PROTECTED SOURCE SCRIPT

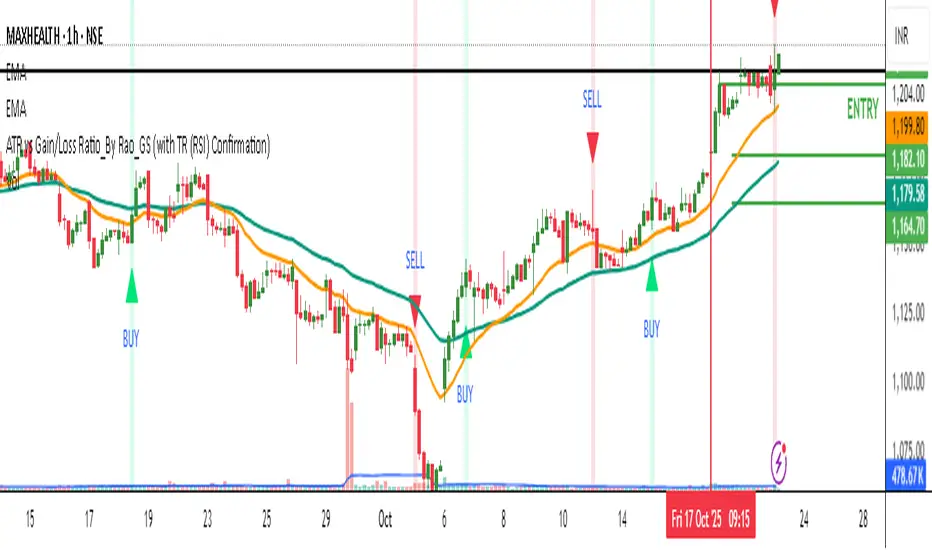

ATR vs Gain/Loss Ratio_By Rao_GS (with TR (RSI) Confirmation)

Description: ATR vs Gain/Loss Ratio_By Rao_GS (with TR (RSI) Confirmation)

🔍 Overview

The ATR vs Gain/Loss Ratio indicator by Rao_GS is a volatility-driven momentum tool designed to detect strong directional shifts confirmed by the relationship between Average True Range (ATR) and the average Gain/Loss ratios.

It helps identify points where volatility expansion aligns with momentum reversal — providing high-probability BUY and SELL zones.

⚙️ Core Logic

ATR (Average True Range):

Measures volatility using the range between high and low prices.

Gain/Loss Averages:

Calculates the average of positive (gain) and negative (loss) movements over a user-defined period.

ATR Ratios:

ATR / Avg Gain and ATR / Avg Loss create two oscillating curves.

Crossover Detection:

Buy Signal → When the ATR/Gain ratio crosses above the ATR/Loss ratio during high volatility.

Sell Signal → When the ATR/Gain ratio crosses below the ATR/Loss ratio during high volatility.

Volatility Confirmation (TR Filter):

The True Range (TR) must be at least a certain multiple of ATR (default 1.1×) to confirm genuine market momentum.

🎯 Signals

🟢 BUY:

Occurs when bullish momentum strengthens (ATR/Gain > ATR/Loss) and volatility confirms the move.

🔴 SELL:

Occurs when bearish momentum dominates (ATR/Loss > ATR/Gain) under heightened volatility.

Background color highlights active signal zones:

Light Green → Confirmed BUY zone

Light Red → Confirmed SELL zone

📈 Visualization

Lime Line: ATR/Gain ratio

Red Line: ATR/Loss ratio

Triangles:

🟢 Up triangle → Buy

🔴 Down triangle → Sell

This design allows traders to see both volatility shifts and momentum transitions together on a single overlay chart.

🔍 Overview

The ATR vs Gain/Loss Ratio indicator by Rao_GS is a volatility-driven momentum tool designed to detect strong directional shifts confirmed by the relationship between Average True Range (ATR) and the average Gain/Loss ratios.

It helps identify points where volatility expansion aligns with momentum reversal — providing high-probability BUY and SELL zones.

⚙️ Core Logic

ATR (Average True Range):

Measures volatility using the range between high and low prices.

Gain/Loss Averages:

Calculates the average of positive (gain) and negative (loss) movements over a user-defined period.

ATR Ratios:

ATR / Avg Gain and ATR / Avg Loss create two oscillating curves.

Crossover Detection:

Buy Signal → When the ATR/Gain ratio crosses above the ATR/Loss ratio during high volatility.

Sell Signal → When the ATR/Gain ratio crosses below the ATR/Loss ratio during high volatility.

Volatility Confirmation (TR Filter):

The True Range (TR) must be at least a certain multiple of ATR (default 1.1×) to confirm genuine market momentum.

🎯 Signals

🟢 BUY:

Occurs when bullish momentum strengthens (ATR/Gain > ATR/Loss) and volatility confirms the move.

🔴 SELL:

Occurs when bearish momentum dominates (ATR/Loss > ATR/Gain) under heightened volatility.

Background color highlights active signal zones:

Light Green → Confirmed BUY zone

Light Red → Confirmed SELL zone

📈 Visualization

Lime Line: ATR/Gain ratio

Red Line: ATR/Loss ratio

Triangles:

🟢 Up triangle → Buy

🔴 Down triangle → Sell

This design allows traders to see both volatility shifts and momentum transitions together on a single overlay chart.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.