Day Trade Scalping - Optimal Trade Entrance Indicator

Indicators:

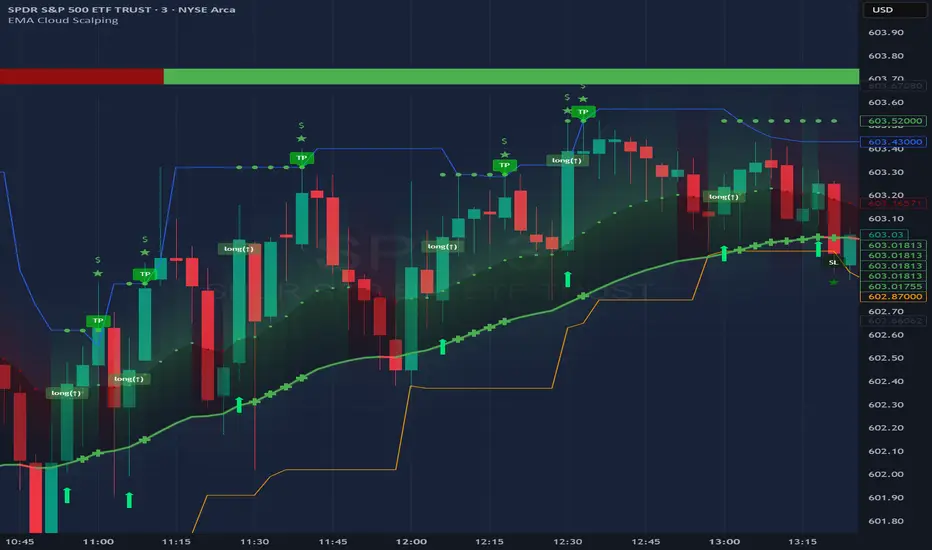

- Regular Signals (red/green) – trade signal arrows, includes alerts

- Risky Signals (orange/olive) – trade signal arrows, includes alerts

- Optimal Trade Entrance Area - target at where to enter the trade with minimal risk and maximum profit

As the signals explained, there are regular and risky signals, which are calculated per different algorithms. Based on the test run, risky signals will appear less and be more risky, but usually spot longer bigger runs!

The original idea of the script is to provide the trader with an Optimal Trade Entrance Area to reduce the risk and maximize the profit. After you receive a signal/alert, wait for the price to re-trace to the Optimal Trade Entrance Area line, which will be shown on the chart. If the price does not reverse - it's best to not open a position. (Remember that the best trade is – no trade!).

If you don’t know how to divide up your position - here is an example on how I take profits between the price targets:

- Open position with buying a multiple of x3 contracts

- Sell 1/3 of the position at first price target and move my SL to entry

- Sell 1/3 of the remaining position at a second price target

- Sell the rest of the position at the third price target or scale out slowly if the trend is still strong

Also, keep an eye on the breakouts, especially if they go along the script signals as with breakouts, there is a good potential for a bigger move.

Please note: it will show potential take profit for each candle, even if it is not a signal candle

Here is why: If you will use the SCALP STRATEGY, when you receive an alert to prepare to open the position > price is hitting the critical area LIVE, so the condition for the "scalp" label is true, you will also receive an alert (which is set to trigger "Once Per Bar") and a label will be shown. If and when on that same candle bar > price goes backwards (where you are expected to open the position per strategy) the condition to prepare for a position is technically no longer true, which basically is repainting, however in reality it does not affect your trading results as the label which sets you to prepare to open the position no longer matters.

- So now there are 2 approaches or strategies:

1) Progressive (where you "catch" the trade when the price exits EMA Cloud after it entered it)

2) Conservative (where candle fully closes bouncing off the EMA Cloud)

- For Conservative, there is a whole trade engine included where signals can be filtered by:

----- ATR/EMA trend confirmation

----- Take Profit line per Highest High / Lowest Low (fully customizable) or per simple distance of price

----- End of day (at market close or before power hour US Session) position close label/alert

NOTE: Trade Engine is only for Conservative approach, however you can still use ATR/EMA trend confirmation and/or Take Profit lines yourself!

There are 2 strategies: PROGRESSIVE and CONSERVATIVE. Each can be "checked/unchecked" (turned on/off to show on chart)

1) PROGRESSIVE > labels/alerts when price enters EMA Cloud, so you can open position when it exits > this is for quick scalping, works well on 1/3/5/15min timeframes

2) CONSERVATIVE > labels/alerts when candle closes "bouncing" off the EMA cloud. This one has much more cool additional features, like candle analysis (exclude signals with doji, confirm signal with Elliot Wave Oscillator and/or ATR, and much more!). This one works great on smaller timeframes as well.

Overall, here is what was added recently:

* Alerts for PROGRESSIVE STRATEGY approach when price is entering the EMA Cloud, so you can prepare for opening a position

* Updated CONSERVATIVE STRATEGY (this is separate from the PROGRESSIVE STRATEGY scalping approach) with a full trading engine, which adds Open signals along with TP (take profit), SL (stop loss) and EOD/EODpw (end of day position close at US market close or before power hour) with alerts

Additional CONSERVATIVE STRATEGY features:

- Signals labels transparency (can be turned off if desired)

- Elliot Wave Oscillator price direction confirmation (powerful tool cleaning out many bad uncertain signals)

- Ability to chose regular/risk or both signals

- Customizable ATR confirmation of the price movement (Example: ATR bullish > bullish signal is confirmed)

- Stop-loss candle body percentage confirmation (if candle breaking into stop-loss (EMA solid slow moving average), so it is an uncertain candle, like a doji or a star or a hammer > it will not be considered a stop-loss

- TP1 (take profit) hit via either touch (price simply touching it) or a close (candle must close breaking the TP1 line beyond it) approach

** The HHLL take profit line can be customized as desired. Also, there is an option to use a manual price distance for TP1 instead, make sure you set it underneath (for SPY, 0.50 would mean that after a position is opened per signal, TP1 line will be set exactly 0.50 cents of SPY price away)

There has been a lot of work done to make this indicator look cooler and all the settings and configurations more organized + new features added:

- The more appealing gradient effects can be turned off if not desired, while EMA Cloud colors can now be customized as desired

- EMA Cloud Strength can now be adjusted by a single Strength number (NOTE: by default it's just like it was originallym with Strength setting set to: 4)

- Additional RSI/MFI Trend Detector feature is added, which can help with Trend direction confirmation. NOTE: when EMA Cloud is super thin and candle bar(s) engulfs it (for CONSERVATIVE approach there is a setting to skip signals where candle bar engulfs [covers up] the whole EMA Cloud) - it's an indication of an indecisive short-term trend. It's displayed on top of the chart as a thick bar with red indicating a bearish trend, while green indicates a bullish trend.

- Short-term bar colors can be now turned off if desired, it is yet an additional very short-term trend indicator

- Trading Schedule was updated to use much more sophisticated configurations where you simply choose a timezone and everything else is automatic (NOTE: you can still set it to Custom and fully customize it as desired)

- The CONSERVATIVE approach risky/non-risk signals were removed for less confusion, where the standard signals can be cleaned up using the signal analysis features such as Skipping opposite structured/indecisive candle bars + EWO / ATR confirmation(s).

- For CONSERVATIVE approach, now there is a SL (Stop-Loss) System: 'EMACloud_dynamic': SL (Stop-Loss) is set to trail slow MA of the EMA Cloud, the solid line; 'HHLL': SL (Stop-Loss) is set to either Highest High (for short trade) or Lowest Low (for long trade); 'Manual Distance': Instrument distance (example: SPY > 0.4 > Take Profit will be taken if SPY moves 0.4 points in your favor). It's now clearly shown on the chart with crosses, when a CONSERVATIVE approach trade is open.

- For CONSERVATIVE approach, now there is a TP (Take-Profit) System: 'HHLL': Highest High / Lowest Low per lookback period (can be customized below) | 'Manual Distance': Instrument distance (example: SPY > 0.4 > Take Profit will be taken if SPY moves 0.4 points in your favor). It's now clearly shown on chart with circles, when a CONSERVATIVE approach trade is open.

* If anything is not working as it should or needs attention - please don't hesitate to reach out to us via TradingView messaging and we will get it fixed!

- "HHLL-Static": this is how it was and is by default, where TP target is set per HHLL at trade open

- "HHLL-Dynamic": this will trail HHLL while the trade is open and TP target becomes dynamic

- Additional, more complex features added to OTE (Optimal Trade Entrance) scalping strategy:

- Can now fully customize the colors and how far the line(s) will extend

- Can now show historical OTE lines

- Now there are 2 Styles for OTE lines:

1) mid-line (the original one): simply a line in the middle of previous bar

2) 1/3 optimal odds line: 2 lines at 1/3rd of previous bar for each trade direction

- Labels can be shown on chart for OTE line crossings

- Alerts can now be turned on for OTE line crossings

So, moved "Bar Colors reflecting very short-term sentiment" setting down to 3) [OTE] CANDLESTICK BAR SCALPING STRATEGY.

Now you can turn on "OTE Crossing previous Bar Color/Sentiment Confirmation", with this setting turned on, both OTE Style Crossing Labels will show/alert ONLY if confirmed by previous candlestick bar sentiment (bullish/bearish[📈/📉]). For example, if previous candlestick bar is Lime (Bullish) - 'mid' OTE Style Crossing Label will show 📈(↑) (with this setting turned off - it will show both directions label (↑↓), where you have to decide which way to open the trade); Similar, for '1/3(↑↓)' OTE Style, with previous bar being Lime (Bullish) - it will ONLY show 📈(↑) Crossing Label and skip the (↓), even if the crossing condition for (↓) occurs, same way it will show 📉(↓) only if previous candlestick bar is Maroon (Bearish).

Skript nur auf Einladung

Ausschließlich Nutzer mit einer Erlaubnis des Autors können Zugriff auf dieses Script erhalten. Sie müssen diese Genehmigung bei dem Autor beantragen. Dies umfasst üblicherweise auch eine Zahlung. Wenn Sie mehr erfahren möchten, dann sehen Sie sich unten die Anweisungen des Autors an oder kontaktieren Sie tso_trade direkt.

TradingView empfiehlt NICHT, für die Nutzung eines Scripts zu bezahlen, wenn Sie den Autor nicht als vertrauenswürdig halten und verstehen, wie das Script funktioniert. Sie können außerdem auch kostenlose Open-Source-Alternativen in unseren Community-Scripts finden.

Hinweise des Autors

Haftungsausschluss

Skript nur auf Einladung

Ausschließlich Nutzer mit einer Erlaubnis des Autors können Zugriff auf dieses Script erhalten. Sie müssen diese Genehmigung bei dem Autor beantragen. Dies umfasst üblicherweise auch eine Zahlung. Wenn Sie mehr erfahren möchten, dann sehen Sie sich unten die Anweisungen des Autors an oder kontaktieren Sie tso_trade direkt.

TradingView empfiehlt NICHT, für die Nutzung eines Scripts zu bezahlen, wenn Sie den Autor nicht als vertrauenswürdig halten und verstehen, wie das Script funktioniert. Sie können außerdem auch kostenlose Open-Source-Alternativen in unseren Community-Scripts finden.