers you to make more informed decisions by providing insights that simple averages cannot:

- Assess True Trend Quality, Not Just Location: Is the price above the SMA simply because of a temporary spike, or is it supported by strong momentum, confirming volume, and stable volatility? EFzSMA's core fuzzyTrendScore (-1 to +1) evaluates the health of the trend, helping you distinguish robust moves from noise.

- Quantify Signal Conviction: How reliable is the current trend signal? The Conviction Proxy (0 to 1) measures the internal consistency among the different market factors analyzed by the FIS. High conviction suggests factors are aligned, boosting confidence in the trend signal. Low conviction warns of conflicting signals, uncertainty, or potential consolidation – acting as a powerful filter against chasing weak moves.

Pine Script® // Simplified Concept: Conviction reflects agreement vs. conflict among fuzzy inputs bullStrength = strength_SB + strength_WB bearStrength = strength_SBe + strength_WBe dominantStrength = max(bullStrength, bearStrength) conflictingStrength = min(bullStrength, bearStrength) + strength_N convictionProxy := (dominantStrength - conflictingStrength) / (dominantStrength + conflictingStrength + 1e-10) // Modifiers (Volatility/Volume) applied... - Anticipate Potential Reversals: Trends don't last forever. The Reversal Risk Proxy (0 to 1) synthesizes multiple warning signs – like extreme RSI readings, surging volatility, or diverging volume – into a single, actionable metric. High reversal risk flags conditions often associated with trend exhaustion, providing early warnings to protect profits or consider counter-trend opportunities.

- Adapt to Changing Market Regimes: Markets shift between high and low volatility. EFzSMA's unique Adaptive Deviation Normalization adjusts how it perceives price deviations based on recent market behavior (percentile rank). This ensures more consistent analysis whether the market is quiet or chaotic.

Pine Script® // Core Idea: Normalize deviation by recent volatility (percentile) diff_abs_percentile = ta.percentile_linear_interpolation(abs(raw_diff), normLookback, percRank) + 1e-10 normalized_diff := raw_diff / diff_abs_percentile // Fuzzy sets for 'normalized_diff' are thus adaptive to volatility - Integrate Complexity, Output Clarity: EFzSMA distills complex, multi-factor analysis into clear, interpretable outputs, helping you cut through market noise and focus on what truly matters for your decision-making process.

Interpreting the Multi-Dimensional Output

The true power of EFzSMA lies in analyzing its outputs together:

A high Trend Score (+0.8) is significant, but its reliability is amplified by high Conviction (0.9) and low Reversal Risk (0.2). This indicates a strong, well-supported trend.

Conversely, the same high Trend Score (+0.8) coupled with low Conviction (0.3) and high Reversal Risk (0.7) signals caution – the trend might look strong superficially, but internal factors suggest weakness or impending exhaustion.

Use these combined insights to:

- [] Filter Entry Signals: Require minimum Trend Score and Conviction levels.

[] Manage Risk: Consider reducing exposure or tightening stops when Reversal Risk climbs significantly, especially if Conviction drops.

[] Time Exits: Use rising Reversal Risk and falling Conviction as potential signals to take profits.

[] Identify Regime Shifts: Monitor how the relationship between the outputs changes over time.

Core Technology (Briefly)

EFzSMA leverages a Mamdani-style Fuzzy Inference System. Crisp inputs (normalized deviation, ROC, RSI, ATR%, Vol Ratio) are mapped to linguistic fuzzy sets ("Low", "High", "Positive", etc.). A rules engine evaluates combinations (e.g., "IF Deviation is LargePositive AND Momentum is StrongPositive THEN Trend is StrongBullish"). Modifiers based on Volatility and Volume context adjust rule strengths. Finally, the system aggregates these and defuzzifies them into the Trend Score, Conviction Proxy, and Reversal Risk Proxy. The key is the system's ability to handle ambiguity and combine multiple, potentially conflicting factors in a nuanced way, much like human expert reasoning.

Customization

While designed with robust defaults, EFzSMA offers granular control:

- [] Adjust SMA, ROC, RSI, ATR, Volume MA lengths.

[] Fine-tune Normalization parameters (lookback, percentile). Note: Fuzzy set definitions for deviation are tuned for the normalized [-3, 3] range.

[] Configure Volatility and Volume thresholds for fuzzy sets. Tuning these is crucial for specific assets/timeframes.[] Toggle visual elements (Proxies, BG Color, Risk Shapes, Volatility-based Transparency).

Recommended Use & Caveats

EFzSMA is a sophisticated analytical tool, not a standalone "buy/sell" signal generator.

Use it to complement your existing strategy and analysis.

Always validate signals with price action, market structure, and other confirming factors.

Thorough backtesting and forward testing are essential to understand its behavior and tune parameters for your specific instruments and timeframes.

Fuzzy logic parameters (membership functions, rules) are based on general heuristics and may require optimization for specific market niches.

Disclaimer

Trading involves substantial risk. EFzSMA is provided for informational and analytical purposes only and does not constitute financial advice. No guarantee of profit is made or implied. Past performance is not indicative of future results. Use rigorous risk management practices.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

FibonacciFlux: Pushing indicator boundaries. Crafting sophisticated, surprising tools via ambitious R&D.Help fuel this solo dev's work (not a team!) - optional support from 15USD appreciated via website link.

🌐 shorturl.at/QIkSt

🌐 shorturl.at/QIkSt

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

FibonacciFlux: Pushing indicator boundaries. Crafting sophisticated, surprising tools via ambitious R&D.Help fuel this solo dev's work (not a team!) - optional support from 15USD appreciated via website link.

🌐 shorturl.at/QIkSt

🌐 shorturl.at/QIkSt

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.