PROTECTED SOURCE SCRIPT

I Stochastic

#Istoch #Version_2.0.3 #Stochastic

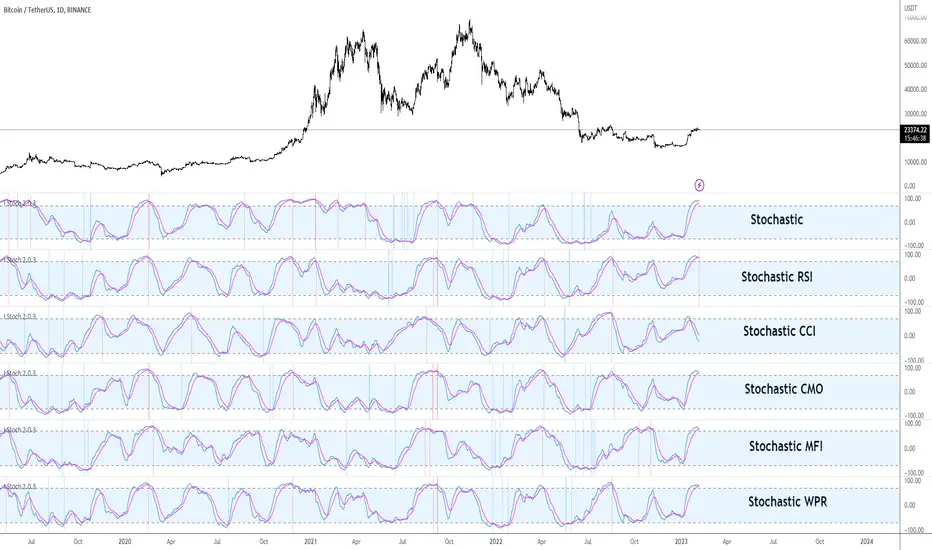

Hello traders from all over the world! Following my last publish on I MACD indicator, today I brought up another powerful customizing tool. This time, it might be good news for those traders with blind faiths on Stochastic and any other related indicators like Stochastic RSI. Stochastic is renowned for its usefulness of identifying market cycle turns that alternate pressure of bulls and bears. Accordingly, along with RSI and MACD, Stochastic is also known as one of the popular technical indicators in recent market regardless of asset and commodity types.

Developed by George Lane in the late 1950s, Stochastic is computed by dividing difference between current and minimum value, by the difference between the maximum and minimum value within a specific range (%K Length, default = 14) as shown in the formula below. Generally, a MA(Moving Average) is used in combination with the Stochastic line whereas the %D smoothing (Default = 3) refers to the length of this MA. Keep in mind that the crosses of these two lines are considered as significantly signals particularly when they appear on the overbought/oversold zone.

Stoch = (Current Price – Min Price) / (Max Price – Min Price)

Stochastic RSI is pretty much the same concept except that it derives its value from the RSI instead of the actual price as shown in the formula below. In other words, StochRSI is basically Stochastic of the RSI. Recently, it seems that many traders prefer StochRSI over classic Stochastic considering the virtue of StochRSI that it reflects proper degree of wave. Furthermore, StochRSI filters out many false signals by smoothing out the noises and outliers, compared to the regular Stochastic.

StochRSI = (Current RSI – Min RSI) / (Max RSI – Min RSI)

Anyhow, it surely has been verified that “Stochastic-fying” the RSI is technically beneficial when comprehending the market trends and spotting the potential trend reversal points. But what if other indicators instead of RSI was combined with the Stochastic? There are countless cutting-edge technical indicators developed by many traders in contemporary markets that are better fitted to the recent markets. This idea inspired me to create this tool that we can test other combinations of different parameters and indicators used within the Stochastic.

I Stoch provides traders the perfect back-testing environment for Stochastic indicator. Why not Stochastic CCI, ATR, CMO, MFI, and ROC? There might be better combinations of setups that are more optimal within the Stochastic. With this, you can design and test various types of indicators to “Stochastic-fy” also with different settings, lengths or sensitivities just fitted for your own trading style. For example, I found 14, 14, 60, 60, EMA(instead of SMA), and RSI parameters useful for myself which is the default setting.

Furthermore, for your convenience I added a few extra side features in setting as listed below. You can turn these on and off accordingly to your preferences and circumstances.

1. Crossovers of Stochastic line and MA: Death-crosses on overbought and golden-crosses on oversold area are signaled with vertical lines.

2. Histogram: Just like the MACD oscillator, this feature visualizes the distance between the Stochastic line and the MA. The greater histogram bar is the wider the distance is between these two lines.

3. Divergence Sensitivity: This feature spots both the regular and hidden divergences of Stochastic line. Higher sensitivity searches for the divergences within the waves of the larger degree and vice versa for the lower sensitivity.

Please let me know if you get to find out some insightful combinations of parameters. Thank you. Your subscriptions, likes, and comments inspire me a lot!

#Istoch #스토캐스틱

안녕하세요 트레이더 여러분. 토미입니다.

지난번 I MACD라는 커스터마이징 지표에 이어 제가 최근에 오랜 공을 들인 I Stochastic 지표에 대해 소개도 드릴 겸 간단한 강의를 준비해봤습니다.

1950년대 George Lane이라는 사람에 의해 개발된 스토캐스틱은 RSI 그리고 MACD와 더불어 요즘 차트 세계에서 가장 대중적으로 이용되는 보조지표입니다. 아래 공식과 같이 본 지표는 주어진 기간 동안의 가격 변동폭과 현재 가격의 상대적 관계를 통해 현 추세의 정도와 잠재적 변곡점을 알려줍니다. 다른 지표들에 비해 노이즈 빈도는 조금 높지만 추세 반전 신호를 꽤 빨리 알려준다는 점과 해석이 직관적이라는 점에서 요즘 많은 트레이더분들의 최애 지표 중 하나로 뽑힙니다.

스토캐스틱 = (현재가 - K길이 중 최저가) / (K길이 중 최고가 – K길이 중 최저가)

한편 스토캐스틱 RSI는 주가가 아닌 RSI에서 도출한 값을 스토캐스틱화 시켜놓은 보조지표이며 아래 공식에서 보실 수 있듯 다른 말로 RSI의 스토캐스틱이라고 보시면 됩니다. 최근에는 일반 스토캐스틱보다 파동의 사이클을 더 잘 반영하고 노이즈 및 Outlier들을 잘 처리해준다는 장점들 때문에 스토캐스틱 RSI를 더 선호하는 트레이더분들이 많아졌습니다.

스토캐스틱 RSI = (현재 RSI – K길이 중 최저 RSI) / (K길이 중 최고 RSI – K길이 중 최저 RSI)

이렇듯 RSI를 스토캐스틱화한 지표는 존재하는데 왜 CCI, MFO, 그리고 CMO 등 다른 지표를 스토캐스틱화한 지표는 없을까요? 왜 스토캐스틱 CCI, 스토캐스틱 MFO, 그리고 스토캐스틱 CMO는 안쓸까요? 요즘 모두 다 비슷한 지표들을 보는 마당에 더 좋은 조합의 스토캐스틱 지표가 존재하지 않을까요? 이러한 발상을 시작으로 이것저것 테스팅도 해볼 겸 해당 지표의 최적화 테스팅 툴을 만들어봤습니다. RSI가 아닌 다른 보조지표들도 클릭 하나로 쉽게 스토캐스틱화 시킬 수 있게끔 디자인해봤습니다.

오늘날 보편적으로 사용되고 있는 스토캐스틱 RSI 기본 설정 값은 3, 3, 14, 14 SMA입니다. RSI 보다 스토캐스틱에 더 잘 맞는 지표 종류뿐만 아니라 더 최적화된 파라미터 값들이 분명 존재할 겁니다. 여러 조합의 테스트를 통해 주가를 더 잘 반영하는 설정 값을 찾아보면 좋을 듯 싶습니다. 제가 찾은 스토캐스틱 RSI 설정 값은 14, 14, 60, 60 EMA로 기존보다 조금 더 큰 추세를 반영해주는 나쁘지 않은 조합인듯 싶어 디폴트 값으로 설정해 두었습니다. 여러분들도 괜찮은 지표 종류 및 설정 값들 찾으면 치사하게 혼자 쓰지 말고 꼭 공유 부탁드립니다!

또한 주요 시그널들을 쉽게 잡아낼 수 있게 아래와 같이 몇가지 자동 기능들을 추가했습니다. 여러분들의 편의와 상황에 따라 사용하셔도 되고 거슬리면 끄셔도 됩니다.

1. 스토캐스틱 두 선들의 크로스: 과매수 구간에서 데드크로스, 과매도 구간에서 골든크로스가 발생하면 세로줄이 떠서 알려줍니다. 이 줄이 뜨면 어느정도 추세의 변환의 시그널로 볼 수 있습니다.

2. 히스토그램: MACD처럼 두 선들의 이격도 혹은 간격을 히스토그램 오실레이터처럼 표시해주는 기능입니다. 혹시 몰라서 넣었습니다.

3. 다이버전스 및 민감도: 스토캐스틱 선의 다이버전스를 표시해줍니다. 민감도를 키울수록 더 큰 단위의 파동 사이클을 기반으로 다이버전스를 잡아냅니다.

트레이딩뷰 차트 상단 지표 창에 I Stoch 검색하시거나 밑에 즐겨찾기 인디케이터 넣기 클릭하시면 사용하실 수 있습니다. 그럼 이만 마치겠습니다. 감사합니다.

여러분의 구독, 좋아요, 그리고 댓글은 저에게 큰 동기부여가 됩니다.

Hello traders from all over the world! Following my last publish on I MACD indicator, today I brought up another powerful customizing tool. This time, it might be good news for those traders with blind faiths on Stochastic and any other related indicators like Stochastic RSI. Stochastic is renowned for its usefulness of identifying market cycle turns that alternate pressure of bulls and bears. Accordingly, along with RSI and MACD, Stochastic is also known as one of the popular technical indicators in recent market regardless of asset and commodity types.

Developed by George Lane in the late 1950s, Stochastic is computed by dividing difference between current and minimum value, by the difference between the maximum and minimum value within a specific range (%K Length, default = 14) as shown in the formula below. Generally, a MA(Moving Average) is used in combination with the Stochastic line whereas the %D smoothing (Default = 3) refers to the length of this MA. Keep in mind that the crosses of these two lines are considered as significantly signals particularly when they appear on the overbought/oversold zone.

Stoch = (Current Price – Min Price) / (Max Price – Min Price)

Stochastic RSI is pretty much the same concept except that it derives its value from the RSI instead of the actual price as shown in the formula below. In other words, StochRSI is basically Stochastic of the RSI. Recently, it seems that many traders prefer StochRSI over classic Stochastic considering the virtue of StochRSI that it reflects proper degree of wave. Furthermore, StochRSI filters out many false signals by smoothing out the noises and outliers, compared to the regular Stochastic.

StochRSI = (Current RSI – Min RSI) / (Max RSI – Min RSI)

Anyhow, it surely has been verified that “Stochastic-fying” the RSI is technically beneficial when comprehending the market trends and spotting the potential trend reversal points. But what if other indicators instead of RSI was combined with the Stochastic? There are countless cutting-edge technical indicators developed by many traders in contemporary markets that are better fitted to the recent markets. This idea inspired me to create this tool that we can test other combinations of different parameters and indicators used within the Stochastic.

I Stoch provides traders the perfect back-testing environment for Stochastic indicator. Why not Stochastic CCI, ATR, CMO, MFI, and ROC? There might be better combinations of setups that are more optimal within the Stochastic. With this, you can design and test various types of indicators to “Stochastic-fy” also with different settings, lengths or sensitivities just fitted for your own trading style. For example, I found 14, 14, 60, 60, EMA(instead of SMA), and RSI parameters useful for myself which is the default setting.

Furthermore, for your convenience I added a few extra side features in setting as listed below. You can turn these on and off accordingly to your preferences and circumstances.

1. Crossovers of Stochastic line and MA: Death-crosses on overbought and golden-crosses on oversold area are signaled with vertical lines.

2. Histogram: Just like the MACD oscillator, this feature visualizes the distance between the Stochastic line and the MA. The greater histogram bar is the wider the distance is between these two lines.

3. Divergence Sensitivity: This feature spots both the regular and hidden divergences of Stochastic line. Higher sensitivity searches for the divergences within the waves of the larger degree and vice versa for the lower sensitivity.

Please let me know if you get to find out some insightful combinations of parameters. Thank you. Your subscriptions, likes, and comments inspire me a lot!

#Istoch #스토캐스틱

안녕하세요 트레이더 여러분. 토미입니다.

지난번 I MACD라는 커스터마이징 지표에 이어 제가 최근에 오랜 공을 들인 I Stochastic 지표에 대해 소개도 드릴 겸 간단한 강의를 준비해봤습니다.

1950년대 George Lane이라는 사람에 의해 개발된 스토캐스틱은 RSI 그리고 MACD와 더불어 요즘 차트 세계에서 가장 대중적으로 이용되는 보조지표입니다. 아래 공식과 같이 본 지표는 주어진 기간 동안의 가격 변동폭과 현재 가격의 상대적 관계를 통해 현 추세의 정도와 잠재적 변곡점을 알려줍니다. 다른 지표들에 비해 노이즈 빈도는 조금 높지만 추세 반전 신호를 꽤 빨리 알려준다는 점과 해석이 직관적이라는 점에서 요즘 많은 트레이더분들의 최애 지표 중 하나로 뽑힙니다.

스토캐스틱 = (현재가 - K길이 중 최저가) / (K길이 중 최고가 – K길이 중 최저가)

한편 스토캐스틱 RSI는 주가가 아닌 RSI에서 도출한 값을 스토캐스틱화 시켜놓은 보조지표이며 아래 공식에서 보실 수 있듯 다른 말로 RSI의 스토캐스틱이라고 보시면 됩니다. 최근에는 일반 스토캐스틱보다 파동의 사이클을 더 잘 반영하고 노이즈 및 Outlier들을 잘 처리해준다는 장점들 때문에 스토캐스틱 RSI를 더 선호하는 트레이더분들이 많아졌습니다.

스토캐스틱 RSI = (현재 RSI – K길이 중 최저 RSI) / (K길이 중 최고 RSI – K길이 중 최저 RSI)

이렇듯 RSI를 스토캐스틱화한 지표는 존재하는데 왜 CCI, MFO, 그리고 CMO 등 다른 지표를 스토캐스틱화한 지표는 없을까요? 왜 스토캐스틱 CCI, 스토캐스틱 MFO, 그리고 스토캐스틱 CMO는 안쓸까요? 요즘 모두 다 비슷한 지표들을 보는 마당에 더 좋은 조합의 스토캐스틱 지표가 존재하지 않을까요? 이러한 발상을 시작으로 이것저것 테스팅도 해볼 겸 해당 지표의 최적화 테스팅 툴을 만들어봤습니다. RSI가 아닌 다른 보조지표들도 클릭 하나로 쉽게 스토캐스틱화 시킬 수 있게끔 디자인해봤습니다.

오늘날 보편적으로 사용되고 있는 스토캐스틱 RSI 기본 설정 값은 3, 3, 14, 14 SMA입니다. RSI 보다 스토캐스틱에 더 잘 맞는 지표 종류뿐만 아니라 더 최적화된 파라미터 값들이 분명 존재할 겁니다. 여러 조합의 테스트를 통해 주가를 더 잘 반영하는 설정 값을 찾아보면 좋을 듯 싶습니다. 제가 찾은 스토캐스틱 RSI 설정 값은 14, 14, 60, 60 EMA로 기존보다 조금 더 큰 추세를 반영해주는 나쁘지 않은 조합인듯 싶어 디폴트 값으로 설정해 두었습니다. 여러분들도 괜찮은 지표 종류 및 설정 값들 찾으면 치사하게 혼자 쓰지 말고 꼭 공유 부탁드립니다!

또한 주요 시그널들을 쉽게 잡아낼 수 있게 아래와 같이 몇가지 자동 기능들을 추가했습니다. 여러분들의 편의와 상황에 따라 사용하셔도 되고 거슬리면 끄셔도 됩니다.

1. 스토캐스틱 두 선들의 크로스: 과매수 구간에서 데드크로스, 과매도 구간에서 골든크로스가 발생하면 세로줄이 떠서 알려줍니다. 이 줄이 뜨면 어느정도 추세의 변환의 시그널로 볼 수 있습니다.

2. 히스토그램: MACD처럼 두 선들의 이격도 혹은 간격을 히스토그램 오실레이터처럼 표시해주는 기능입니다. 혹시 몰라서 넣었습니다.

3. 다이버전스 및 민감도: 스토캐스틱 선의 다이버전스를 표시해줍니다. 민감도를 키울수록 더 큰 단위의 파동 사이클을 기반으로 다이버전스를 잡아냅니다.

트레이딩뷰 차트 상단 지표 창에 I Stoch 검색하시거나 밑에 즐겨찾기 인디케이터 넣기 클릭하시면 사용하실 수 있습니다. 그럼 이만 마치겠습니다. 감사합니다.

여러분의 구독, 좋아요, 그리고 댓글은 저에게 큰 동기부여가 됩니다.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

토미 유튜브: youtube.com/@TommyTradingTV

제 모든 인사이트, 분석, 관점은 t.me/tommy_trading 에 가장 먼저 올라갑니다!

제 모든 인사이트, 분석, 관점은 t.me/tommy_trading 에 가장 먼저 올라갑니다!

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

토미 유튜브: youtube.com/@TommyTradingTV

제 모든 인사이트, 분석, 관점은 t.me/tommy_trading 에 가장 먼저 올라갑니다!

제 모든 인사이트, 분석, 관점은 t.me/tommy_trading 에 가장 먼저 올라갑니다!

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.