OPEN-SOURCE SCRIPT

ATR Rope Strategy - Jaxon0007

🔹 Overview

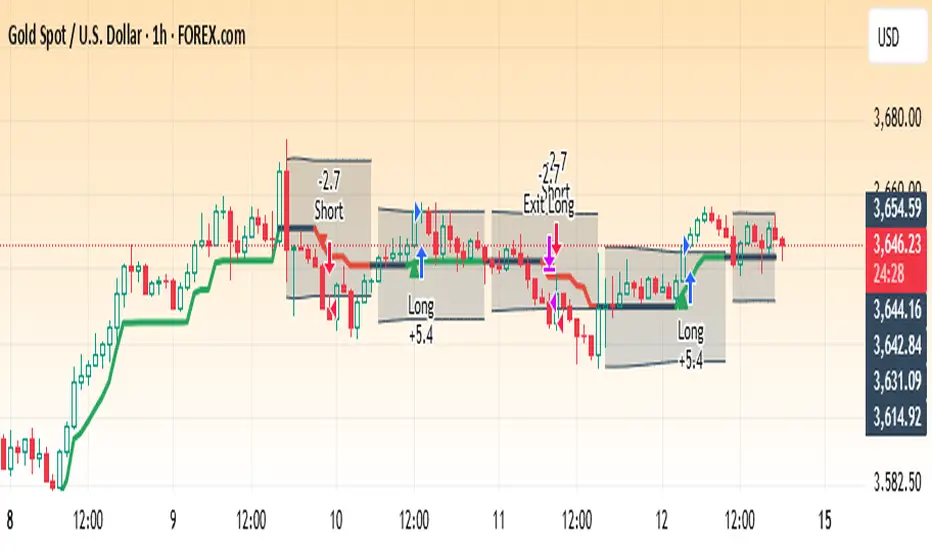

The ATR Trend Rope is a volatility-based trend detection tool designed to adapt dynamically to price movements.

It combines Average True Range (ATR) smoothing with a rope-style adaptive channel to identify:

📈 Bullish trends (green rope)

📉 Bearish trends (red rope)

⚖️ Neutral/consolidation zones (gray rope with shaded areas)

This makes it useful for detecting trend continuation, reversals, and sideways consolidation ranges.

🔹 Features

✔️ Adaptive Rope Line → Filters out market noise using ATR.

✔️ ATR Channel → Upper & lower dynamic levels for volatility tracking.

✔️ Consolidation Zones → Highlights sideways price action.

✔️ Dynamic Colors → Instant visual feedback of trend direction.

🔹 How to Use

Trend Detection

Green rope = bullish trend (look for longs).

Red rope = bearish trend (look for shorts).

Gray rope = neutral / range (avoid trend trades).

Consolidation Zones

Shaded areas represent sideways phases.

Breakouts from these zones often lead to strong moves.

ATR Channel

Optional channel lines act as dynamic support/resistance.

Price above channel → strong bullish pressure.

Price below channel → strong bearish pressure.

🔹 Backtest / Strategy Idea

Although this script is coded as an indicator, you can manually backtest it with simple rules:

Long Entries:

Rope turns green after a consolidation or cross.

Confirm with price closing above rope.

Short Entries:

Rope turns red after a consolidation or cross.

Confirm with price closing below rope.

Exit / Stop-Loss:

Exit when rope flips color.

Stop-loss can be placed at ATR channel levels.

This system can be turned into a strategy by adding entry/exit conditions directly in Pine Script (optional).

🔹 Settings

Price Source: Default close (can be changed).

ATR Period: Default 14.

ATR Multiplier: Default 1.5 (controls sensitivity).

Show Consolidation Zones: On/Off toggle.

Show ATR Channel: On/Off toggle.

The ATR Trend Rope is a volatility-based trend detection tool designed to adapt dynamically to price movements.

It combines Average True Range (ATR) smoothing with a rope-style adaptive channel to identify:

📈 Bullish trends (green rope)

📉 Bearish trends (red rope)

⚖️ Neutral/consolidation zones (gray rope with shaded areas)

This makes it useful for detecting trend continuation, reversals, and sideways consolidation ranges.

🔹 Features

✔️ Adaptive Rope Line → Filters out market noise using ATR.

✔️ ATR Channel → Upper & lower dynamic levels for volatility tracking.

✔️ Consolidation Zones → Highlights sideways price action.

✔️ Dynamic Colors → Instant visual feedback of trend direction.

🔹 How to Use

Trend Detection

Green rope = bullish trend (look for longs).

Red rope = bearish trend (look for shorts).

Gray rope = neutral / range (avoid trend trades).

Consolidation Zones

Shaded areas represent sideways phases.

Breakouts from these zones often lead to strong moves.

ATR Channel

Optional channel lines act as dynamic support/resistance.

Price above channel → strong bullish pressure.

Price below channel → strong bearish pressure.

🔹 Backtest / Strategy Idea

Although this script is coded as an indicator, you can manually backtest it with simple rules:

Long Entries:

Rope turns green after a consolidation or cross.

Confirm with price closing above rope.

Short Entries:

Rope turns red after a consolidation or cross.

Confirm with price closing below rope.

Exit / Stop-Loss:

Exit when rope flips color.

Stop-loss can be placed at ATR channel levels.

This system can be turned into a strategy by adding entry/exit conditions directly in Pine Script (optional).

🔹 Settings

Price Source: Default close (can be changed).

ATR Period: Default 14.

ATR Multiplier: Default 1.5 (controls sensitivity).

Show Consolidation Zones: On/Off toggle.

Show ATR Channel: On/Off toggle.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

✨ Shared Success | Trusted Growth ✨

🚀 Profit Sharing 50/50 – Discipline & Transparency

📊 Free Signals: 👉 t.me/Forexcryptoaccountms

💼 Account Management: DM me or join the channel

🚀 Profit Sharing 50/50 – Discipline & Transparency

📊 Free Signals: 👉 t.me/Forexcryptoaccountms

💼 Account Management: DM me or join the channel

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.

Open-source Skript

Ganz im Sinne von TradingView hat dieser Autor sein/ihr Script als Open-Source veröffentlicht. Auf diese Weise können nun auch andere Trader das Script rezensieren und die Funktionalität überprüfen. Vielen Dank an den Autor! Sie können das Script kostenlos verwenden, aber eine Wiederveröffentlichung des Codes unterliegt unseren Hausregeln.

✨ Shared Success | Trusted Growth ✨

🚀 Profit Sharing 50/50 – Discipline & Transparency

📊 Free Signals: 👉 t.me/Forexcryptoaccountms

💼 Account Management: DM me or join the channel

🚀 Profit Sharing 50/50 – Discipline & Transparency

📊 Free Signals: 👉 t.me/Forexcryptoaccountms

💼 Account Management: DM me or join the channel

Haftungsausschluss

Die Informationen und Veröffentlichungen sind nicht als Finanz-, Anlage-, Handels- oder andere Arten von Ratschlägen oder Empfehlungen gedacht, die von TradingView bereitgestellt oder gebilligt werden, und stellen diese nicht dar. Lesen Sie mehr in den Nutzungsbedingungen.