PROTECTED SOURCE SCRIPT

Student Wyckoff Effort Result Time

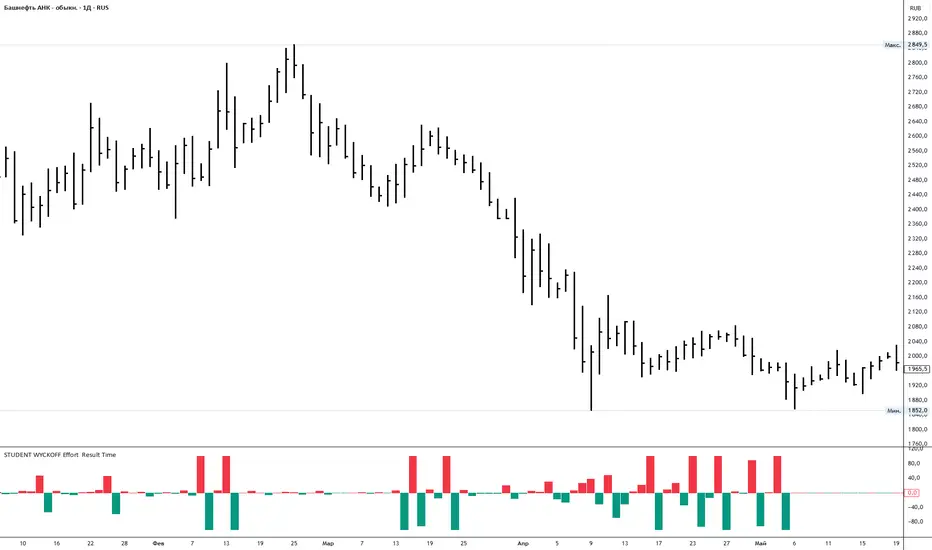

**STUDENT WYCKOFF Effort vs Result**

This tool measures how *hard* the market is working on every bar and compares the current effort with the previous one. It is built in the spirit of Wyckoff: first we look at the effort (volume), then at the result (price progress), and only after that compare them.

---

### Calculation (logic in simple terms)

For each bar the script:

1. Takes an **ERT window (N bars)** – by default 2 bars:

* **Effort (E)** = sum of volume over the last N bars.

* **Time (T)** = number of bars in the window = N.

* **Result (R)** = absolute % price change from the first bar in the window to the last bar.

2. Computes **ERT** as the “effort per unit of result”:

* More volume and smaller price move → higher ERT (movement is heavy).

* Less volume and bigger price move → lower ERT (movement is easy).

3. Plots a **histogram of ΔERT** – the difference between the current ERT and the previous ERT:

* **Red bar above 0** – current ERT > previous ERT →

*the last N bars were heavier than the previous N bars*.

* **Teal bar below 0** – current ERT < previous ERT →

*the last N bars were easier than the previous N bars*.

4. Optional **normalization window** rescales ΔERT over the last M bars, so extreme spikes do not destroy the readability of the whole histogram. It does not change the logic, only the visual scale.

---

### How to use

* Look for **clusters of high red bars** – segments where price needs noticeably more effort than before to make progress. On up-moves this often appears before slowing, churning or topping; on down-moves it often appears near potential stopping zones.

* Look for **deep teal bars** – segments where price moves easier than before. On rallies this can confirm a strong trend; on declines it can confirm strong selling pressure.

* Divergences between price and the pattern of heavy/light ΔERT can highlight zones where the balance between effort and result is shifting.

Inputs:

* **ERT window (bars)** – how many bars are used to measure effort and result (N).

* **Normalize ΔERT for readability** – on/off for visual normalization.

* **Normalization window (bars)** – how many last bars are used to adapt the scale.

* Colors for “current ERT heavier than previous” and “current ERT lighter than previous”.

This tool measures how *hard* the market is working on every bar and compares the current effort with the previous one. It is built in the spirit of Wyckoff: first we look at the effort (volume), then at the result (price progress), and only after that compare them.

---

### Calculation (logic in simple terms)

For each bar the script:

1. Takes an **ERT window (N bars)** – by default 2 bars:

* **Effort (E)** = sum of volume over the last N bars.

* **Time (T)** = number of bars in the window = N.

* **Result (R)** = absolute % price change from the first bar in the window to the last bar.

2. Computes **ERT** as the “effort per unit of result”:

* More volume and smaller price move → higher ERT (movement is heavy).

* Less volume and bigger price move → lower ERT (movement is easy).

3. Plots a **histogram of ΔERT** – the difference between the current ERT and the previous ERT:

* **Red bar above 0** – current ERT > previous ERT →

*the last N bars were heavier than the previous N bars*.

* **Teal bar below 0** – current ERT < previous ERT →

*the last N bars were easier than the previous N bars*.

4. Optional **normalization window** rescales ΔERT over the last M bars, so extreme spikes do not destroy the readability of the whole histogram. It does not change the logic, only the visual scale.

---

### How to use

* Look for **clusters of high red bars** – segments where price needs noticeably more effort than before to make progress. On up-moves this often appears before slowing, churning or topping; on down-moves it often appears near potential stopping zones.

* Look for **deep teal bars** – segments where price moves easier than before. On rallies this can confirm a strong trend; on declines it can confirm strong selling pressure.

* Divergences between price and the pattern of heavy/light ΔERT can highlight zones where the balance between effort and result is shifting.

Inputs:

* **ERT window (bars)** – how many bars are used to measure effort and result (N).

* **Normalize ΔERT for readability** – on/off for visual normalization.

* **Normalization window (bars)** – how many last bars are used to adapt the scale.

* Colors for “current ERT heavier than previous” and “current ERT lighter than previous”.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Уже 18 лет я торгую на рынках

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Уже 18 лет я торгую на рынках

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.