OPEN-SOURCE SCRIPT

🔥 MomentumWave HA Trend

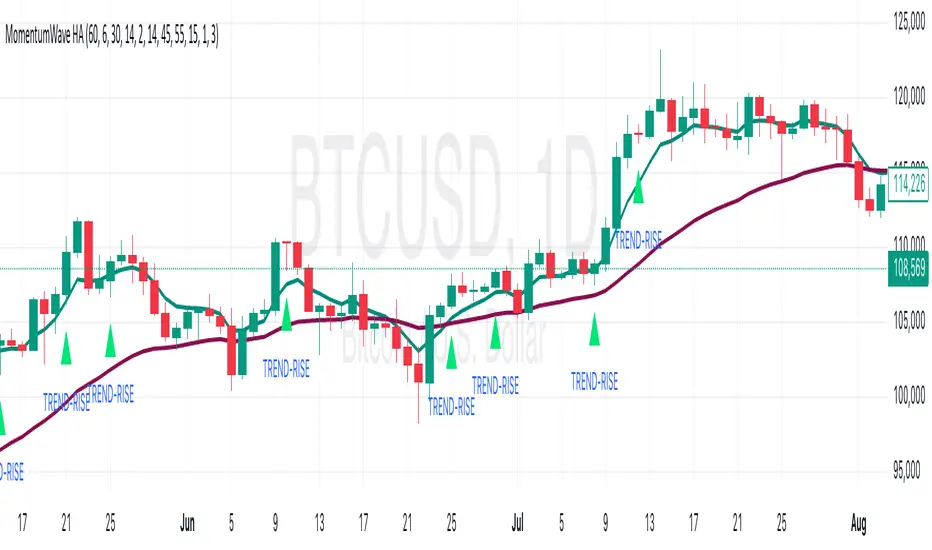

1. Heikin Ashi Candles

The indicator calculates Heikin Ashi candles to smooth price movements.

Heikin Ashi reduces market noise, making it easier to spot trends than regular candlesticks.

Bullish candle: close > open → green-ish candle.

Bearish candle: close < open → red-ish candle.

2. Exponential Moving Averages (EMA)

Two EMAs are plotted on the chart: fast EMA and slow EMA.

Fast EMA: reacts quickly to recent price changes.

Slow EMA: shows the overall trend.

When fast EMA > slow EMA → market is trending up.

When fast EMA < slow EMA → market is trending down.

3. Momentum Filters

EMA slope: the indicator checks if the fast EMA is rising or falling to confirm momentum.

ROC (Rate of Change): ensures price movement is strong in the current direction.

RSI filter: prevents signals when the market is overbought or oversold.

RSI above lower bound → allows bullish trend.

RSI below upper bound → allows bearish trend.

4. Optional MACD Filter

If enabled, the indicator uses the MACD slope to confirm trend strength.

This reduces false signals in weak trend periods.

5. Confirmation of Consecutive Candles

The indicator requires a certain number of consecutive Heikin Ashi candles in the same direction before generating a signal.

This avoids acting on a single volatile candle and increases accuracy.

6. Cooldown Period

After a signal is generated, a cooldown period prevents immediate repeated signals.

This reduces overtrading in volatile markets.

7. Signals

TREND-RISE (triangle below candle): indicates a confirmed bullish trend.

TREND-FALL (triangle above candle): indicates a confirmed bearish trend.

Alerts can be set for both signals to notify you in real time.

8. How to Use

Open a chart and add the MomentumWave HA Trend indicator.

Look at the EMA fast (teal) and EMA slow (maroon) lines.

Wait for a signal:

TREND-RISE: consider long positions or buying opportunities.

TREND-FALL: consider short positions or selling opportunities.

Check RSI and MACD (if enabled) to confirm signal strength.

Observe consecutive Heikin Ashi candle confirmation.

Respect the cooldown period before opening another position.

Apply risk management (stop-loss, position size) based on your strategy.

9. Disclaimer

This indicator is a technical analysis tool and does not guarantee profits.

Always use proper risk management and validate signals with your own analysis before trading.

The indicator calculates Heikin Ashi candles to smooth price movements.

Heikin Ashi reduces market noise, making it easier to spot trends than regular candlesticks.

Bullish candle: close > open → green-ish candle.

Bearish candle: close < open → red-ish candle.

2. Exponential Moving Averages (EMA)

Two EMAs are plotted on the chart: fast EMA and slow EMA.

Fast EMA: reacts quickly to recent price changes.

Slow EMA: shows the overall trend.

When fast EMA > slow EMA → market is trending up.

When fast EMA < slow EMA → market is trending down.

3. Momentum Filters

EMA slope: the indicator checks if the fast EMA is rising or falling to confirm momentum.

ROC (Rate of Change): ensures price movement is strong in the current direction.

RSI filter: prevents signals when the market is overbought or oversold.

RSI above lower bound → allows bullish trend.

RSI below upper bound → allows bearish trend.

4. Optional MACD Filter

If enabled, the indicator uses the MACD slope to confirm trend strength.

This reduces false signals in weak trend periods.

5. Confirmation of Consecutive Candles

The indicator requires a certain number of consecutive Heikin Ashi candles in the same direction before generating a signal.

This avoids acting on a single volatile candle and increases accuracy.

6. Cooldown Period

After a signal is generated, a cooldown period prevents immediate repeated signals.

This reduces overtrading in volatile markets.

7. Signals

TREND-RISE (triangle below candle): indicates a confirmed bullish trend.

TREND-FALL (triangle above candle): indicates a confirmed bearish trend.

Alerts can be set for both signals to notify you in real time.

8. How to Use

Open a chart and add the MomentumWave HA Trend indicator.

Look at the EMA fast (teal) and EMA slow (maroon) lines.

Wait for a signal:

TREND-RISE: consider long positions or buying opportunities.

TREND-FALL: consider short positions or selling opportunities.

Check RSI and MACD (if enabled) to confirm signal strength.

Observe consecutive Heikin Ashi candle confirmation.

Respect the cooldown period before opening another position.

Apply risk management (stop-loss, position size) based on your strategy.

9. Disclaimer

This indicator is a technical analysis tool and does not guarantee profits.

Always use proper risk management and validate signals with your own analysis before trading.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Join my trading community on Discord! 📈 Use all our indicators for FREE

discord.gg/xPEDcNEupw

discord.gg/xPEDcNEupw

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

Join my trading community on Discord! 📈 Use all our indicators for FREE

discord.gg/xPEDcNEupw

discord.gg/xPEDcNEupw

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.