PROTECTED SOURCE SCRIPT

TPO Block Szie Helper

TPO Assistant Overview

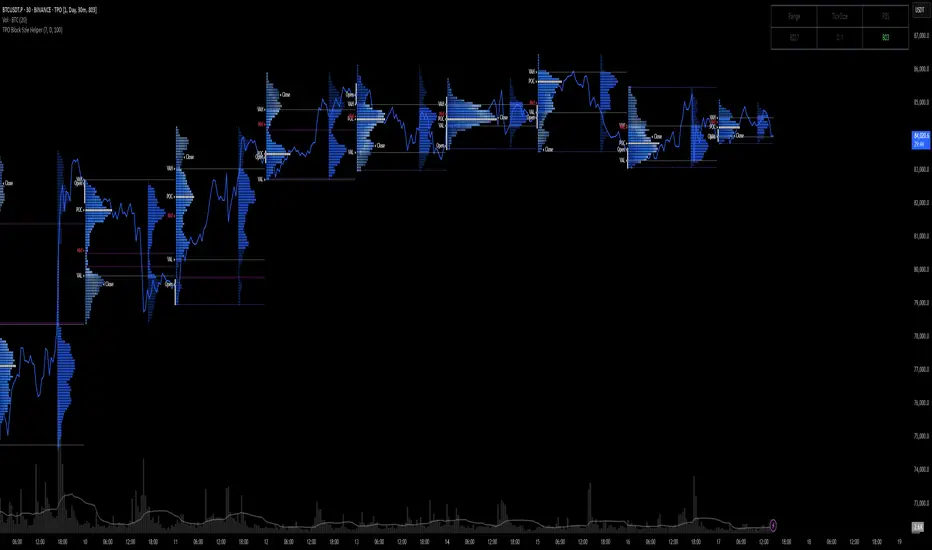

The TPO Assistant is a tool designed to enhance the use of Time-Price Opportunity (TPO) charts by offering dynamic guidance on block size selection based on recent market volatility. It serves as a precision aid in adapting TPO structure to different market conditions, improving both clarity and usability of TPO-based analysis.

Key Functionality

By statistically analyzing the volatility of the past N days, the assistant calculates a recommended block size for the current ticker. This value can be manually entered into the official TPO indicator on TradingView, helping users align the chart resolution with the underlying market’s price behavior.

In markets where price movement elasticity varies significantly, a fixed block size may not offer sufficient resolution. This tool solves that problem by providing an adaptive estimate—guiding users in refining TPO segmentation and supporting better structural interpretations.

Use Cases

Volatility-aware block sizing: Automatically suggests a block size that reflects current market conditions.

TPO merge/split support: Helps refine how TPOs are grouped or separated, depending on market rhythm.

SP (Significant Point) estimation aid: Provides stronger context for defining key levels within the TPO framework.

Benefits

Precision alignment with market behavior: Enhances resolution of TPO charts to better reflect real-time volatility shifts.

Minimizes trial and error: Offers a quantitative starting point for block size decisions, reducing guesswork.

Adaptive and context-sensitive: Useful in both trending and ranging markets, with no need for constant manual adjustments.

Disclaimer

This tool is intended as an analytical aid only and does not constitute financial advice. Market volatility is inherently uncertain, and this assistant should be used in conjunction with a comprehensive trading strategy.

The TPO Assistant is a tool designed to enhance the use of Time-Price Opportunity (TPO) charts by offering dynamic guidance on block size selection based on recent market volatility. It serves as a precision aid in adapting TPO structure to different market conditions, improving both clarity and usability of TPO-based analysis.

Key Functionality

By statistically analyzing the volatility of the past N days, the assistant calculates a recommended block size for the current ticker. This value can be manually entered into the official TPO indicator on TradingView, helping users align the chart resolution with the underlying market’s price behavior.

In markets where price movement elasticity varies significantly, a fixed block size may not offer sufficient resolution. This tool solves that problem by providing an adaptive estimate—guiding users in refining TPO segmentation and supporting better structural interpretations.

Use Cases

Volatility-aware block sizing: Automatically suggests a block size that reflects current market conditions.

TPO merge/split support: Helps refine how TPOs are grouped or separated, depending on market rhythm.

SP (Significant Point) estimation aid: Provides stronger context for defining key levels within the TPO framework.

Benefits

Precision alignment with market behavior: Enhances resolution of TPO charts to better reflect real-time volatility shifts.

Minimizes trial and error: Offers a quantitative starting point for block size decisions, reducing guesswork.

Adaptive and context-sensitive: Useful in both trending and ranging markets, with no need for constant manual adjustments.

Disclaimer

This tool is intended as an analytical aid only and does not constitute financial advice. Market volatility is inherently uncertain, and this assistant should be used in conjunction with a comprehensive trading strategy.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.