PROTECTED SOURCE SCRIPT

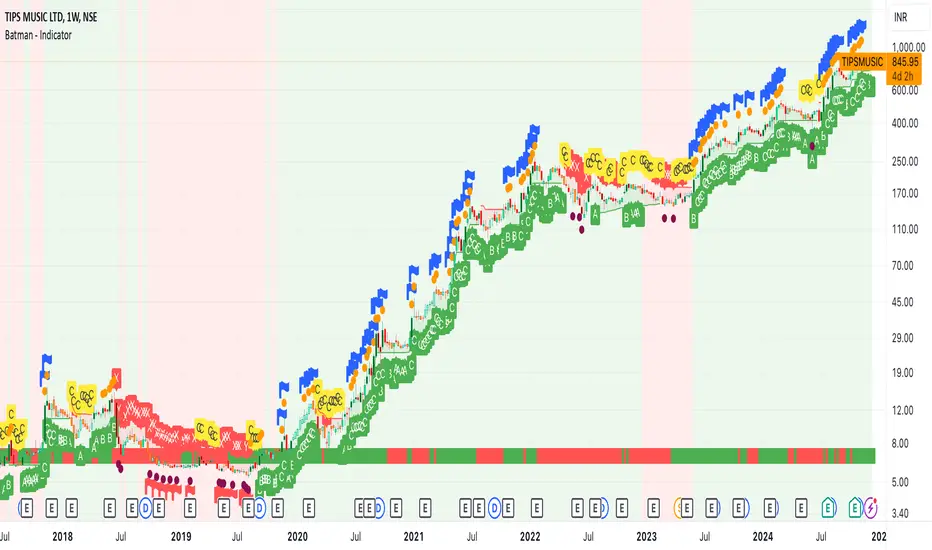

Batman - Indicator

The Batman - Indicator is an advanced trend-following tool that combines multiple methodologies to provide traders with actionable insights for efficient decision-making. This comprehensive indicator leverages both classic and innovative approaches to detect market trends, identify relative strength, and signal entry/exit opportunities. Key features include:

Core Features:

1. Trend Analysis with ADX:

- Measures trend strength and signals shifts in momentum using the Average Directional Index (ADX).

- Configurable parameters allow traders to fine-tune the threshold for their preferred trading style.

2. Relative Strength (RS) Evaluation:

- Analyzes the relative strength of the asset compared to broader market indices (e.g., CRYPTOCAP:TOTAL, NSE:NIFTY, NASDAQ:NDX).

- Provides intuitive visual cues with strength and weakness coloring for quick decision-making.

3. Volume-Based Price Action Insights:

- Highlights bars with significant volume activity relative to a configurable moving average.

- Identifies potential turning points and momentum using color-coded volume bars.

4. 52-Week High/Low Detection:

- Tracks and flags new 52-week highs or lows to highlight key levels of interest.

- Adds context for long-term market trends and potential breakout/breakdown points.

5. Donchian Channel Breakouts:

- Detects changes in Donchian channel levels, signaling potential breakout or reversal scenarios.

6. Multi-Layered Scoring System:

- Combines ADX and RSI to score market conditions on a scale from bearish (Z) to bullish (A).

- Includes intermediate levels (X, Y, C) to capture nuanced shifts in sentiment.

7. Exit Strategies:

- Features customizable exit indicators, offering a choice between SuperTrend and VStop.

- Provides dynamic, visually distinct trendlines for clear trend-following exits.

Unique Value:

- Unlike traditional single-purpose indicators, the Batman - Indicator integrates multiple tools into a single cohesive framework.

- Each component is independently configurable, allowing traders to adapt the indicator to their unique strategy and risk tolerance.

- Background color and plot shapes improve visual clarity, ensuring ease of use during fast-paced trading sessions.

Use Cases:

- Scalping and intraday trading with dynamic trend and volume signals.

- Swing and positional trading with long-term high/low levels and trend exits.

- Relative strength analysis for pair trading or benchmarking performance against broader markets.

How It Works:

- Trend Identification: Utilizes ADX and RSI to provide directional bias and signal overbought/oversold conditions.

- Volume Analysis: Highlights potential areas of interest based on abnormal volume activity.

- Breakout Signals: Detects new 52-week highs/lows and Donchian channel breakouts for actionable alerts.

- Exit Planning: Offers clear, customizable exit levels via SuperTrend or VStop, reducing emotional decision-making.

Configuration:

- The indicator includes customizable inputs for all calculations (length, thresholds, multipliers) to suit diverse market conditions and trading styles.

- Default settings provide a balanced approach suitable for most markets but can be tailored as needed.

---

Instructions for Use:

1. Add the indicator to your chart and configure the inputs according to your trading timeframe and asset type.

2. Pay attention to the ADX-RSI Scoring System for overall market sentiment.

3. Use volume-based price action and 52-week breakout signals to identify potential entries.

4. Exit trades based on the chosen exit indicator (SuperTrend or VStop) to manage risk and lock in profits.

Alerts:

- Set up alerts for scoring system changes, 52-week high/low breakouts, and exit signals for seamless trading automation.

Core Features:

1. Trend Analysis with ADX:

- Measures trend strength and signals shifts in momentum using the Average Directional Index (ADX).

- Configurable parameters allow traders to fine-tune the threshold for their preferred trading style.

2. Relative Strength (RS) Evaluation:

- Analyzes the relative strength of the asset compared to broader market indices (e.g., CRYPTOCAP:TOTAL, NSE:NIFTY, NASDAQ:NDX).

- Provides intuitive visual cues with strength and weakness coloring for quick decision-making.

3. Volume-Based Price Action Insights:

- Highlights bars with significant volume activity relative to a configurable moving average.

- Identifies potential turning points and momentum using color-coded volume bars.

4. 52-Week High/Low Detection:

- Tracks and flags new 52-week highs or lows to highlight key levels of interest.

- Adds context for long-term market trends and potential breakout/breakdown points.

5. Donchian Channel Breakouts:

- Detects changes in Donchian channel levels, signaling potential breakout or reversal scenarios.

6. Multi-Layered Scoring System:

- Combines ADX and RSI to score market conditions on a scale from bearish (Z) to bullish (A).

- Includes intermediate levels (X, Y, C) to capture nuanced shifts in sentiment.

7. Exit Strategies:

- Features customizable exit indicators, offering a choice between SuperTrend and VStop.

- Provides dynamic, visually distinct trendlines for clear trend-following exits.

Unique Value:

- Unlike traditional single-purpose indicators, the Batman - Indicator integrates multiple tools into a single cohesive framework.

- Each component is independently configurable, allowing traders to adapt the indicator to their unique strategy and risk tolerance.

- Background color and plot shapes improve visual clarity, ensuring ease of use during fast-paced trading sessions.

Use Cases:

- Scalping and intraday trading with dynamic trend and volume signals.

- Swing and positional trading with long-term high/low levels and trend exits.

- Relative strength analysis for pair trading or benchmarking performance against broader markets.

How It Works:

- Trend Identification: Utilizes ADX and RSI to provide directional bias and signal overbought/oversold conditions.

- Volume Analysis: Highlights potential areas of interest based on abnormal volume activity.

- Breakout Signals: Detects new 52-week highs/lows and Donchian channel breakouts for actionable alerts.

- Exit Planning: Offers clear, customizable exit levels via SuperTrend or VStop, reducing emotional decision-making.

Configuration:

- The indicator includes customizable inputs for all calculations (length, thresholds, multipliers) to suit diverse market conditions and trading styles.

- Default settings provide a balanced approach suitable for most markets but can be tailored as needed.

---

Instructions for Use:

1. Add the indicator to your chart and configure the inputs according to your trading timeframe and asset type.

2. Pay attention to the ADX-RSI Scoring System for overall market sentiment.

3. Use volume-based price action and 52-week breakout signals to identify potential entries.

4. Exit trades based on the chosen exit indicator (SuperTrend or VStop) to manage risk and lock in profits.

Alerts:

- Set up alerts for scoring system changes, 52-week high/low breakouts, and exit signals for seamless trading automation.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Geschütztes Skript

Dieses Script ist als Closed-Source veröffentlicht. Sie können es kostenlos und ohne Einschränkungen verwenden – erfahren Sie hier mehr.

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.