PROTECTED SOURCE SCRIPT

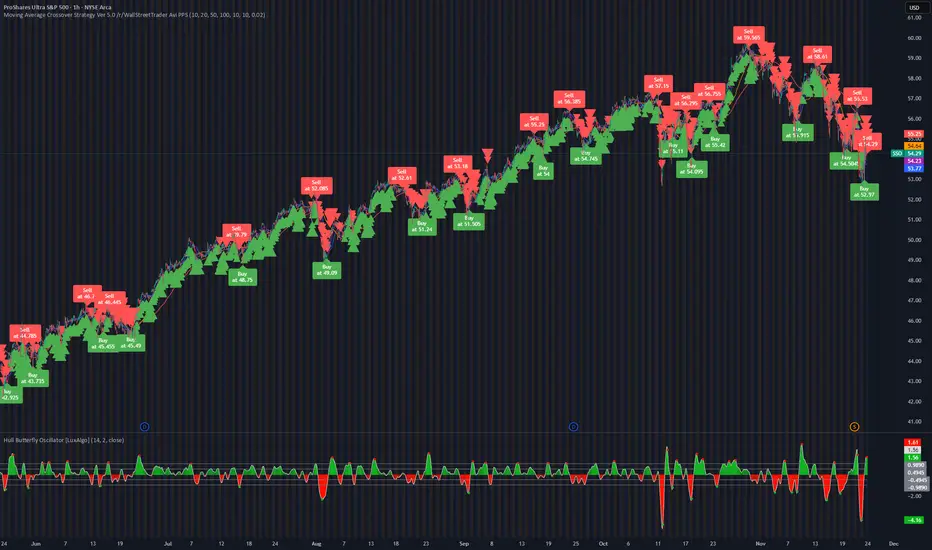

Moving Average Crossover Strategy Ver 5.0 /r/WallStreetTrader

patreon.com/c/wallstreettrader

Moving Average Crossover Strategy Ver 5.0 /r/WallStreetTrader

This script is a dual-system trading approach combining

(1) moving-average trend signals and

(2) peak/dip detection using smoothed highs/lows and a minimum profit-gap filter. It tries to catch trend-aligned buy/sell points, but only confirms signals when both the moving-average regime and local price-extreme logic agree.

✅ FULL STRATEGY DESCRIPTION

This is NOT a simple MA crossover script.

It is a combined trend + swing-reversal system that uses:

✅ Trend tracking → via MA50 and MA100

✅ Short-term direction → via MA10 / MA20

✅ Swing highs & swing lows → via smoothed extremes

✅ Profit-gap filters → ensure only meaningful moves

✅ Signal de-duplication → prevents spam labels

This creates a system intended for day-trading or swing-trading reversals inside trend direction.

🔵 PART 1 — Moving Averages (Trend Logic)

The script calculates four SMAs:

MA10 – very fast, day-trading signal

MA20 – short-term fast trend

MA50 – main trend reference

MA100 – slow trend reference

The MA50 vs MA100 relationship defines trend direction:

Bullish trend when:

close > MA50 AND close > MA100

MA50 crosses ABOVE MA100 = buySignal1

close already above both = buySignal2

Bearish trend when:

close < MA50 AND close < MA100

MA50 crosses BELOW MA100 = sellSignal1

close already below both = sellSignal2

Meaning:

The script only wants to Buy in an uptrend and Sell in a downtrend.

🔵 PART 2 — Peak/Dip Detection (Swing Logic)

It smooths highs & lows with a moving average:

smoothedHigh = SMA(high, smoothingPeriod)

smoothedLow = SMA(low, smoothingPeriod)

Then checks whether these smoothed values are extreme over a lookback window:

isPeak → smoothed high = highest high in last N bars

isDip → smoothed low = lowest low in last N bars

This detects:

Local swing highs

Local swing lows

BUT they must also meet a minimum gap profit rule:

minGapPercent = 2% // e.g. high must be 2% above last buy price

This prevents signals when price barely moves.

🔵 PART 3 — Label & Signal Filtering (No Spam)

The script stores:

lastBuyPrice

lastSellPrice

lastBuyLabel

lastSellLabel

When a new swing appears:

A. For Sell signals (peaks)

If isPeak AND (high - lastBuyPrice) >= lastBuyPrice * minGapPercent:

delete previous Sell label

place a new Sell label

B. For Buy signals (dips)

If isDip AND (lastSellPrice - low) >= lastSellPrice * minGapPercent:

delete previous Buy label

place a new Buy label

This ensures:

Only ONE buy per cycle

Only ONE sell per cycle

Only AFTER meaningful price movement

🔵 PART 4 — Final Confirmation Signals

The MA trend signals and Peak/Dip signals combine:

plotshape(isDip AND buySignal) // “confirmed buy”

plotshape(isPeak AND sellSignal) // “confirmed sell”

A Buy Confirmation requires BOTH:

Price in an uptrend (MA condition)

A dip detected (swing low)

A Sell Confirmation requires BOTH:

Price in a downtrend (MA condition)

A peak detected (swing high)

This is the core idea:

📌 “Only buy dips in an uptrend, only sell peaks in a downtrend.”

🔥 What This Strategy is Trying to Do

Identify the dominant trend using MA50/MA100.

Find swing lows inside a bullish regime → buy dips.

Find swing highs inside a bearish regime → sell rallies.

Filter out noise using:

Smooth highs/lows

Lookback extremes

Minimum profit-gap threshold

State-resetting labels to avoid duplicates

Only mark the “best” dip or peak in each mini-trend run.

🧠 How It Would Perform (likely behaviour)

✔ Works best in:

Trending markets

Smooth swingy markets

High liquidity assets

Indices (SPY, QQQ)

Crypto on higher timeframes

❌ Performs poorly in:

Chop/range-bound price

Flash crashes

Super-high volatility with no trend

Assets with large gaps

Because the system requires:

Clean dips

Clean peaks

Enough momentum to hit minGapPercent

Smooth behaviour for MA50/MA100 to hold direction

⭐ TL;DR – Simple Description

This strategy finds dips in an uptrend and peaks in a downtrend.

It uses MA50/MA100 to define trend direction and smoothed swing-high/low detection to identify reversals. It only fires if price moves at least a minimum percentage away from the last entry, avoiding overtrading. It confirms signals only when both trend and swing logic agree.

Perfectly summarized:

➡ “Trend + Swing Reversal Filter: Buy strong dips, sell strong peaks, inside clean trend structure.”

patreon.com/c/wallstreettrader

Moving Average Crossover Strategy Ver 5.0 /r/WallStreetTrader

This script is a dual-system trading approach combining

(1) moving-average trend signals and

(2) peak/dip detection using smoothed highs/lows and a minimum profit-gap filter. It tries to catch trend-aligned buy/sell points, but only confirms signals when both the moving-average regime and local price-extreme logic agree.

✅ FULL STRATEGY DESCRIPTION

This is NOT a simple MA crossover script.

It is a combined trend + swing-reversal system that uses:

✅ Trend tracking → via MA50 and MA100

✅ Short-term direction → via MA10 / MA20

✅ Swing highs & swing lows → via smoothed extremes

✅ Profit-gap filters → ensure only meaningful moves

✅ Signal de-duplication → prevents spam labels

This creates a system intended for day-trading or swing-trading reversals inside trend direction.

🔵 PART 1 — Moving Averages (Trend Logic)

The script calculates four SMAs:

MA10 – very fast, day-trading signal

MA20 – short-term fast trend

MA50 – main trend reference

MA100 – slow trend reference

The MA50 vs MA100 relationship defines trend direction:

Bullish trend when:

close > MA50 AND close > MA100

MA50 crosses ABOVE MA100 = buySignal1

close already above both = buySignal2

Bearish trend when:

close < MA50 AND close < MA100

MA50 crosses BELOW MA100 = sellSignal1

close already below both = sellSignal2

Meaning:

The script only wants to Buy in an uptrend and Sell in a downtrend.

🔵 PART 2 — Peak/Dip Detection (Swing Logic)

It smooths highs & lows with a moving average:

smoothedHigh = SMA(high, smoothingPeriod)

smoothedLow = SMA(low, smoothingPeriod)

Then checks whether these smoothed values are extreme over a lookback window:

isPeak → smoothed high = highest high in last N bars

isDip → smoothed low = lowest low in last N bars

This detects:

Local swing highs

Local swing lows

BUT they must also meet a minimum gap profit rule:

minGapPercent = 2% // e.g. high must be 2% above last buy price

This prevents signals when price barely moves.

🔵 PART 3 — Label & Signal Filtering (No Spam)

The script stores:

lastBuyPrice

lastSellPrice

lastBuyLabel

lastSellLabel

When a new swing appears:

A. For Sell signals (peaks)

If isPeak AND (high - lastBuyPrice) >= lastBuyPrice * minGapPercent:

delete previous Sell label

place a new Sell label

B. For Buy signals (dips)

If isDip AND (lastSellPrice - low) >= lastSellPrice * minGapPercent:

delete previous Buy label

place a new Buy label

This ensures:

Only ONE buy per cycle

Only ONE sell per cycle

Only AFTER meaningful price movement

🔵 PART 4 — Final Confirmation Signals

The MA trend signals and Peak/Dip signals combine:

plotshape(isDip AND buySignal) // “confirmed buy”

plotshape(isPeak AND sellSignal) // “confirmed sell”

A Buy Confirmation requires BOTH:

Price in an uptrend (MA condition)

A dip detected (swing low)

A Sell Confirmation requires BOTH:

Price in a downtrend (MA condition)

A peak detected (swing high)

This is the core idea:

📌 “Only buy dips in an uptrend, only sell peaks in a downtrend.”

🔥 What This Strategy is Trying to Do

Identify the dominant trend using MA50/MA100.

Find swing lows inside a bullish regime → buy dips.

Find swing highs inside a bearish regime → sell rallies.

Filter out noise using:

Smooth highs/lows

Lookback extremes

Minimum profit-gap threshold

State-resetting labels to avoid duplicates

Only mark the “best” dip or peak in each mini-trend run.

🧠 How It Would Perform (likely behaviour)

✔ Works best in:

Trending markets

Smooth swingy markets

High liquidity assets

Indices (SPY, QQQ)

Crypto on higher timeframes

❌ Performs poorly in:

Chop/range-bound price

Flash crashes

Super-high volatility with no trend

Assets with large gaps

Because the system requires:

Clean dips

Clean peaks

Enough momentum to hit minGapPercent

Smooth behaviour for MA50/MA100 to hold direction

⭐ TL;DR – Simple Description

This strategy finds dips in an uptrend and peaks in a downtrend.

It uses MA50/MA100 to define trend direction and smoothed swing-high/low detection to identify reversals. It only fires if price moves at least a minimum percentage away from the last entry, avoiding overtrading. It confirms signals only when both trend and swing logic agree.

Perfectly summarized:

➡ “Trend + Swing Reversal Filter: Buy strong dips, sell strong peaks, inside clean trend structure.”

patreon.com/c/wallstreettrader

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.